Answered step by step

Verified Expert Solution

Question

1 Approved Answer

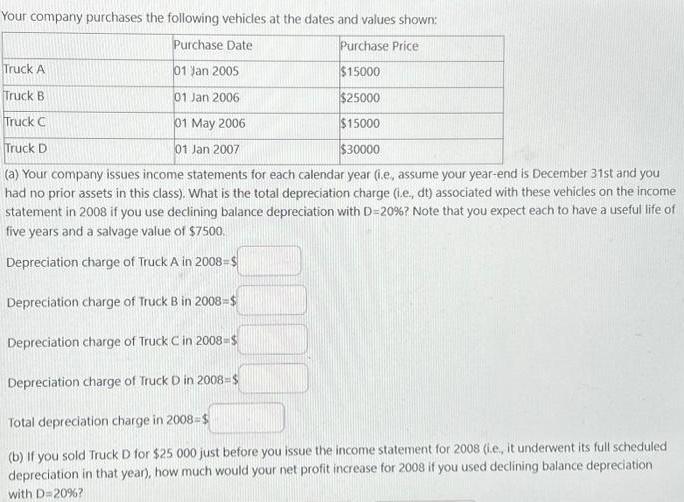

Your company purchases the following vehicles at the dates and values shown: Purchase Date 01 Jan 2005 Purchase Price Truck A $15000 Truck B

Your company purchases the following vehicles at the dates and values shown: Purchase Date 01 Jan 2005 Purchase Price Truck A $15000 Truck B $25000 Truck C $15000 Truck D $30000 (a) Your company issues income statements for each calendar year (i.e, assume your year-end is December 31st and you had no prior assets in this class). What is the total depreciation charge (i.e., dt) associated with these vehicles on the income statement in 2008 if you use declining balance depreciation with D=20 % ? Note that you expect each to have a useful life of five years and a salvage value of $7500. Depreciation charge of Truck A in 2008=$ Depreciation charge of Truck B in 2008-$ Depreciation charge of Truck C in 2008-$ Depreciation charge of Truck D in 2008-$ Total depreciation charge in 2008-$ (b) If you sold Truck D for $25 000 just before you issue the income statement for 2008 (i.e, it underwent its full scheduled depreciation in that year), how much would your net profit increase for 2008 if you used declining balance depreciation with D=20%? 01 Jan 2006 01 May 2006 01 Jan 2007

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the depreciation charge for each truck in 2008 using the declining balance method with a depreciation rate of 20 D20 we need to determi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started