Answered step by step

Verified Expert Solution

Question

1 Approved Answer

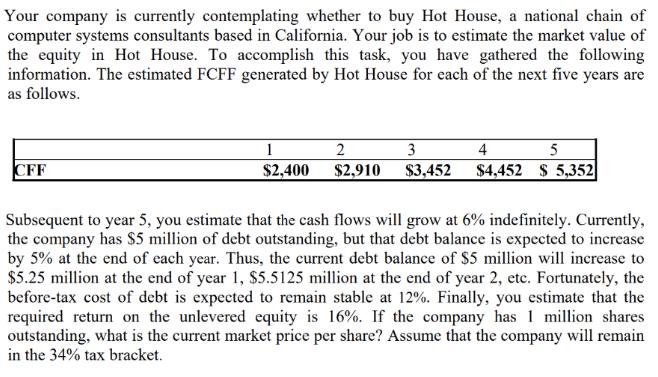

Your company is currently contemplating whether to buy Hot House, a national chain of computer systems consultants based in California. Your job is to

Your company is currently contemplating whether to buy Hot House, a national chain of computer systems consultants based in California. Your job is to estimate the market value of the equity in Hot House. To accomplish this task, you have gathered the following information. The estimated FCFF generated by Hot House for each of the next five years are as follows. 3 4 CFF $4,452 $ 5,352 $2,910 $3,452 $2,400 Subsequent to year 5, you estimate that the cash flows will grow at 6% indefinitely. Currently, the company has $5 million of debt outstanding, but that debt balance is expected to increase by 5% at the end of each year. Thus, the current debt balance of $5 million will increase to $5.25 million at the end of year 1, $5.5125 million at the end of year 2, etc. Fortunately, the before-tax cost of debt is expected to remain stable at 12%. Finally, you estimate that the required return on the unlevered equity is 16%. If the company has 1 million shares outstanding, what is the current market price per share? Assume that the company will remain in the 34% tax bracket.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started