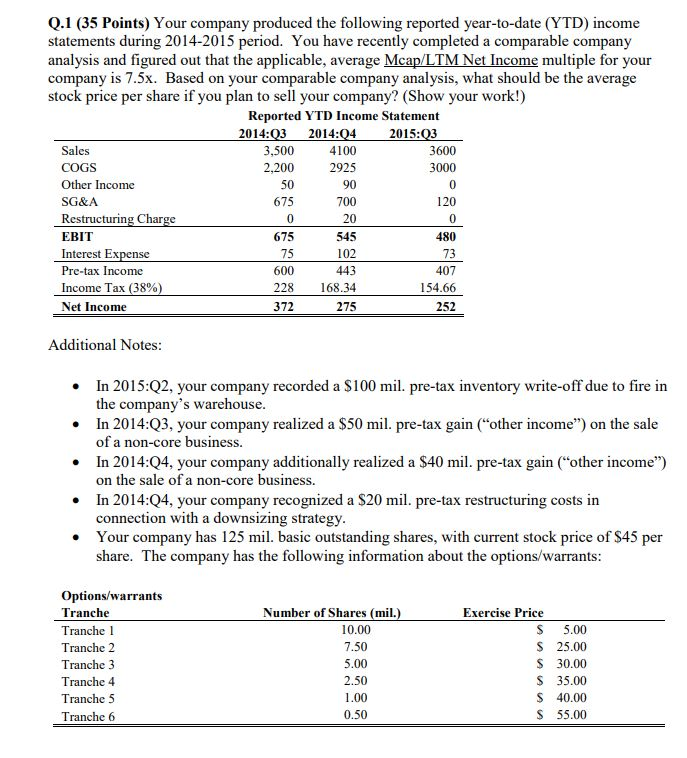

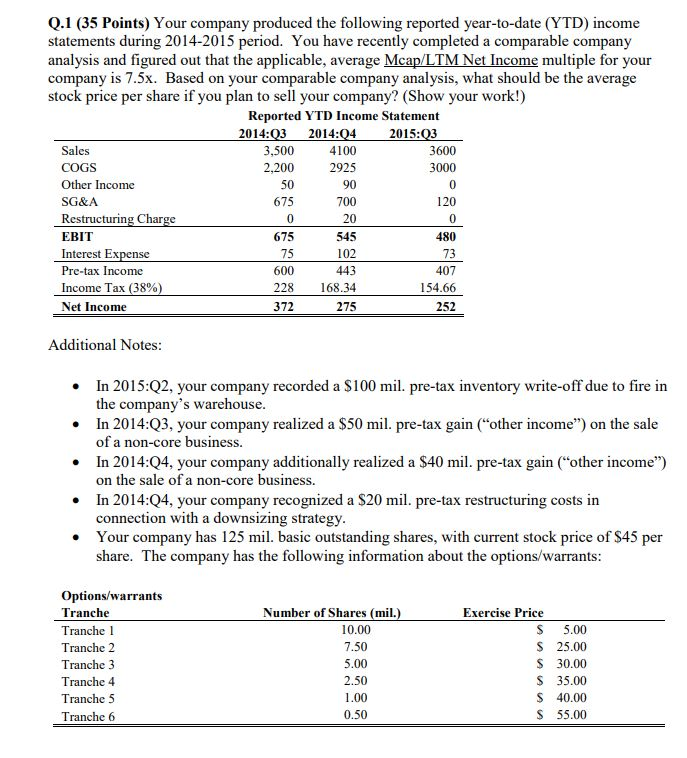

Your company produced the following reported year-to-date (YTD) income statements during 2014-2015 period. You have recently completed a comparable company analysis and figured out that the applicable, average Mcap/LTM Net Income multiple for your company is 7.5x. Based on your comparable company analysis, what should be the average stock price per share if you plan to sell your company? (Show your work!)

Q.1 (35 Points) Your company produced the following reported year-to-date (YTD) income statements during 2014-2015 period. You have recently completed a comparable company analysis and figured out that the applicable, average Mcap/LTM Net Income multiple for your company is 7.5x. Based on your comparable company analysis, what should be the average stock price per share if you plan to sell your company? (Show your work!) Reported YTD Income Statement 2014:03 2014:04 2015:03 Sales 3,500 4100 3600 COGS 2,200 2925 3000 Other Income SG&A Restructuring Charge EBIT Interest Expense Pre-tax Income 600 Income Tax (38%) 154.66 Net Income 372 252 50 675 0 675 75 90 700 20 545 102 443 168.34 275 0 120 0 480 73 407 228 Additional Notes: In 2015:Q2, your company recorded a $100 mil. pre-tax inventory write-off due to fire in the company's warehouse. In 2014:Q3, your company realized a $50 mil. pre-tax gain (other income) on the sale of a non-core business. In 2014:04, your company additionally realized a $40 mil. pre-tax gain (other income) on the sale of a non-core business. In 2014:Q4, your company recognized a $20 mil. pre-tax restructuring costs in connection with a downsizing strategy. Your company has 125 mil. basic outstanding shares, with current stock price of $45 per share. The company has the following information about the options/warrants: Options/warrants Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Tranche 6 Number of Shares (mil.) 10.00 7.50 5.00 2.50 1.00 0.50 Exercise Price $ 5.00 $ 25.00 $ 30.00 $ 35.00 $ 40.00 $ 55.00 Q.1 (35 Points) Your company produced the following reported year-to-date (YTD) income statements during 2014-2015 period. You have recently completed a comparable company analysis and figured out that the applicable, average Mcap/LTM Net Income multiple for your company is 7.5x. Based on your comparable company analysis, what should be the average stock price per share if you plan to sell your company? (Show your work!) Reported YTD Income Statement 2014:03 2014:04 2015:03 Sales 3,500 4100 3600 COGS 2,200 2925 3000 Other Income SG&A Restructuring Charge EBIT Interest Expense Pre-tax Income 600 Income Tax (38%) 154.66 Net Income 372 252 50 675 0 675 75 90 700 20 545 102 443 168.34 275 0 120 0 480 73 407 228 Additional Notes: In 2015:Q2, your company recorded a $100 mil. pre-tax inventory write-off due to fire in the company's warehouse. In 2014:Q3, your company realized a $50 mil. pre-tax gain (other income) on the sale of a non-core business. In 2014:04, your company additionally realized a $40 mil. pre-tax gain (other income) on the sale of a non-core business. In 2014:Q4, your company recognized a $20 mil. pre-tax restructuring costs in connection with a downsizing strategy. Your company has 125 mil. basic outstanding shares, with current stock price of $45 per share. The company has the following information about the options/warrants: Options/warrants Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Tranche 6 Number of Shares (mil.) 10.00 7.50 5.00 2.50 1.00 0.50 Exercise Price $ 5.00 $ 25.00 $ 30.00 $ 35.00 $ 40.00 $ 55.00