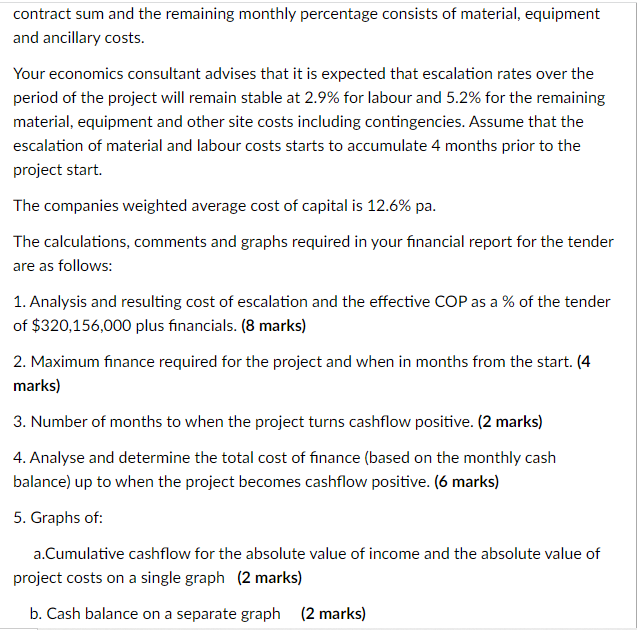

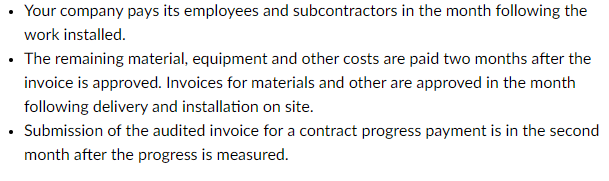

Your company "WasteConstructors Pty Ltd" have almost completed the tender for a waste processing facility on the outskirts of Melbourne for "Cleanair Pty Ltd". You have been asked by your company's Chief Financial Officer (CFO) to report on the impact of financial factors and the cost of working capital for the project on a monthby-month basis (Hint: what are your recommendations to the CFO?). The facility will take 36 months from contract award to handover and the proposed tender price is currently $320,156,000 plus financial costs. Your planning group have produced a cashflow based on when the work will actually be performed over a 36 month schedule. Here is the excesheet with cashflow 2022C30004 examModelTemplate R0-2.xlsx (Note: the excel cashflow supplied must be used to develop your analysis and print ready report and hint: you may need to use split screens to set up your analysis). The Clients proposed terms of payment are: - The client will pay 100% of monthly progress claims, paid two months after receipt of an audited invoice, provided the contractor supplies a bank guarantee. - On average, submission of the audited invoice for payment is in the second month after the progress is measured. The COP and contingency included in the tender, works out as 19.5% and 2.8% of the current tender price, respectively. Company policy for cashflow forecasts is to assume contingency will be spent. On a month-by-month basis employees and subcontractors make up 23% of the contract sum and the remaining monthly percentage consists of material, equipment contract sum and the remaining monthly percentage consists of material, equipment and ancillary costs. Your economics consultant advises that it is expected that escalation rates over the period of the project will remain stable at 2.9% for labour and 5.2% for the remaining material, equipment and other site costs including contingencies. Assume that the escalation of material and labour costs starts to accumulate 4 months prior to the project start. The companies weighted average cost of capital is 12.6% pa. The calculations, comments and graphs required in your financial report for the tender are as follows: 1. Analysis and resulting cost of escalation and the effective COP as a \% of the tender of $320,156,000 plus financials. ( 8 marks) 2. Maximum finance required for the project and when in months from the start. (4 marks) 3. Number of months to when the project turns cashflow positive. ( 2 marks) 4. Analyse and determine the total cost of finance (based on the monthly cash balance) up to when the project becomes cashflow positive. (6 marks) 5. Graphs of: a.Cumulative cashflow for the absolute value of income and the absolute value of project costs on a single graph (2 marks) b. Cash balance on a separate graph (2 marks) - Your company pays its employees and subcontractors in the month following the work installed. - The remaining material, equipment and other costs are paid two months after the invoice is approved. Invoices for materials and other are approved in the month following delivery and installation on site. - Submission of the audited invoice for a contract progress payment is in the second month after the progress is measured. Your company "WasteConstructors Pty Ltd" have almost completed the tender for a waste processing facility on the outskirts of Melbourne for "Cleanair Pty Ltd". You have been asked by your company's Chief Financial Officer (CFO) to report on the impact of financial factors and the cost of working capital for the project on a monthby-month basis (Hint: what are your recommendations to the CFO?). The facility will take 36 months from contract award to handover and the proposed tender price is currently $320,156,000 plus financial costs. Your planning group have produced a cashflow based on when the work will actually be performed over a 36 month schedule. Here is the excesheet with cashflow 2022C30004 examModelTemplate R0-2.xlsx (Note: the excel cashflow supplied must be used to develop your analysis and print ready report and hint: you may need to use split screens to set up your analysis). The Clients proposed terms of payment are: - The client will pay 100% of monthly progress claims, paid two months after receipt of an audited invoice, provided the contractor supplies a bank guarantee. - On average, submission of the audited invoice for payment is in the second month after the progress is measured. The COP and contingency included in the tender, works out as 19.5% and 2.8% of the current tender price, respectively. Company policy for cashflow forecasts is to assume contingency will be spent. On a month-by-month basis employees and subcontractors make up 23% of the contract sum and the remaining monthly percentage consists of material, equipment contract sum and the remaining monthly percentage consists of material, equipment and ancillary costs. Your economics consultant advises that it is expected that escalation rates over the period of the project will remain stable at 2.9% for labour and 5.2% for the remaining material, equipment and other site costs including contingencies. Assume that the escalation of material and labour costs starts to accumulate 4 months prior to the project start. The companies weighted average cost of capital is 12.6% pa. The calculations, comments and graphs required in your financial report for the tender are as follows: 1. Analysis and resulting cost of escalation and the effective COP as a \% of the tender of $320,156,000 plus financials. ( 8 marks) 2. Maximum finance required for the project and when in months from the start. (4 marks) 3. Number of months to when the project turns cashflow positive. ( 2 marks) 4. Analyse and determine the total cost of finance (based on the monthly cash balance) up to when the project becomes cashflow positive. (6 marks) 5. Graphs of: a.Cumulative cashflow for the absolute value of income and the absolute value of project costs on a single graph (2 marks) b. Cash balance on a separate graph (2 marks) - Your company pays its employees and subcontractors in the month following the work installed. - The remaining material, equipment and other costs are paid two months after the invoice is approved. Invoices for materials and other are approved in the month following delivery and installation on site. - Submission of the audited invoice for a contract progress payment is in the second month after the progress is measured