Your company was incorporated in January 1st. The business provides a full range of landscaping services, including landscape design, construction, and maintenance. The following transactions occured during the first two years of operations.

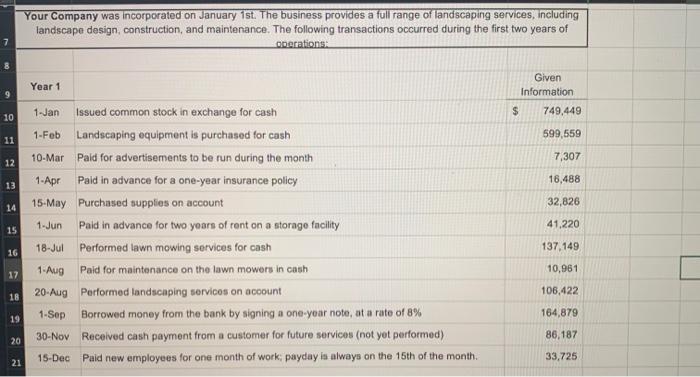

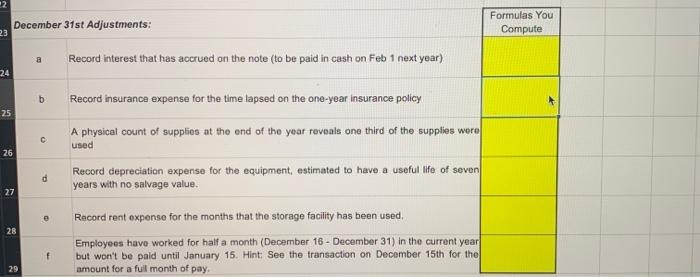

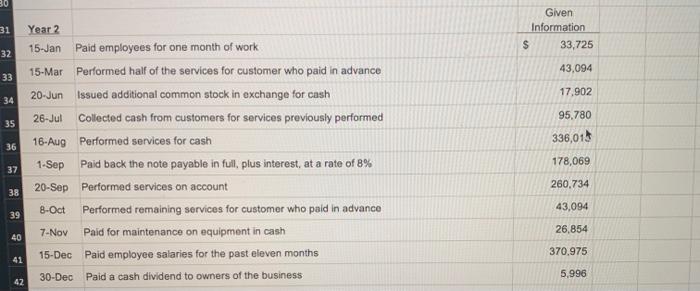

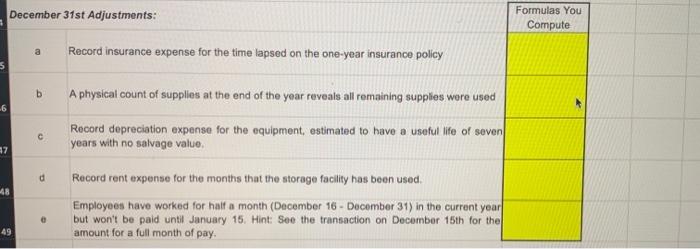

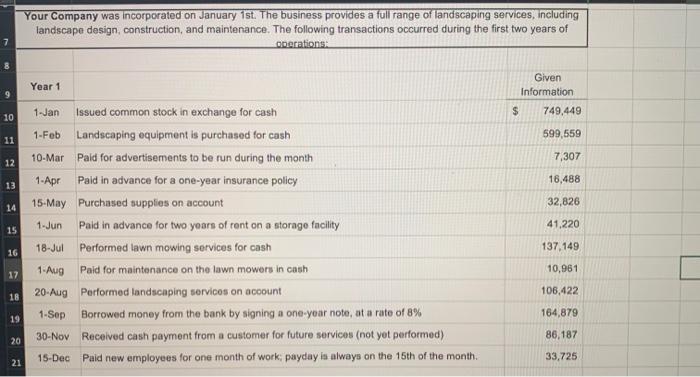

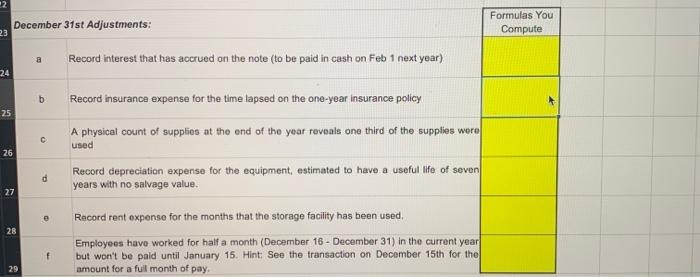

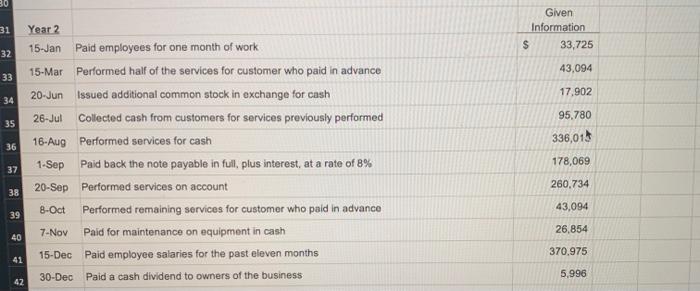

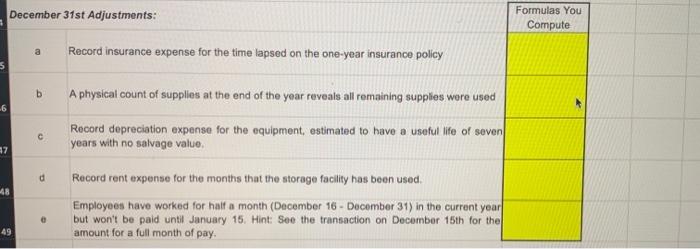

Your Company was incorporated on January 1st. The business provides a full range of landscaping services, including landscape design, construction, and maintenance. The following transactions occurred during the first two years of operations 7 8 Year 1 9 Given Information $ 749,449 10 599,559 11 7,307 12 16,488 13 32,826 14 41.220 15 1-Jan Issued common stock in exchange for cash 1-Feb Landscaping equipment is purchased for cash 10-Mar Paid for advertisements to be run during the month 1-Apr Pald in advance for a one-year insurance policy 15-May Purchased supplies on account 1.Jun Paid in advance for two years of rent on a storage facility 18-Jul Performed lawn mowing services for cash 1-Aug Paid for maintenance on the lawn mowers in cash 20-Aug Performed landscaping services on account 1-Sep Borrowed money from the bank by signing a one-year note, at a rate of 8% 30-Nov Received cash payment from a customer for future services (not yet performed) 15-Dec Paid new employees for one month of work payday is always on the 15th of the month. 137.149 16 10,981 17 106,422 18 164,879 19 86, 187 20 33,725 21 22 December 31st Adjustments: Formulas You Compute 23 a Record interest that has accrued on the note (to be paid in cash on Feb 1 next year) 24 b Record insurance expense for the time lapsed on the one-year insurance policy 25 A physical count of supplies at the end of the year reveals one third of the supplies were used 26 Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value. 27 e Record rent expense for the months that the storage facility has been used. 28 f Employees have worked for half a month (December 16 - December 31) in the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay. 29 31 Given Information $ 33,725 32 43,094 33 17,902 34 95.780 35 Year 2 15-Jan Paid employees for one month of work 15-Mar Performed half of the services for customer who paid in advance 20-Jun Issued additional common stock in exchange for cash 26-Jul Collected cash from customers for services previously performed 16-Aug Performed services for cash 1.Sep Paid back the note payable in full, plus interest, at a rate of 8% 20-Sep Performed services on account 8-Oct Performed remaining services for customer who paid in advance 7-Nov Paid for maintenance on equipment in cash 336,015 36 178,069 37 260,734 38 43,094 39 26,854 40 15-Dec Paid employee salaries for the past eleven months 41 370,975 30-Dec Paid a cash dividend to owners of the business 5,996 42 December 31st Adjustments: Formulas You Compute a Record insurance expense for the time lapsed on the one-year insurance policy b A physical count of supplies at the end of the year reveals all remaining supplies were used -6 Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value 17 d Record rent exponse for the months that the storage facility has been used 48 Employees have worked for half a month (December 16 - December 31) in the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay. 49