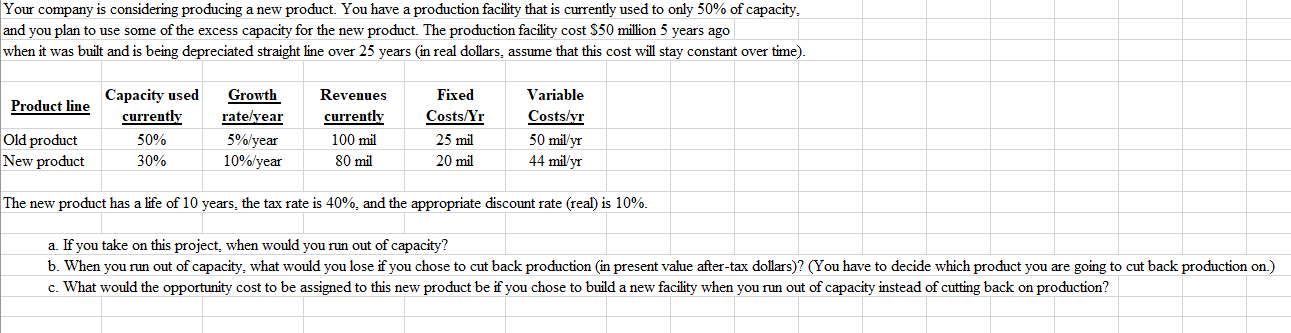

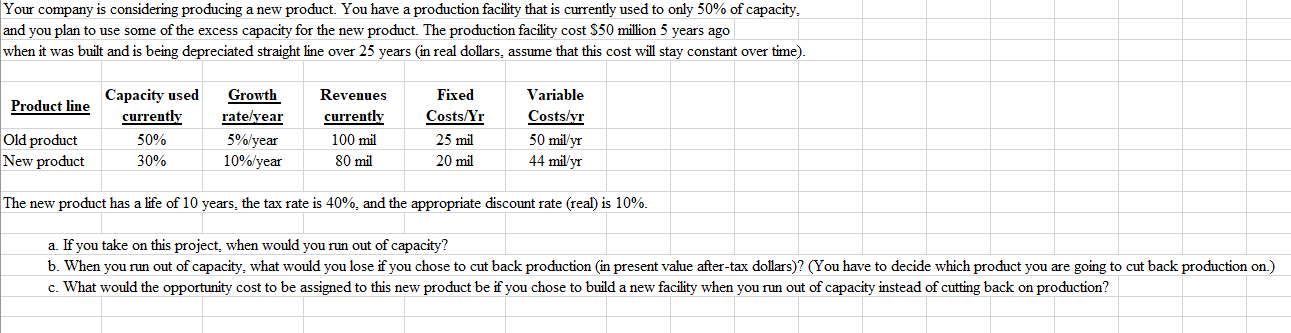

Your company is considering producing a new product. You have a production facility that is currently used to only 50% of capacity. and you plan to use some of the excess capacity for the new product. The production facility cost $50 million 5 years ago when it was built and is being depreciated straight line over 25 years in real dollars, assume that this cost will stay constant over time). Product line Old product New product Capacity used currently 50% 30% Growth rate/year 5%/year 10%/year Revenues currently 100 mil 80 mil Fixed Costs/Yr 25 mil 20 mil Variable Costs/yr 50 milyr 44 mily The new product has a life of 10 years, the tax rate is 40%, and the appropriate discount rate (real) is 10%. a. If you take on this project, when would you run out of capacity? b. When you run out of capacity, what would you lose if you chose to cut back production (in present value after-tax dollars)? (You have to decide which product you are going to cut back production on.) c. What would the opportunity cost to be assigned to this new product be if you chose to build a new facility when you run out of capacity instead of cutting back on production? Your company is considering producing a new product. You have a production facility that is currently used to only 50% of capacity. and you plan to use some of the excess capacity for the new product. The production facility cost $50 million 5 years ago when it was built and is being depreciated straight line over 25 years in real dollars, assume that this cost will stay constant over time). Product line Old product New product Capacity used currently 50% 30% Growth rate/year 5%/year 10%/year Revenues currently 100 mil 80 mil Fixed Costs/Yr 25 mil 20 mil Variable Costs/yr 50 milyr 44 mily The new product has a life of 10 years, the tax rate is 40%, and the appropriate discount rate (real) is 10%. a. If you take on this project, when would you run out of capacity? b. When you run out of capacity, what would you lose if you chose to cut back production (in present value after-tax dollars)? (You have to decide which product you are going to cut back production on.) c. What would the opportunity cost to be assigned to this new product be if you chose to build a new facility when you run out of capacity instead of cutting back on production