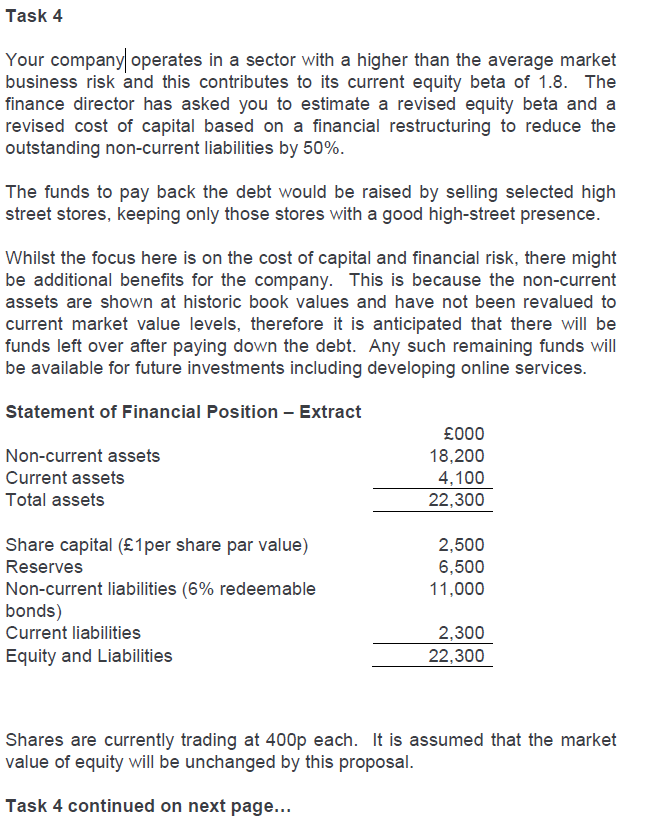

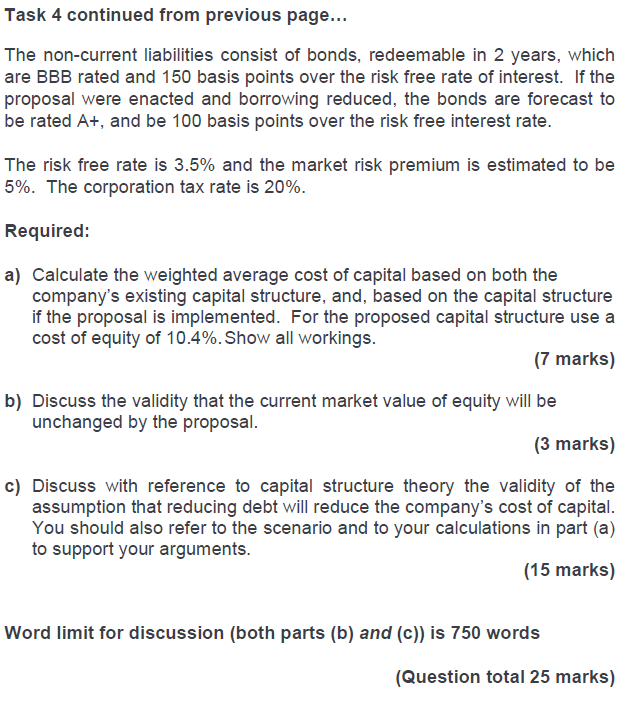

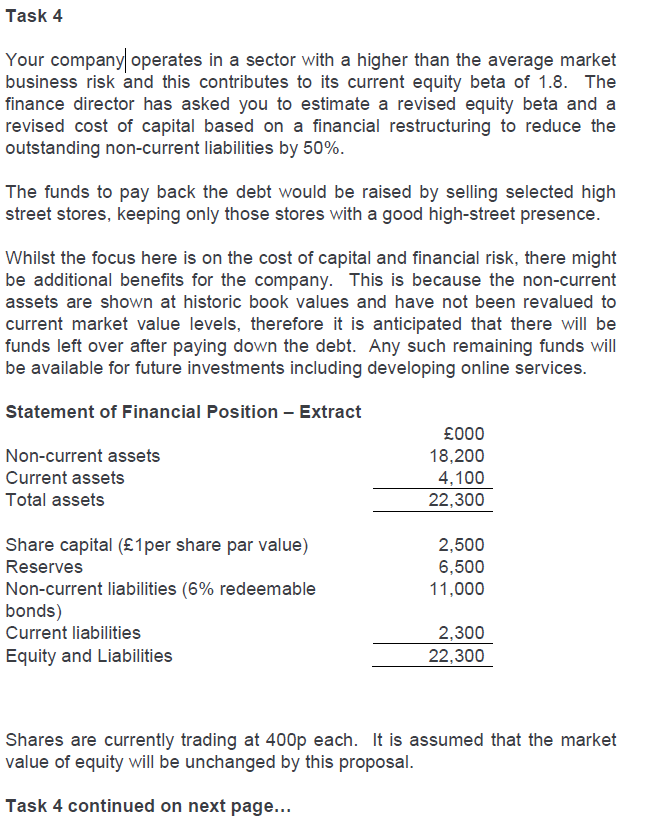

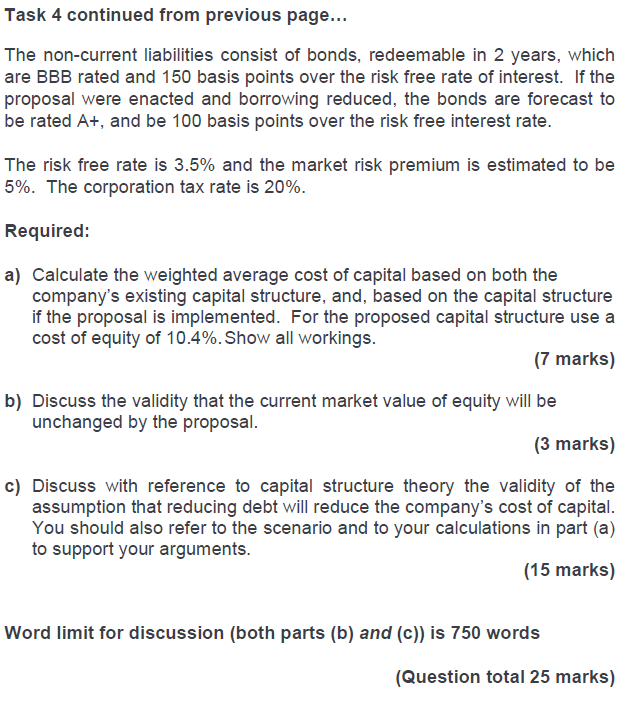

Your company| operates in a sector with a higher than the average market business risk and this contributes to its current equity beta of 1.8. The finance director has asked you to estimate a revised equity beta and a revised cost of capital based on a financial restructuring to reduce the outstanding non-current liabilities by 50%. The funds to pay back the debt would be raised by selling selected high street stores, keeping only those stores with a good high-street presence. Whilst the focus here is on the cost of capital and financial risk, there might be additional benefits for the company. This is because the non-current assets are shown at historic book values and have not been revalued to current market value levels, therefore it is anticipated that there will be funds left over after paying down the debt. Any such remaining funds will be available for future investments including developing online services. Shares are currently trading at 400p each. It is assumed that the market value of equity will be unchanged by this proposal. Task 4 continued on next page... Task 4 continued from previous page... The non-current liabilities consist of bonds, redeemable in 2 years, which are BBB rated and 150 basis points over the risk free rate of interest. If the proposal were enacted and borrowing reduced, the bonds are forecast to be rated A+, and be 100 basis points over the risk free interest rate. The risk free rate is 3.5% and the market risk premium is estimated to be 5%. The corporation tax rate is 20%. Required: a) Calculate the weighted average cost of capital based on both the company's existing capital structure, and, based on the capital structure if the proposal is implemented. For the proposed capital structure use a cost of equity of 10.4%. Show all workings. (7 marks) b) Discuss the validity that the current market value of equity will be unchanged by the proposal. (3 marks) c) Discuss with reference to capital structure theory the validity of the assumption that reducing debt will reduce the company's cost of capital. You should also refer to the scenario and to your calculations in part (a) to support your arguments. (15 marks) Word limit for discussion (both parts (b) and (c)) is 750 words (Question total 25 marks) Your company| operates in a sector with a higher than the average market business risk and this contributes to its current equity beta of 1.8. The finance director has asked you to estimate a revised equity beta and a revised cost of capital based on a financial restructuring to reduce the outstanding non-current liabilities by 50%. The funds to pay back the debt would be raised by selling selected high street stores, keeping only those stores with a good high-street presence. Whilst the focus here is on the cost of capital and financial risk, there might be additional benefits for the company. This is because the non-current assets are shown at historic book values and have not been revalued to current market value levels, therefore it is anticipated that there will be funds left over after paying down the debt. Any such remaining funds will be available for future investments including developing online services. Shares are currently trading at 400p each. It is assumed that the market value of equity will be unchanged by this proposal. Task 4 continued on next page... Task 4 continued from previous page... The non-current liabilities consist of bonds, redeemable in 2 years, which are BBB rated and 150 basis points over the risk free rate of interest. If the proposal were enacted and borrowing reduced, the bonds are forecast to be rated A+, and be 100 basis points over the risk free interest rate. The risk free rate is 3.5% and the market risk premium is estimated to be 5%. The corporation tax rate is 20%. Required: a) Calculate the weighted average cost of capital based on both the company's existing capital structure, and, based on the capital structure if the proposal is implemented. For the proposed capital structure use a cost of equity of 10.4%. Show all workings. (7 marks) b) Discuss the validity that the current market value of equity will be unchanged by the proposal. (3 marks) c) Discuss with reference to capital structure theory the validity of the assumption that reducing debt will reduce the company's cost of capital. You should also refer to the scenario and to your calculations in part (a) to support your arguments. (15 marks) Word limit for discussion (both parts (b) and (c)) is 750 words (Question total 25 marks)