Question

Your company has just signed a? three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy

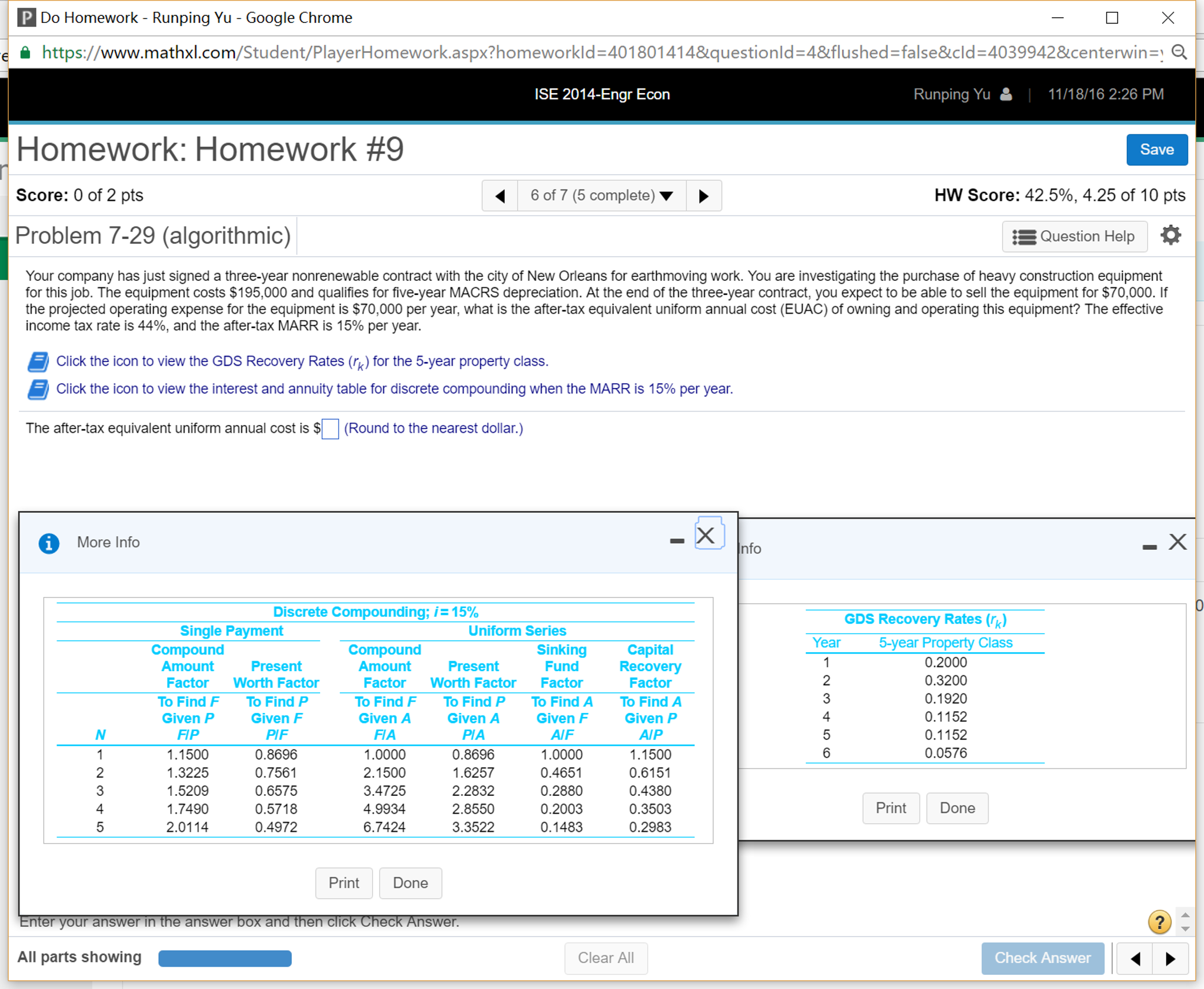

Your company has just signed a? three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs

Your company has just signed a? three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs

?$195 comma 000195,000

and qualifies for? five-year MACRS depreciation. At the end of the? three-year contract, you expect to be able to sell the equipment for

?$70 comma 00070,000.

If the projected operating expense for the equipment is

?$70 comma 00070,000

per? year, what is the? after-tax equivalent uniform annual cost? (EUAC) of owning and operating this? equipment? The effective income tax rate is

4444?%,

and the? after-tax MARR is

1515?%

per year.

Do Homework Runping Yu Google Chrome e https:// homeworkld 4018014148 questionld- 4&flushed-false&cld-40399428 centerwin y a ISE 2014-Engr Econ 11/18/16 2:26 PM Runping Yu Homework: Homework #9 Save HW Score: 42.5%, 4.25 of 10 pts Score: 0 of 2 pts 6 of 7 (5 complete) E Question Help Problem 7-29 (algorithmic) Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $195,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $70,000. lf the projected operating expense for the equipment is $70,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 44%, and the after-tax MARR is 15% per year. E Click the icon to view the GDS Recovery Rates (rk) for the 5-year property class Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year. The after-tax equivalent uniform annual cost is Round to the nearest dollar.) More Info nfo Discrete Compounding; 15% GDS Recovery Rates (r Single Payment Uniform Series Year 5-year Property Class Compound Compound Sinking Capita 0.2000 Amount Present Amount Present Fund Recovery 0.3200 Factor Worth Factor Factor Worth Factor Factor Factor 0.1920 To Find F To Find P To Find F To Find P To Find A To Find A 0.1152 Given P Given F Given A Given A Given F Given P FIP PIF FIA PIA AIF AIP 0.1152 0.8696 0.8696 1.0000 0.0576 1500 1.0000 1500 1.3225 0.7561 2.1500 1.6257 0.4651 0.6151 3.4725 0.2880 1.5209 0.6575 2.2832 0.4380 1.7490 2.8550 0.3503 Print Done 4.9934 0.2003 0.5718 3.3522 6.7424 0.1483 0.4972 0.2983 2.0114 Print Done nter your answer in e answer box an en CTIC eC nswer. All parts showing Clear A CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started