Answered step by step

Verified Expert Solution

Question

1 Approved Answer

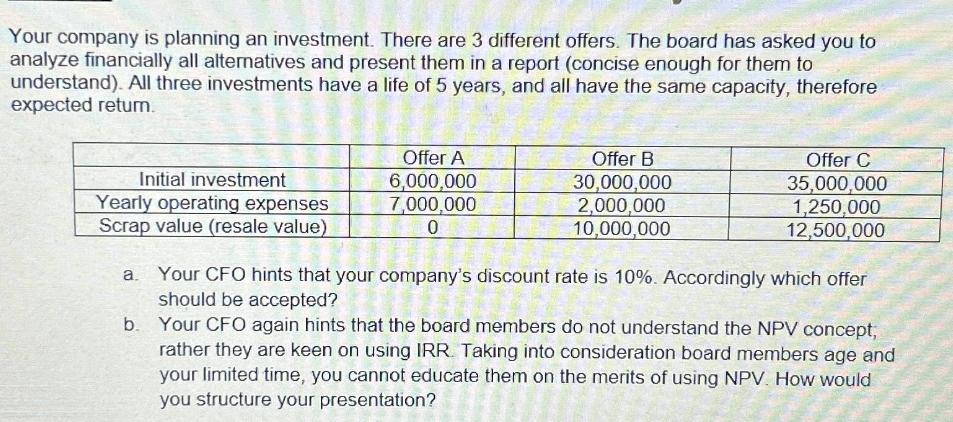

Your company is planning an investment. There are 3 different offers. The board has asked you to analyze financially all alternatives and present them

Your company is planning an investment. There are 3 different offers. The board has asked you to analyze financially all alternatives and present them in a report (concise enough for them to understand). All three investments have a life of 5 years, and all have the same capacity, therefore expected retum. Initial investment Yearly operating expenses Scrap value (resale value) Offer A 6,000,000 7,000,000 0 Offer B 30,000,000 2,000,000 10,000,000 Offer C 35,000,000 1,250,000 12,500,000 a. Your CFO hints that your company's discount rate is 10%. Accordingly which offer should be accepted? b. Your CFO again hints that the board members do not understand the NPV concept, rather they are keen on using IRR. Taking into consideration board members age and your limited time, you cannot educate them on the merits of using NPV. How would you structure your presentation?

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution Here is how I would structure the presentation for the board Gentlemen We have three invest...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started