Answered step by step

Verified Expert Solution

Question

1 Approved Answer

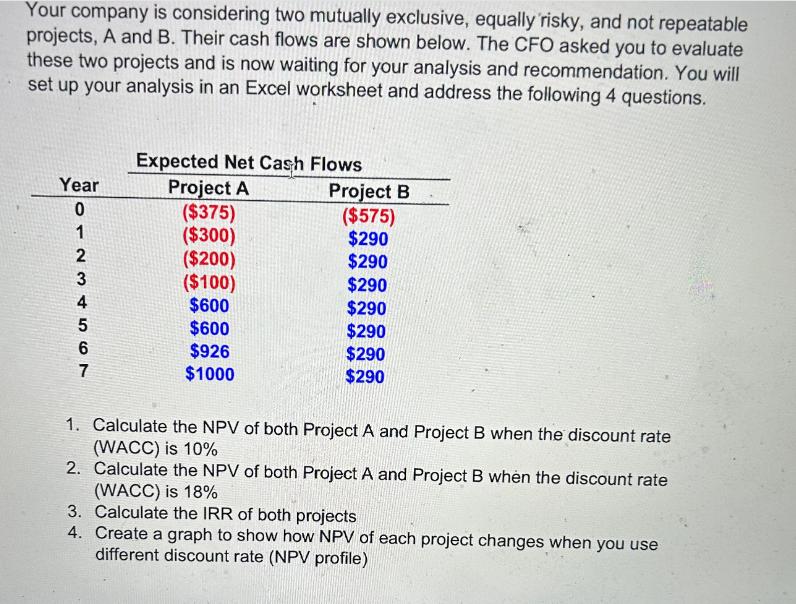

Your company is considering two mutually exclusive, equally 'risky, and not repeatable projects, A and B. Their cash flows are shown below. The CFO

Your company is considering two mutually exclusive, equally 'risky, and not repeatable projects, A and B. Their cash flows are shown below. The CFO asked you to evaluate these two projects and is now waiting for your analysis and recommendation. You will set up your analysis in an Excel worksheet and address the following 4 questions. Year 01234567 Expected Net Cash Flows Project A ($375) ($300) ($200) ($100) $600 $600 $926 $1000 Project B ($575) $290 $290 $290 $290 $290 $290 $290 1. Calculate the NPV of both Project A and Project B when the discount rate (WACC) is 10% 2. Calculate the NPV of both Project A and Project B when the discount rate (WACC) is 18% 3. Calculate the IRR of both projects 4. Create a graph to show how NPV of each project changes when you use different discount rate (NPV profile)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate the two mutually exclusive projects A and B and address the questions asked by the CFO w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started