Answered step by step

Verified Expert Solution

Question

1 Approved Answer

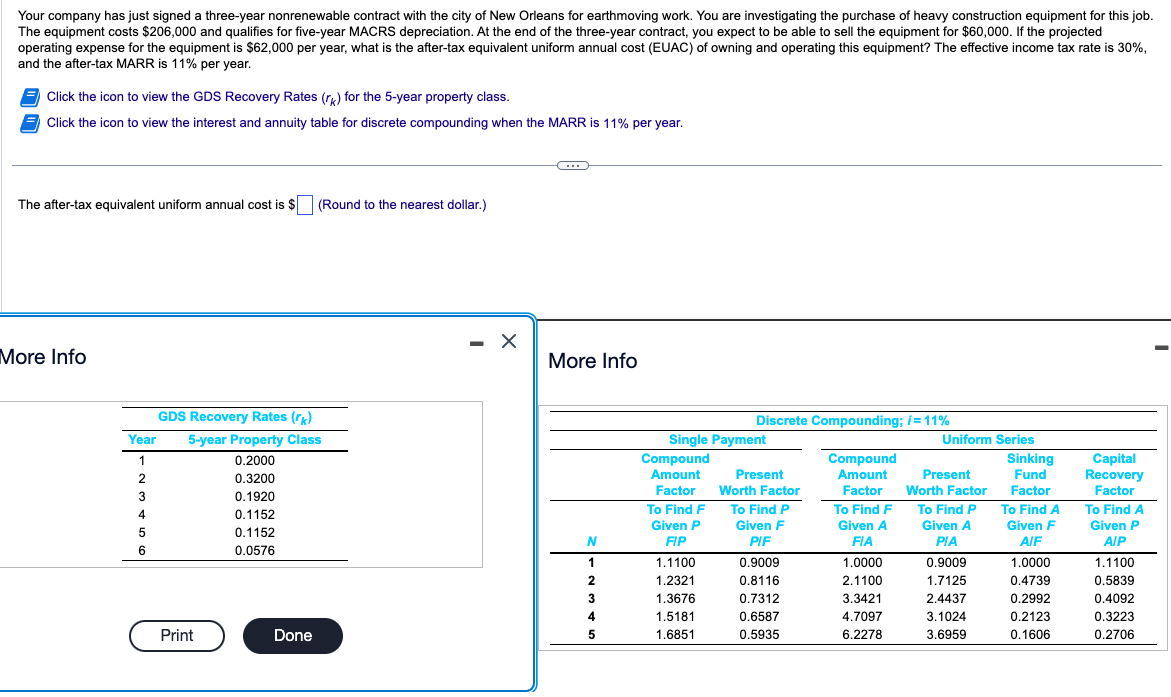

Your company has just signed a three - year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase

Your company has just signed a threeyear nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job.

The equipment costs $ and qualifies for fiveyear MACRS depreciation. At the end of the threeyear contract, you expect to be able to sell the equipment for $ If the projected

operating expense for the equipment is $ per year, what is the aftertax equivalent uniform annual cost EUAC of owning and operating this equipment? The effective income tax rate is

and the aftertax MARR is per year.

Click the icon to view the GDS Recovery Rates for the year property class.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is per year.

The aftertax equivalent uniform annual cost is $Round to the nearest dollar.

More Info

More Info

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started