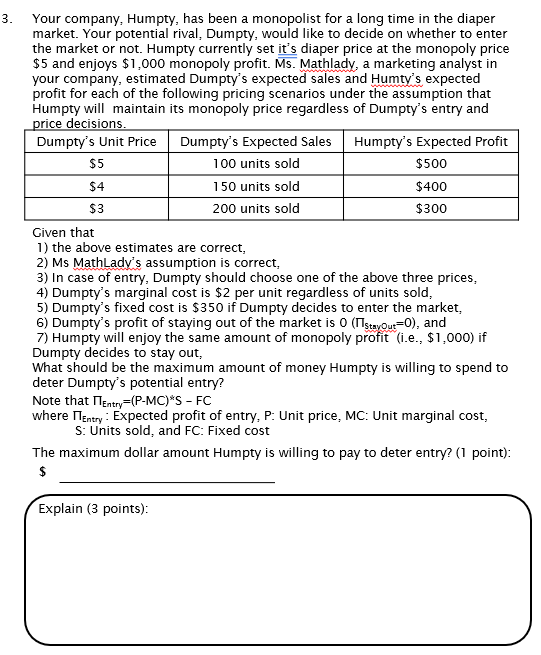

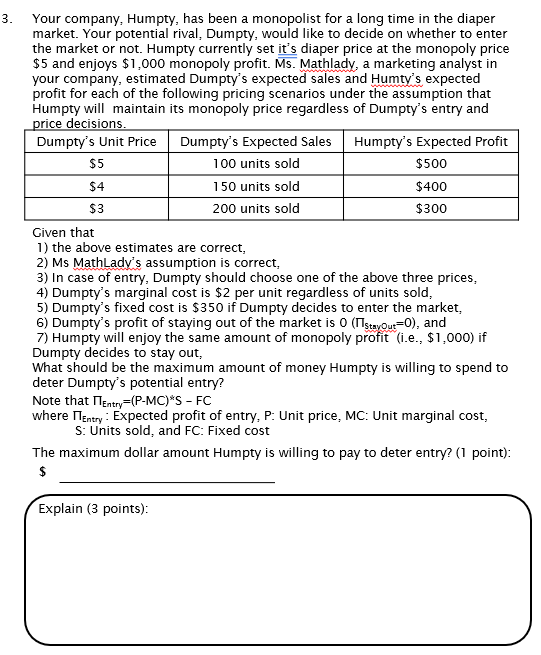

Your company, Humpty, has been a monopolist for a long time in the diaper market. Your potential rival, Dumpty, would like to decide on whether to enter the market or not. Humpty currently set it's diaper price at the monopoly price $5 and enjoys $1,000 monopoly profit. Ms. Mathlady, a marketing analyst in your company, estimated Dumpty's expected sales and Humty's expected profit for each of the following pricing scenarios under the assumption that Humpty will maintain its monopoly price regardless of Dumpty's entry and nrice decisions Given that 1) the above estimates are correct, 2) Ms MathLady's assumption is correct, 3) In case of entry, Dumpty should choose one of the above three prices, 4) Dumpty's marginal cost is $2 per unit regardless of units sold, 5) Dumpty's fixed cost is $350 if Dumpty decides to enter the market, 6) Dumpty's profit of staying out of the market is 0(stayout=0), and 7) Humpty will enjoy the same amount of monopoly profit ( i.e., $1,000) if Dumpty decides to stay out, What should be the maximum amount of money Humpty is willing to spend to deter Dumpty's potential entry? Note that Entry=(PMC)SFC where Entryy : Expected profit of entry, P: Unit price, MC: Unit marginal cost, S: Units sold, and FC: Fixed cost The maximum dollar amount Humpty is willing to pay to deter entry? (1 point): $ Your company, Humpty, has been a monopolist for a long time in the diaper market. Your potential rival, Dumpty, would like to decide on whether to enter the market or not. Humpty currently set it's diaper price at the monopoly price $5 and enjoys $1,000 monopoly profit. Ms. Mathlady, a marketing analyst in your company, estimated Dumpty's expected sales and Humty's expected profit for each of the following pricing scenarios under the assumption that Humpty will maintain its monopoly price regardless of Dumpty's entry and nrice decisions Given that 1) the above estimates are correct, 2) Ms MathLady's assumption is correct, 3) In case of entry, Dumpty should choose one of the above three prices, 4) Dumpty's marginal cost is $2 per unit regardless of units sold, 5) Dumpty's fixed cost is $350 if Dumpty decides to enter the market, 6) Dumpty's profit of staying out of the market is 0(stayout=0), and 7) Humpty will enjoy the same amount of monopoly profit ( i.e., $1,000) if Dumpty decides to stay out, What should be the maximum amount of money Humpty is willing to spend to deter Dumpty's potential entry? Note that Entry=(PMC)SFC where Entryy : Expected profit of entry, P: Unit price, MC: Unit marginal cost, S: Units sold, and FC: Fixed cost The maximum dollar amount Humpty is willing to pay to deter entry? (1 point): $