Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company has entered a three - year swap contract with a swap dealer with a total notional amount of EUR 2 , 0 0

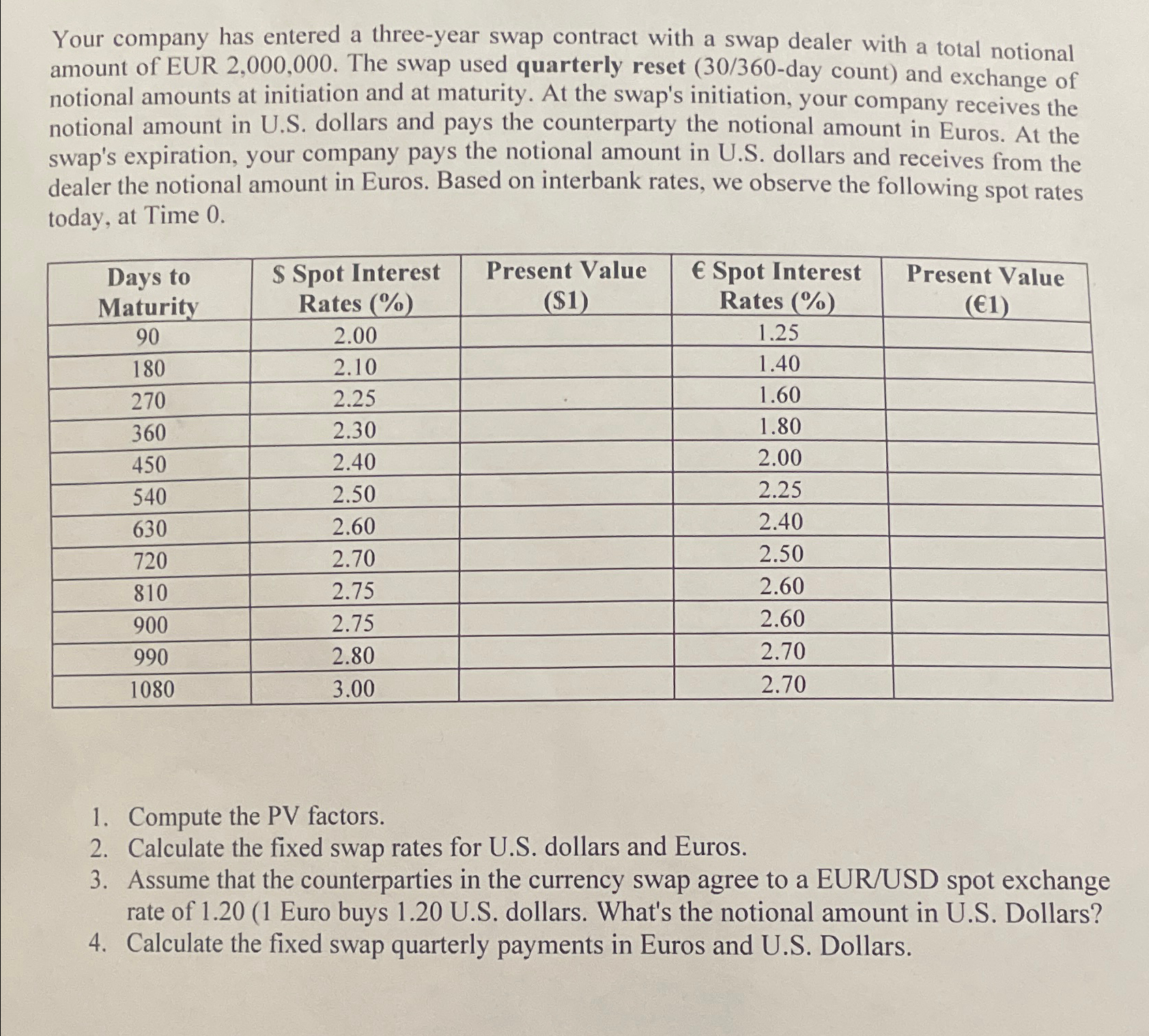

Your company has entered a threeyear swap contract with a swap dealer with a total notional amount of EUR The swap used quarterly reset day count and exchange of notional amounts at initiation and at maturity. At the swap's initiation, your company receives the notional amount in US dollars and pays the counterparty the notional amount in Euros. At the swap's expiration, your company pays the notional amount in US dollars and receives from the dealer the notional amount in Euros. Based on interbank rates, we observe the following spot rates today, at Time

tabletableDays toMaturitytableS Spot InterestRates tablePresent Value$tableE Spot InterestRates tablePresent Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started