Answered step by step

Verified Expert Solution

Question

1 Approved Answer

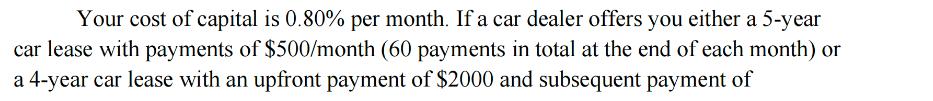

Your cost of capital is 0.80% per month. If a car dealer offers you either a 5-year car lease with payments of $500/month (60

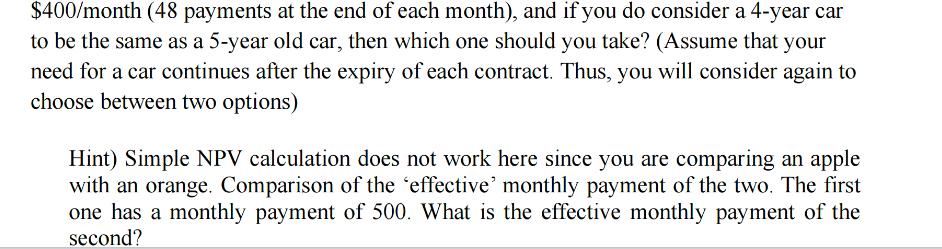

Your cost of capital is 0.80% per month. If a car dealer offers you either a 5-year car lease with payments of $500/month (60 payments in total at the end of each month) or a 4-year car lease with an upfront payment of $2000 and subsequent payment of $400/month (48 payments at the end of each month), and if you do consider a 4-year car to be the same as a 5-year old car, then which one should you take? (Assume that your need for a car continues after the expiry of each contract. Thus, you will consider again to choose between two options) Hint) Simple NPV calculation does not work here since you are comparing an apple with an orange. Comparison of the effective' monthly payment of the two. The first one has a monthly payment of 500. What is the effective monthly payment of the second?

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To compare the two lease options we need to find the effective monthly payment for the second option ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started