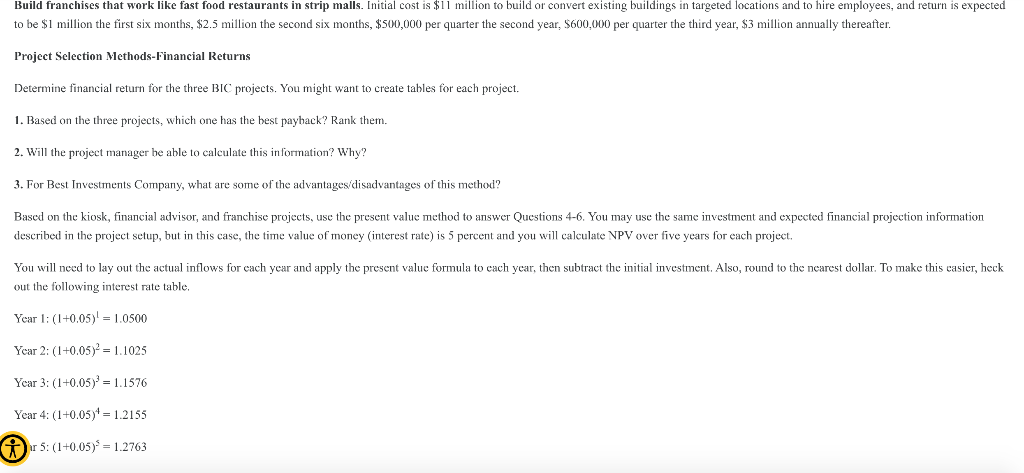

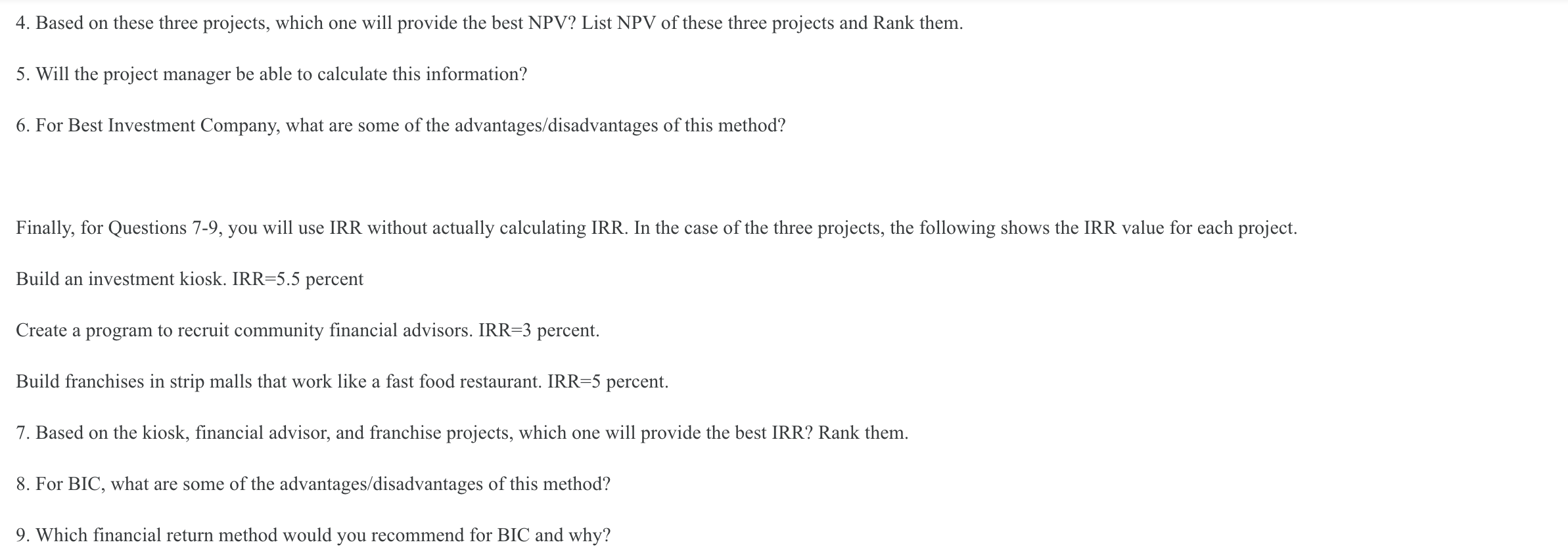

Your consulting company, Terrific Project Management Partners (TPMP), has been asked to help an established investments company, Best Investments Company (BIC), use project selection methods. Best Investments Company tends to take on any project proposal so it has become increasingly difficult manage the company's project portfolio. Just as BIC helps its customers achieve the best return for their money, BIC would like to ensure that its three projects have the best financial return; BIC decided to use financial return as their major project selection method. In order to select the best financial return method, you will take the executives at BIC through several exercises to help them decide which one they should use. They have decided that they want their project managers to be able to calculate these financial return methodologies; they do not want to make the work too complex, hut they want the most accurate method possible. You will take them through the following financial return methods: Payback period Payback period is the amount of time it takes a company to recoup its initial investment in the cost of producing a product or service. It is fairly simple to use, but is not as accurate as other methods because it does not consider how the value of money is affected by interest over time. The decision is based on when the payback comes, not on how much the organization will make after that payback point. Discounted cash flowet present value (NPV) Net present value (NPV) brings the value of future monies received into today's dollars minus the initial investment. It is a fairly accurate method because it takes into account the time value of money, but it uses more complicated formulas. You would choose projects with the highest NPV. Internal rate of return (IRR) IRR is the discount rate when the present valuc of the cash inflows equals the original investment. This is a complex but accurate calculation. You should choose projects with the highest IRR value, When completing Excrcise 1.2, you will use the following projects and financial projections to help the company see how these methods work. Build an investment kiosk. Initial cost is $5 million to install in targeted locations, and return is expected to be $750,000 the first year, $300,000 per quarter over the next two years, and $750,000 semiannually, thereafter. Create a program to recruit community financial advisors. Initial cost is $8 million to recruit and train the advisors, and return is expected to be $1.5 million the first year, $400,000 per quarter over next three years, and $750,000 semiannually thereafter. Build franchises that work like fast food restaurants in strip malls. Initial cost is $11 million to build or convert existing buildings in targeted locations and to hire employees, and return is expected to be $1 million the first six months, $2.5 million the second six months, $500,000 per quarter the second year, $600,000 per quarter the third year, $3 million annually thereafter. Project Selection Methods-Financial Returns Determine financial return for the three BIC projects. You might want to create tables for each project. 1. Based on the three projects, which one has the best payback? Rank them. 2. Will the project manager be able to calculate this information? Why? 3. For Best Investments Company, what are some of the advantages/disadvantages of this method? Based on the kiosk, financial advisor, and franchisc projects, use the present value method to answer Questions 4-6. You may use the same investment and expected financial projection information described in the project setup, but in this case, the time value of money (interest rate) is 5 percent and you will calculate NPV over five years for each project. You will need to lay out the actual inflows for cach year and apply the present value formula to cach ycar, then subtract the initial investment. Also, round to the nearest dollar. To make this casier, heck out the following interest rate table. Year 1: (1+0.05)! = 1.0500 Year 2: (1+0,05)y = 1.1025 Year 3: (1+0,05) = 1.1576 Year 4: (1+0.05)* = 1.2155 Oir 5: (1+0.05) = 1.2763 4. Based on these three projects, which one will provide the best NPV? List NPV of these three projects and Rank them. 5. Will the project manager be able to calculate this information? 6. For Best Investment Company, what are some of the advantages/disadvantages of this method? Finally, for Questions 7-9, you will use IRR without actually calculating IRR. In the case of the three projects, the following shows the IRR value for each project. Build an investment kiosk. IRR=5.5 percent Create a program to recruit community financial advisors. IRR=3 percent. Build franchises in strip malls that work like a fast food restaurant. IRR=5 percent. 7. Based on the kiosk, financial advisor, and franchise projects, which one will provide the best IRR? Rank them. 8. For BIC, what are some of the advantages/disadvantages of this method? 9. Which financial return method would you recommend for BIC and why