Answered step by step

Verified Expert Solution

Question

1 Approved Answer

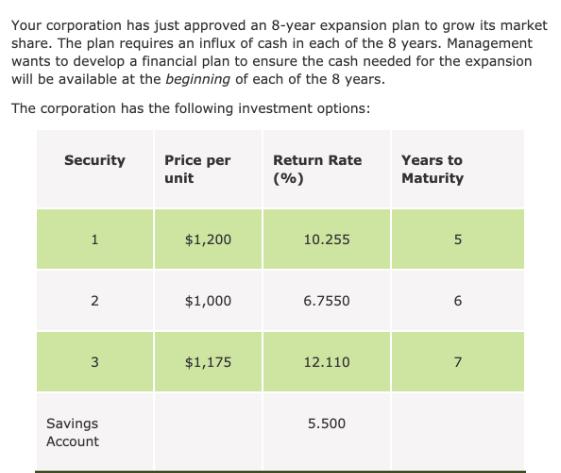

Your corporation has just approved an 8-year expansion plan to grow its market share. The plan requires an influx of cash in each of

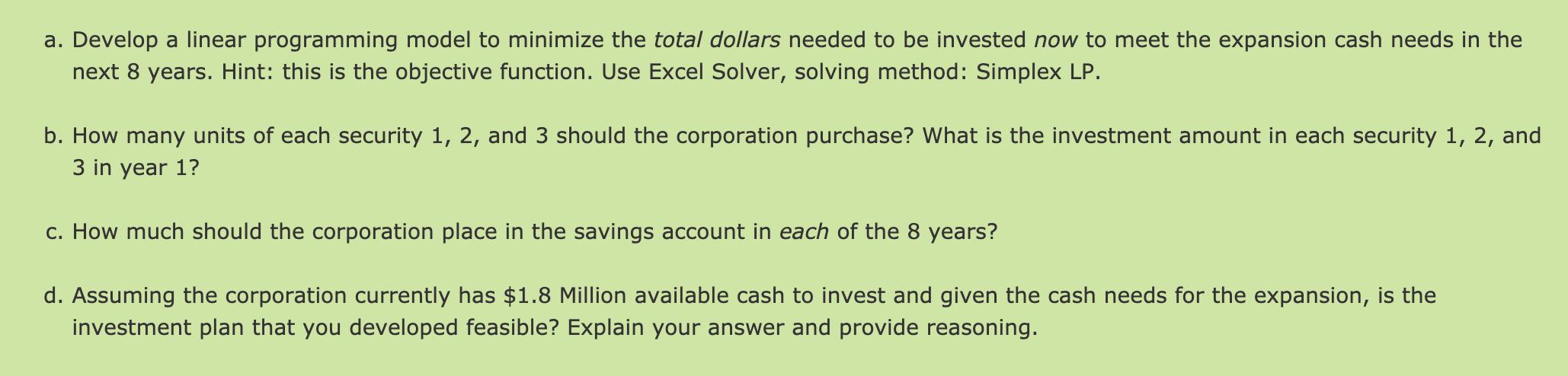

Your corporation has just approved an 8-year expansion plan to grow its market share. The plan requires an influx of cash in each of the 8 years. Management wants to develop a financial plan to ensure the cash needed for the expansion will be available at the beginning of each of the 8 years. The corporation has the following investment options: Security 1 2 3 Savings Account Price per unit $1,200 $1,000 $1,175 Return Rate (%) 10.255 6.7550 12.110 5.500 Years to Maturity 5 6 a. Develop a linear programming model to minimize the total dollars needed to be invested now to meet the expansion cash needs in the next 8 years. Hint: this is the objective function. Use Excel Solver, solving method: Simplex LP. b. How many units of each security 1, 2, and 3 should the corporation purchase? What is the investment amount in each security 1, 2, and 3 in year 1? c. How much should the corporation place in the savings account in each of the 8 years? d. Assuming the corporation currently has $1.8 Million available cash to invest and given the cash needs for the expansion, is the investment plan that you developed feasible? Explain your answer and provide reasoning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Linear Programming Model for Expansion Cash Needs Heres the linear programming model for this scenar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started