Question

Your company produces a fancy bag of potato chips . There are three main processes used in the chips. The first process washes and peels

Your company produces a fancy bag of potato chips . There are three main processes used in the chips. The first process washes and peels the potatoes. The second process slices and fries the potatoes. The third process seasons and packages the chips. The potato chips are sold in 12 oz bags (1 bag is a unit)

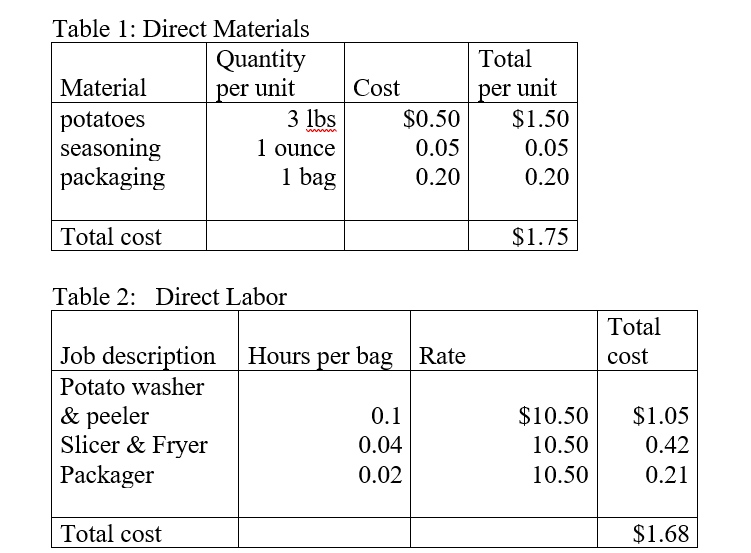

Information on the direct materials is listed in table 1. Consider this information the standard. Direct labor information given in Table 2. Consider this information the standard.

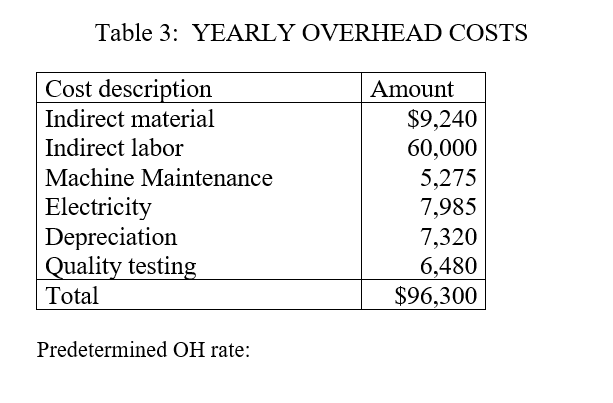

Annual overhead information is given in Table 3. Overhead is allocated based direct labor hours. Estimated annual direct labor hours are 18,000. Calculate a predetermined OH rate (round to two decimal places if needed). Use this rate when you need to apply OH.

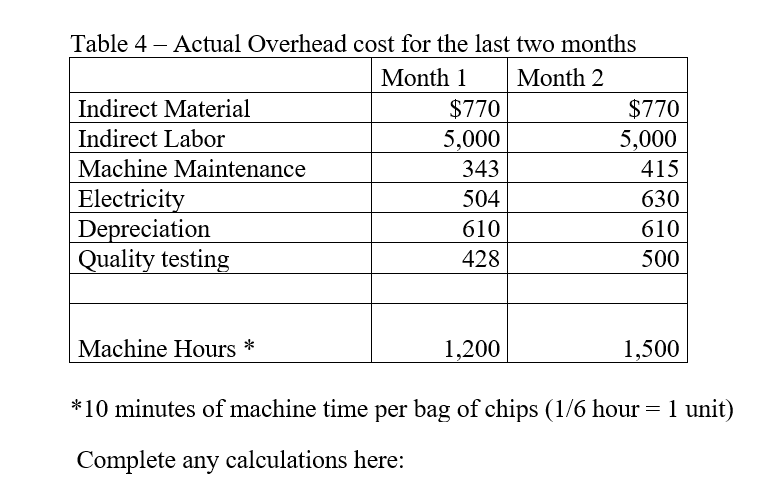

Table 4 gives you the information for the last two months on the overhead cost. Use this information to determine the fixed and variable portions of the cost. (You will need this information to complete Table 5). Machine hours have been determined as the best cost driver for separating mixed cost into their fixed and variable portions. It takes approximately 10 minutes of total machine time for each bag of chips (or 1/6 a machine hour per bag of chips).

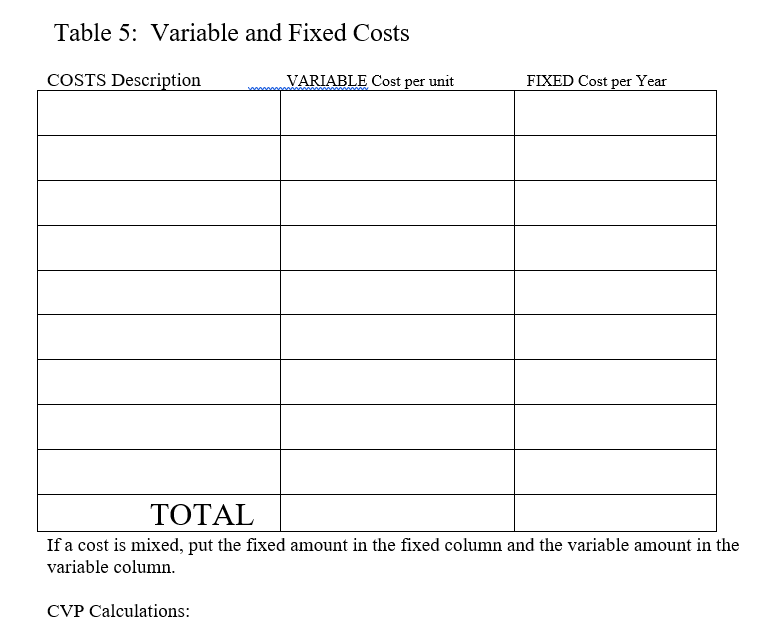

Table 5 is where you will list all your production cost, separated into their fixed and variable components.

Cost-Volume-Profit (CVP) Relationships

Selling Price: You sell a bag of chips for $5.75

Breakeven point: Calculate the breakeven point. Be sure to include the fixed component of mixed cost in your fixed costs and the variable component in the variable cost. Show your breakeven in Sales units and in Sales Dollars

Profit Planning: Determine the number of units you must sell to make an annual pre-tax profit using 3 assumptions concerning your net income (profit), both in sales units and sales dollars.

Aggressive Profit ($250,000)

Conservative Profit ($50,000)

Average Profit ($165,225)

Budgeting:

Create a sales budget using the information for earning an average profit for the year. You will break the budget down into the four quarters for the year. (Sales tend to be consistent each quarter, you can only sale a whole unit so round-up if necessary) Use table 6 to complete the sales budget.

Create a production budget for each quarter of the year (keep it in quarters; you do not need to break it down by month). You desire to keep 10% of next quarters sales in ending inventory. Sales for Qtr 1 the following year (year 2) are expected to be 30,000 bags of chips. There is not any beginning finished goods inventory for quarter one. Use table 7 to complete the production budget.

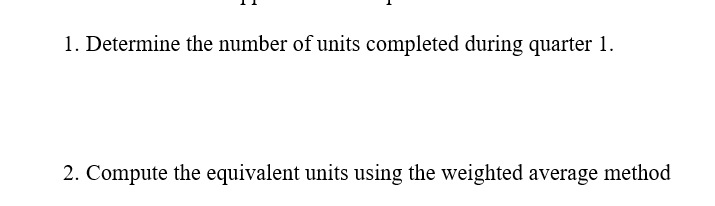

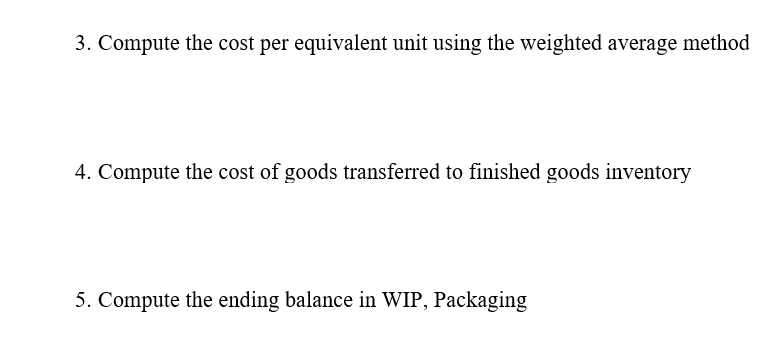

Running quarter one -- Weighted-average process costing. Table 8 presents the information for the packaging department. Complete the questions under table 8.

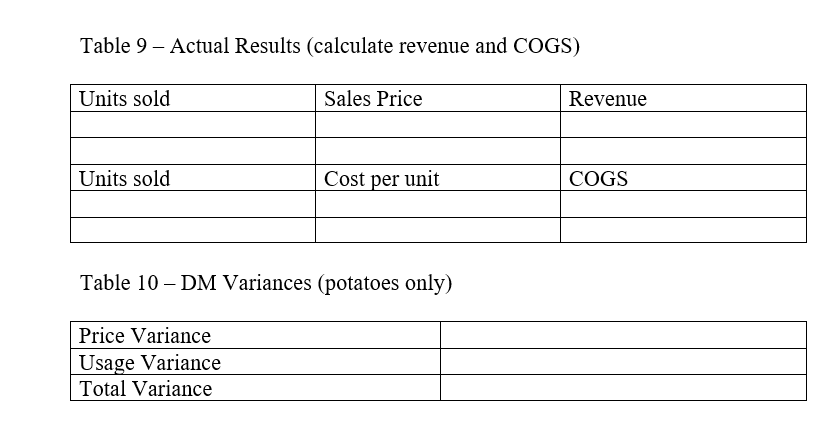

Actuals are in for quarter one. You sold 10% more units than you budgeted for (round to a whole unit), but price per unit was only $5.50.

Calculate revenue

Compute the cost of goods sold (total and per unit) before adjusting for actual OH cost

Actual potato usage for quarter one was 119,500 pounds at a price of $0.51 per pound. Actual equivalent units of production (bags of chips) completed through the first process (where the potatoes are added) was 42,055. Calculate the direct materials variances for the potatoes (price, usage, and total) and indicate if these variances are favorable or unfavorable.

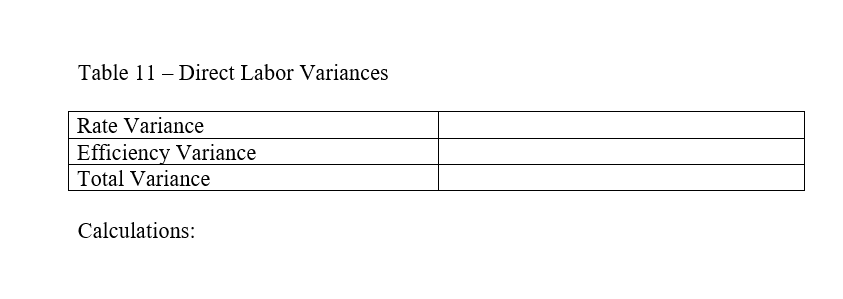

Actual direct labor hours for the quarter were 6,700 at an average rate of $11.00 per hour. For actual production, you expected to use 6,800 direct labor hours. Calculate the direct labor variances (rate, efficiency and total) and indicate if these variances are favorable or unfavorable.

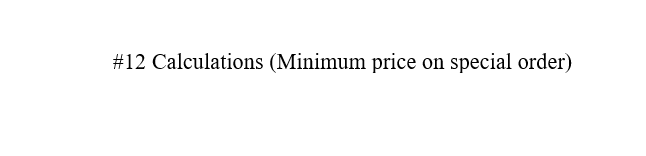

For next quarter, you have been asked to supply a special order of you potato chips. The non-profit organization requesting this order would like a custom bag (packaging) that will cost $0.50 instead of the normal $0.20 per bag. The request is for 1,500 bags of chips. Based on your projections you have the capacity for this order. What is the minimum price per unit and total price you would be willing to accept on this order? (You cannot afford to take this offer at a loss, but you are fine with accepting it at cost).

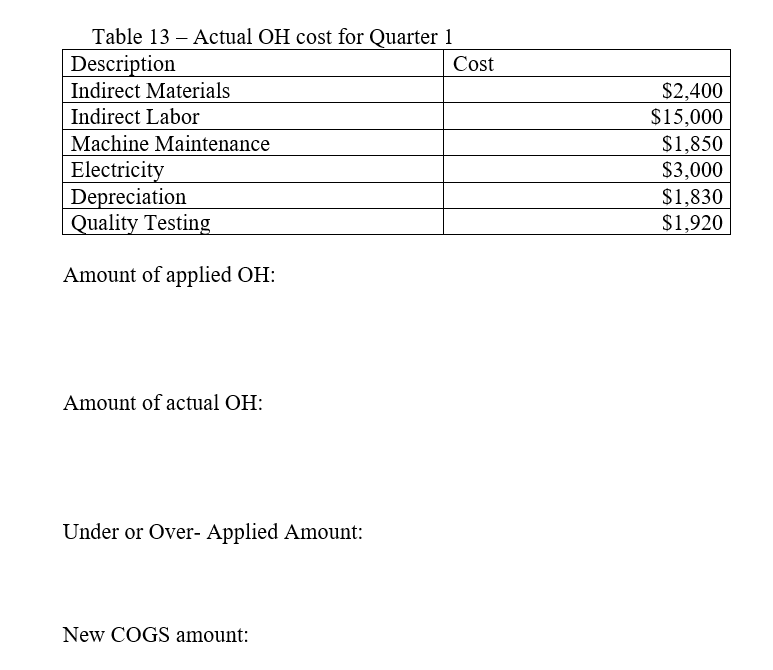

Determine over- or under-applied overhead and close to cost of goods sold. Actual OH cost are given in table 13 (look at #11 for actual DL hours used to apply OH). Determine the new cost of goods sold amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started