Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company has recently released its financial results for the previous financial year. It is anticipated that the company will experience a growth of

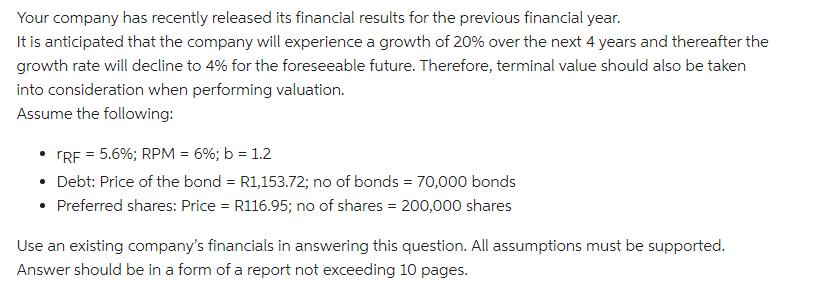

Your company has recently released its financial results for the previous financial year. It is anticipated that the company will experience a growth of 20% over the next 4 years and thereafter the growth rate will decline to 4% for the foreseeable future. Therefore, terminal value should also be taken into consideration when performing valuation. Assume the following: TRF = 5.6%; RPM = 6%; b = 1.2 Debt: Price of the bond = R1,153.72; no of bonds = 70,000 bonds Preferred shares: Price = R116.95; no of shares = 200,000 shares Use an existing company's financials in answering this question. All assumptions must be supported. Answer should be in a form of a report not exceeding 10 pages.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Solution Essay On Financial Statements In this business world of increased competition quality of financial information provided by companies is considered to be the most important element in process ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started