Question

Your company is exploring the opportunity to buy an office building that is expected to generate a Net Operating Income (NOI) of $650,000 next year.

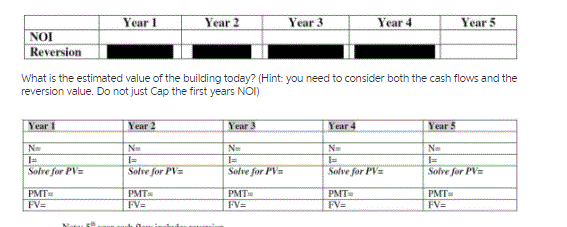

Your company is exploring the opportunity to buy an office building that is expected to generate a Net Operating Income (NOI) of $650,000 next year. The NOI is expected to grow at 2.5% each year. After 5 years (i.e. at the end of the 5th year) you can expect to sell the building for $9,500,000. Your required rate of return (i.e. the discount rate) is 5.5%, compounded annually. You will first need to fill in the following table. (Nothing should be entered in the row labeled

Reversion until year 5)

What is the estimated value of the building today? (Hint: you need to consider both the cash flows and the reversion value. Do not just Cap the first years NOI)

Fill in the charts above to answer the following questions

2. What is the reversion amount in year 5?

Year 2 Year 3 Years Year 4 Year 1 NOI Reversion What is the estimated value of the building today? (Hint: you need to consider both the cash flows and the reversion value. Do not just Cap the first years NOI) Year 3 Year I Year 5 ear 4 EN EN EN Solve for PV Solve for PV EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started