Answered step by step

Verified Expert Solution

Question

1 Approved Answer

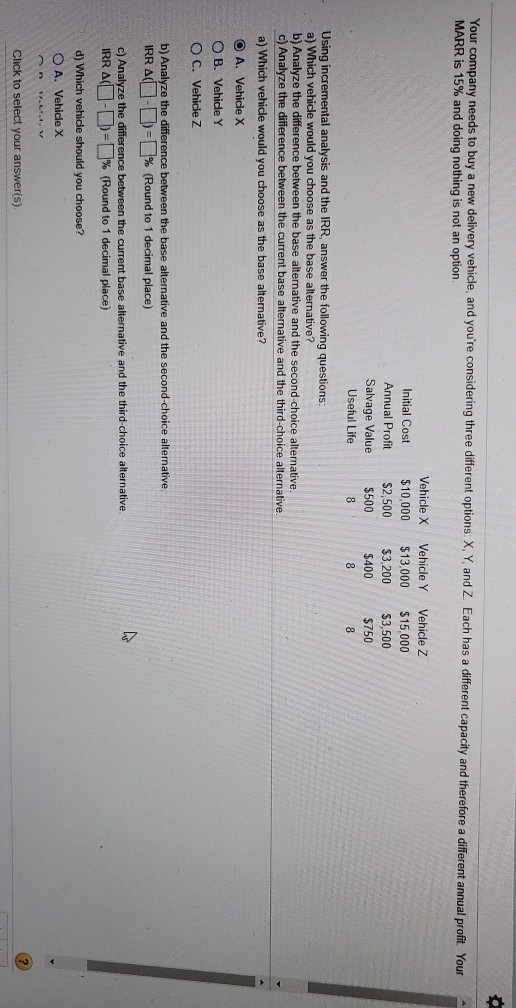

Your company needs to buy a new delivery vehicle, and you're considering three different options: X, Y, and Z. Each has a different capacity and

Your company needs to buy a new delivery vehicle, and you're considering three different options: X, Y, and Z. Each has a different capacity and therefore a different annual profit. Your MARR is 15% and doing nothing is not an option. Initial Cost Annual Profit Salvage Value Useful Life Vehicle X $10,000 $2,500 $500 Vehicle Y $13,000 $3,200 $400 Vehicle Z $15,000 $3,500 $750 8 Using incremental analysis and the IRR answer the following questions: a) Which vehicle would you choose as the base alternative? b) Analyze the difference between the base alternative and the second choice alternative. c) Analyze the difference between the current base alternative and the third-choice alternative. a) Which vehicle would you choose as the base alternative? O A. Vehicle X OB. Vehicle Y O C. Vehicle Z b) Analyze the difference between the base alternative and the second-choice alternative IRRAU-D = % (Round to 1 decimal place) c) Analyze the difference between the current base alternative and the third choice alternative IRR A -D % (Round to 1 decimal place) d) Which vehicle should you choose? O A. Vehicle X Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started