Answered step by step

Verified Expert Solution

Question

1 Approved Answer

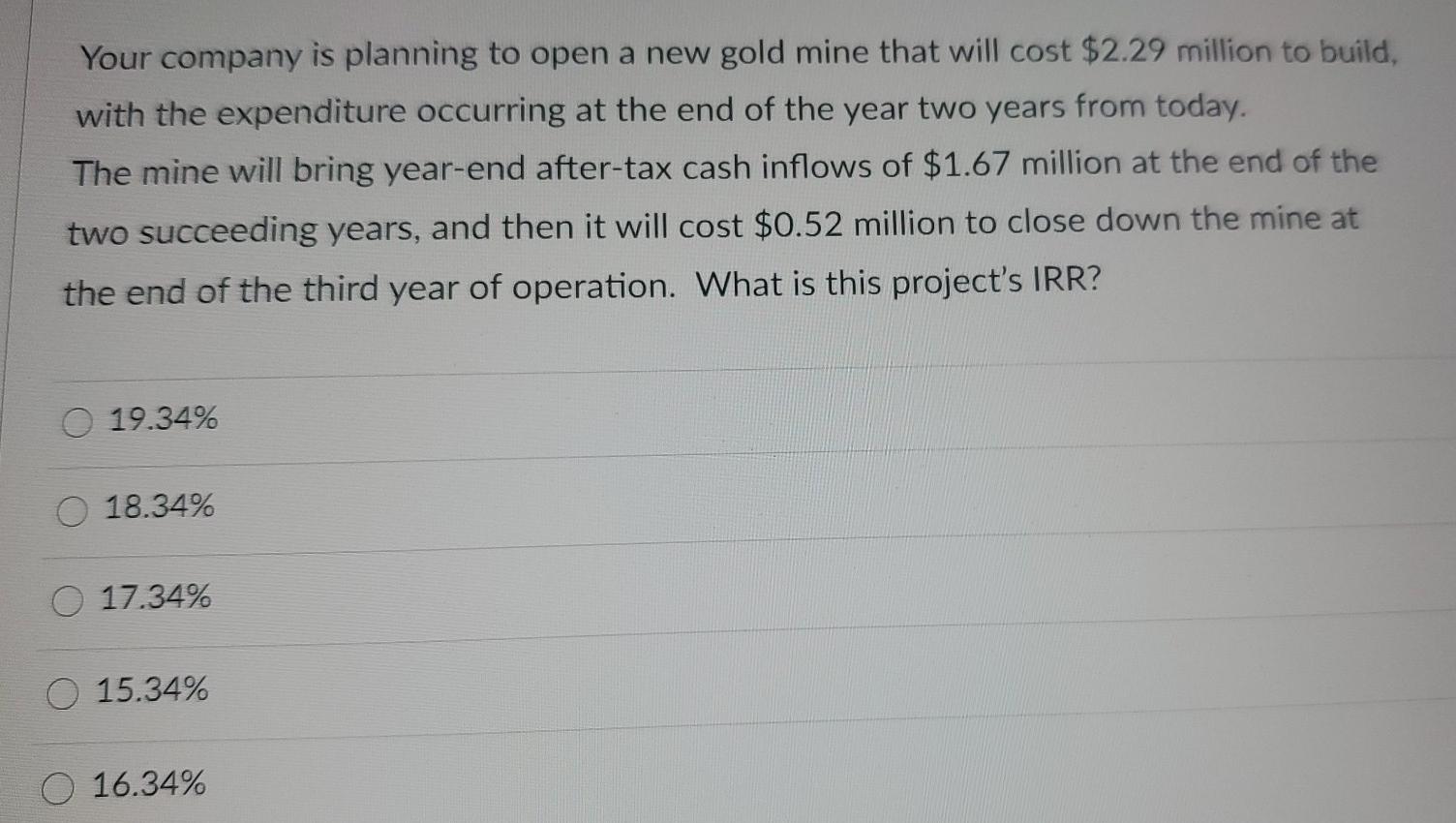

Your company is planning to open a new gold mine that will cost $2.29 million to build, with the expenditure occurring at the end of

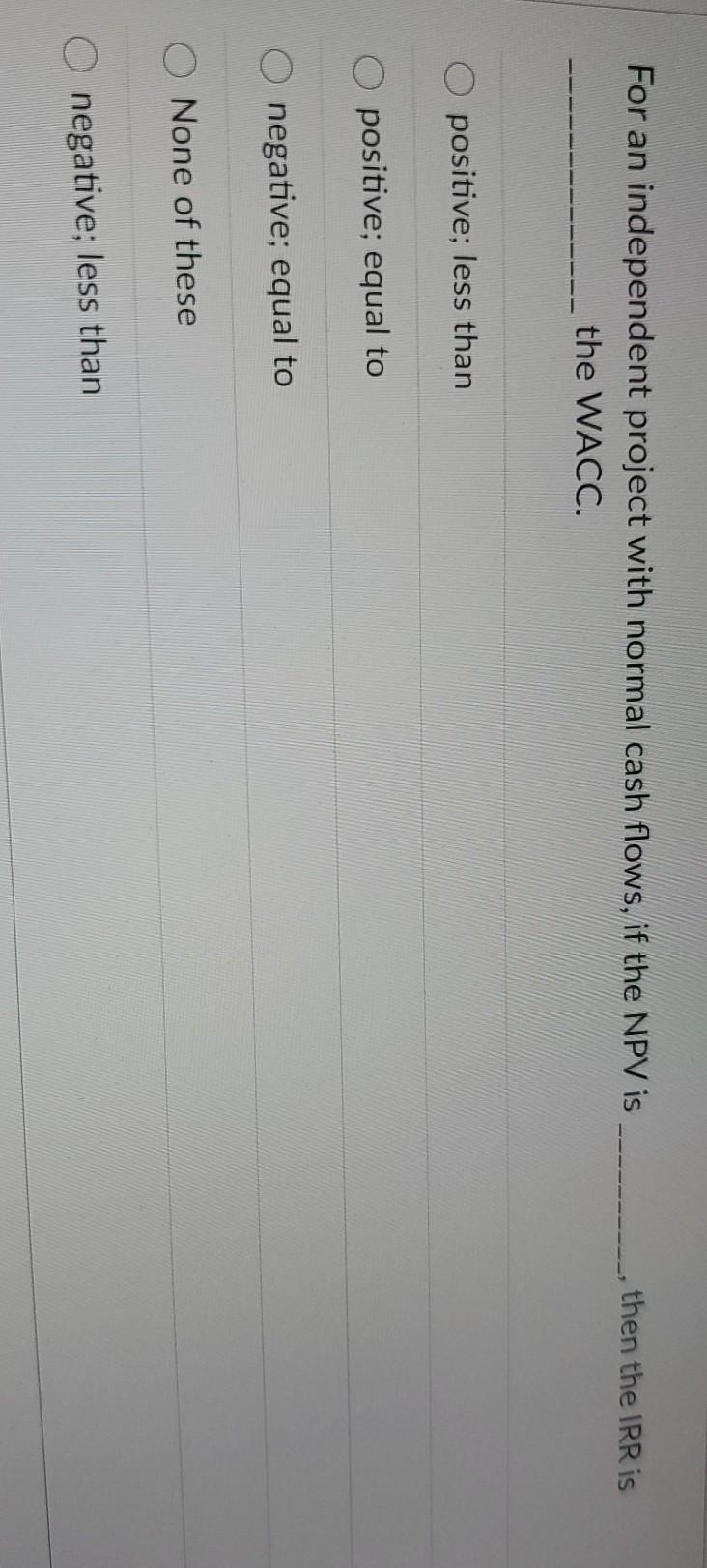

Your company is planning to open a new gold mine that will cost $2.29 million to build, with the expenditure occurring at the end of the year two years from today. The mine will bring year-end after-tax cash inflows of $1.67 million at the end of the two succeeding years, and then it will cost $0.52 million to close down the mine at the end of the third year of operation. What is this project's IRR? 19.34% 18.34% 17.34% 15.34% 16.34% then the IRR is For an independent project with normal cash flows, if the NPV is the WACC. positive; less than positive; equal to negative; equal to None of these O negative; less than

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started