Answered step by step

Verified Expert Solution

Question

1 Approved Answer

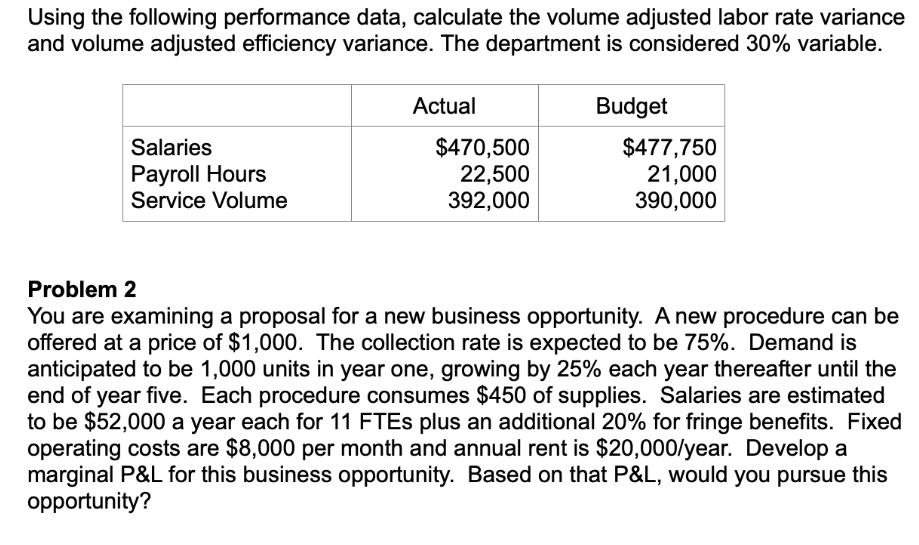

Using the following performance data, calculate the volume adjusted labor rate variance and volume adjusted efficiency variance. The department is considered 30% variable. Salaries

Using the following performance data, calculate the volume adjusted labor rate variance and volume adjusted efficiency variance. The department is considered 30% variable. Salaries Payroll Hours Service Volume Actual $470,500 22,500 392,000 Budget $477,750 21,000 390,000 Problem 2 You are examining a proposal for a new business opportunity. A new procedure can be offered at a price of $1,000. The collection rate is expected to be 75%. Demand is anticipated to be 1,000 units in year one, growing by 25% each year thereafter until the end of year five. Each procedure consumes $450 of supplies. Salaries are estimated to be $52,000 a year each for 11 FTEs plus an additional 20% for fringe benefits. Fixed operating costs are $8,000 per month and annual rent is $20,000/year. Develop a marginal P&L for this business opportunity. Based on that P&L, would you pursue this opportunity?

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Volume Adjusted Labor Rate Variance Actual Hours Budget Hours Budget Rate Variable Rate Percentage 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started