Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your corporation is currently all-equity financed with 400,000 shares of common stock selling for $37 a share. Currently your firm generates $4,000,000 in EBIT

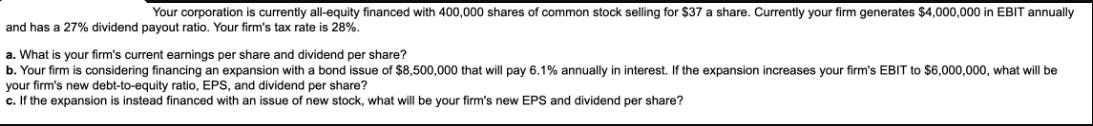

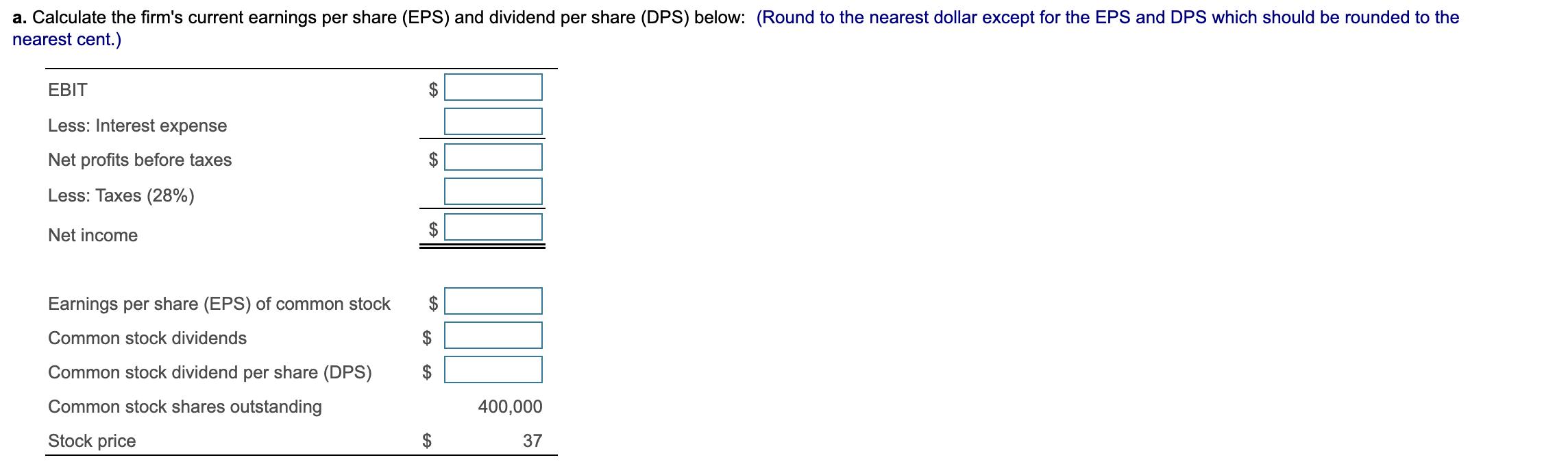

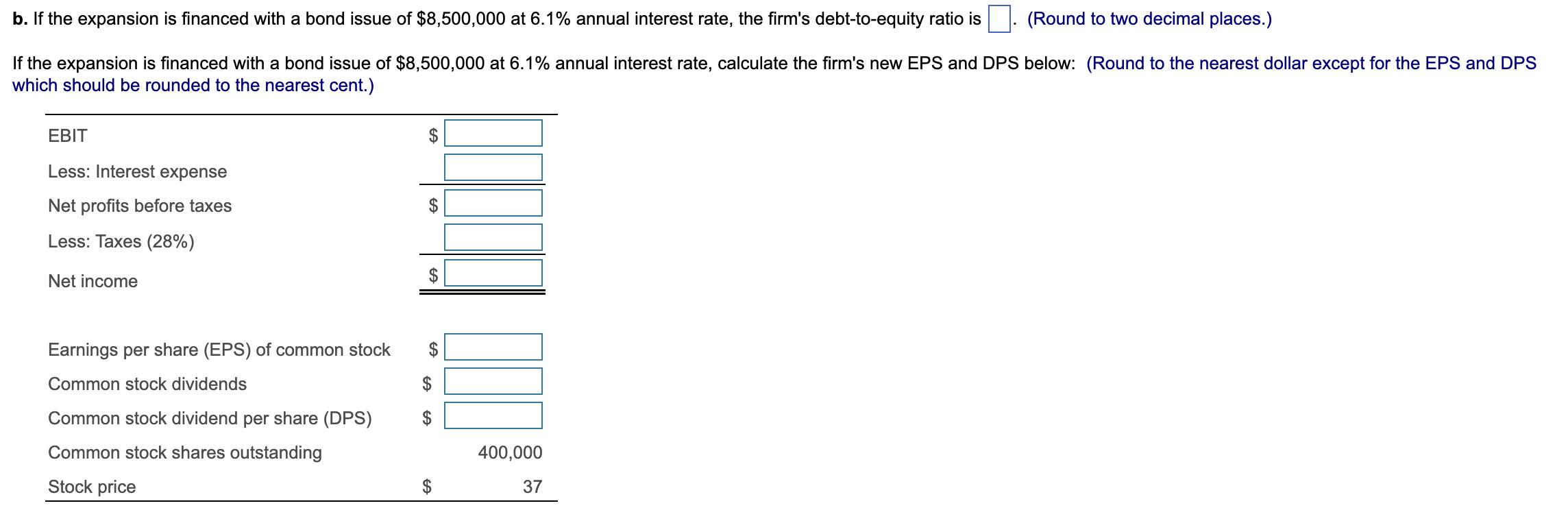

Your corporation is currently all-equity financed with 400,000 shares of common stock selling for $37 a share. Currently your firm generates $4,000,000 in EBIT annually and has a 27% dividend payout ratio. Your firm's tax rate is 28%. a. What is your firm's current earnings per share and dividend per share? b. Your firm is considering financing an expansion with a bond issue of $8,500,000 that will pay 6.1% annually in interest. If the expansion increases your firm's EBIT to $6,000,000, what will be your firm's new debt-to-equity ratio, EPS, and dividend per share? c. If the expansion is instead financed with an issue of new stock, what will be your firm's new EPS and dividend per share? a. Calculate the firm's current earnings per share (EPS) and dividend per share (DPS) below: (Round to the nearest dollar except for the EPS and DPS which should be rounded to the nearest cent.) EBIT Less: Interest expense Net profits before taxes Less: Taxes (28%) Net income Earnings per share (EPS) of common stock Common stock dividends Common stock dividend per share (DPS) Common stock shares outstanding Stock price GA $ $ $ SA 400,000 37 b. If the expansion is financed with a bond issue of $8,500,000 at 6.1% annual interest rate, the firm's debt-to-equity ratio is (Round to two decimal places.) If the expansion is financed with a bond issue of $8,500,000 at 6.1% annual interest rate, calculate the firm's new EPS and DPS below: (Round to the nearest dollar except for the EPS and DPS which should be rounded to the nearest cent.) EBIT Less: Interest expense Net profits before taxes Less: Taxes (28%) Net income Earnings per share (EPS) of common stock Common stock dividends Common stock dividend per share (DPS) Common stock shares outstanding Stock price $ $ $ 400,000 37 c. If the expansion is instead financed with a new stock issue of $8,500,000, the total number of common stock shares outstanding after the expansion will be shares. (Round to the nearest whole number.) If the expansion is instead financed with a new stock issue of $8,500,000, calculate the firm's new EPS and DPS below: (Round to the nearest dollar except for the EPS and DPS which should be rounded to the nearest cent.) EBIT Less: Interest expense Net profits before taxes Less: Taxes (28%) Net income Earnings per share (EPS) of common stock Common stock dividends Common stock dividend per share (DPS) Common stock shares outstanding Stock price GA GA $ EA 629,730 37

Step by Step Solution

★★★★★

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Current EPS and DPS EBIT 4000000 Interest expense 0 Net profits before taxes 4000000 Taxes 28 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started