Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company, is analyzing a potential opportunity to cut costs. It can spend $1,750,000 today on the purchase and $ 10,000 on the installation

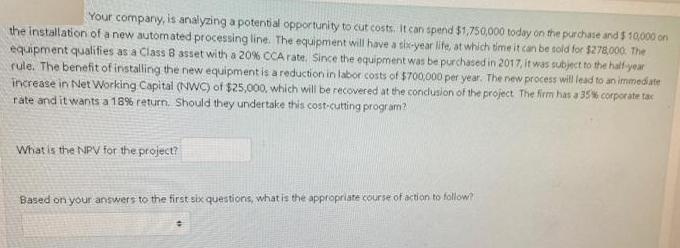

Your company, is analyzing a potential opportunity to cut costs. It can spend $1,750,000 today on the purchase and $ 10,000 on the installation of a new automated processing line. The equipment will have a six-year lite, at which time it can be sold for $278,000. The equipment qualifies as a Class 8 asset with a 20% CCA rate, Since the equipment was be purchased in 2017, it was subject to the half-year rule. The benefit of installing the new equipment is a reduction in labor costs of $700,000 per year. The new process will lead to an immedate increase in Net Working Capital (NWC) of $25,000, which will be recovered at the condusion of the project The firm has a 35% corporate tac rte and it wants a 18% return. Should they undertake this cost-cutting program? What is the NPV for the project? Based on your answers to the first six questions, what is the appropriate course of action to follow?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of NPV Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Cash Inflows Savings in Labour C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started