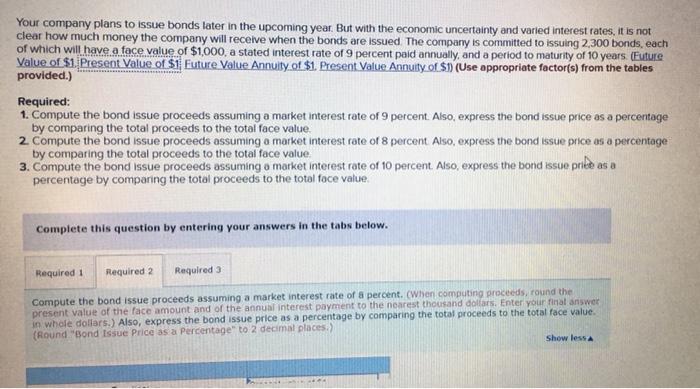

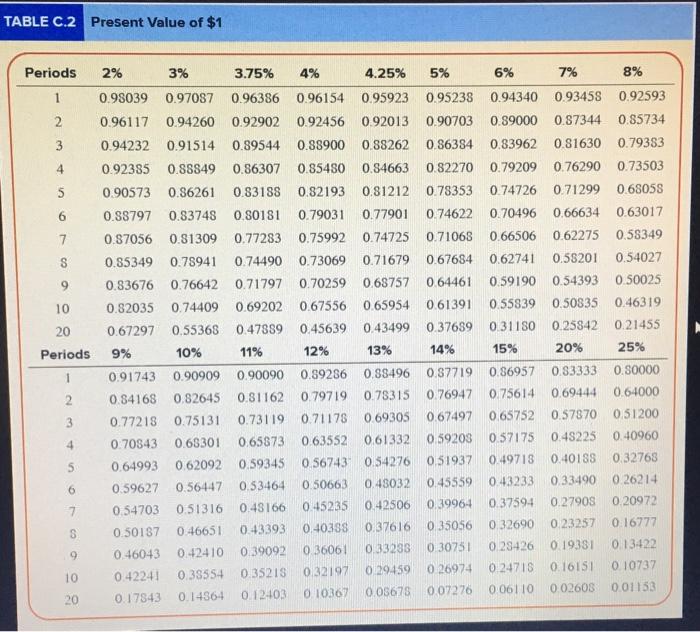

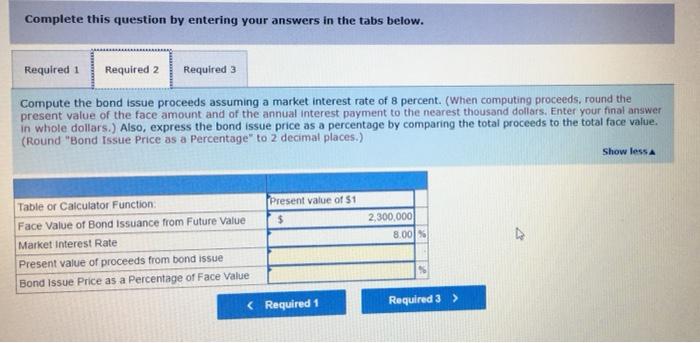

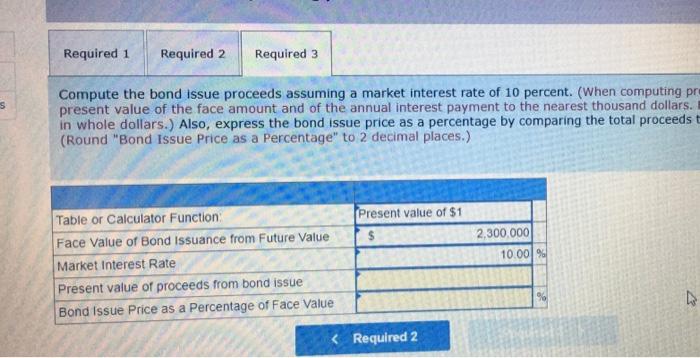

Your company plans to issue bonds later in the upcoming year. But with the economic uncertainty and varied interest rates, it is not clear how much money the company will receive when the bonds are issued The company is committed to issuing 2,300 bonds, each of which will have a face value of $1,000, a stated interest rate of 9 percent paid annually, and a period to maturity of 10 years (Future Value of $1. Present Value of $1 Future Value Annuity of $1. Present Value Annuity of S1) (Use appropriate factor(s) from the tables provided.) Required: 1. Compute the bond issue proceeds assuming a market interest rate of 9 percent. Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value 2 Compute the bond issue proceeds assuming a market interest rate or 8 percent Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value 3. Compute the bond issue proceeds assuming a market interest rate of 10 percent. Also, express the bond issue pribe as a percentage by comparing the total proceeds to the total foce value Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Compute the bond issue proceeds assuming a market interest rate of 8 percent. (When computing proceeds, round the present value of the face amount and of the annual interest payment to the nearest thousand dollars. Enter your final answer in whole dollars.) Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value. (Round "Bond Issue Price as a percentage" to 2 decimal places) Show less TABLE C.2 Present Value of $1 Periods 6% 1 2 3 4 5 6 7 S 9 10 20 Periods 2% 3% 3.75% 4% 4.25% 5% 7% 8% 0.98039 0.97087 0.96386 0.96154 0.95923 0.95238 0.94340 0.93458 0.92593 0.96117 0.94260 0.92902 0.92456 0.92013 0.90703 0.89000 0.87344 0.85734 0.94232 0.91514 0.89544 0.88900 0.88262 0.86384 0.83962 0.81630 0.79383 0.92385 0.88849 0.86307 0.85480 0.84663 0.82270 0.79209 0.76290 0.73503 0.90573 0.86261 0.83188 0.82193 0.81212 0.78353 0.74726 0.71299 0.68058 0.88797 0.83748 0.80181 0.79031 0.77901 0.74622 0.70496 0.66634 0.63017 0.87056 0.81309 0.77283 0.75992 0.74725 0.71068 0.66506 0.62275 0.58349 0.85349 0.78941 0.74490 0.73069 0.71679 0.67684 0.62741 0.58201 0.54027 0.83676 0.76642 0.71797 0.70259 0.68757 064461 0.59190 0.54393 0.50025 0.82035 0.74409 0.69202 0.67556 0.65954 0.61391 0.55839 0.50835 0.46319 0.67297 0.55368 0.47889 0.45639 0.43499 0.37689 0.31180 0.25842 0.21455 9% 10% 11% 12% 13% 14% 15% 20% 25% 0.91743 0.90909 0.90090 0.89286 0.88496 0.877190.86957 0.83333 0.80000 0.84168 0.82645 0.81162 0.79719 0.78315 0.76947 0.75614 0.69444 0.64000 0.77218 0.75131 0.73119 071178 069305 0.67497 0.65752 0.578700,51200 0.70843 0.68301 0.65873 0.63552 0.61332 059203 0.57175 0.48225 0.40960 0.64993 0.62092 0.59345 0.56743 0.54276 0.51937 0.49713 0.40158 0.32768 0.59627 0.56447 0.53464 0.50663 0.43032 0.45559 0.43233 0.33490 0.26214 0.54703 0.51316 0.48166 0.45235 0.42506 0.39964 0.37594 0.27903 0.20972 0.50187 0.46651 0.43393 0.40338 0.37616 035056 0.32690 0.23257 0.16777 0.46043 0.42410 0.39092 0.36061 0.33285 030751 028426 0.19381 0.13422 0.42241 0.38554 0.3521S 0.32197 0 29459 0 26974 024718 0.16151 0.10737 0.17843 0.14364 0.12.03 0.10367 0.05675 0.07276 0.06110 0.02608 0.01153 1 2 3 4 5 6 7 S 9 10 20 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the bond issue proceeds assuming a market interest rate of 8 percent. (When computing proceeds, round the present value of the face amount and of the annual interest payment to the nearest thousand dollars. Enter your final answer in whole dollars.) Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value. (Round "Bond Issue Price as a Percentage" to 2 decimal places.) Show less Present value of $1 $ 2.300.000 8.00 Table or Calculator Function Face Value of Bond Issuance from Future Value Market Interest Rate Present value of proceeds from bond issue Bond issue Price as a Percentage of Face Value Required 1 Required 2 Required 3 Compute the bond issue proceeds assuming a market interest rate of 10 percent. (When computing pro present value of the face amount and of the annual interest payment to the nearest thousand dollars. in whole dollars.) Also, express the bond issue price as a percentage by comparing the total proceeds (Round "Bond Issue Price as a Percentage" to 2 decimal places.) Present value of $1 $ 2,300,000 10.00% Table or Calculator Function: Face Value of Bond Issuance from Future Value Market Interest Rate Present value of proceeds from bond issue Bond Issue Price as a Percentage of Face Value