Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your Cousin has emailed you and wants to know if you think her business is a good investment opportunity. You know that ratios help to

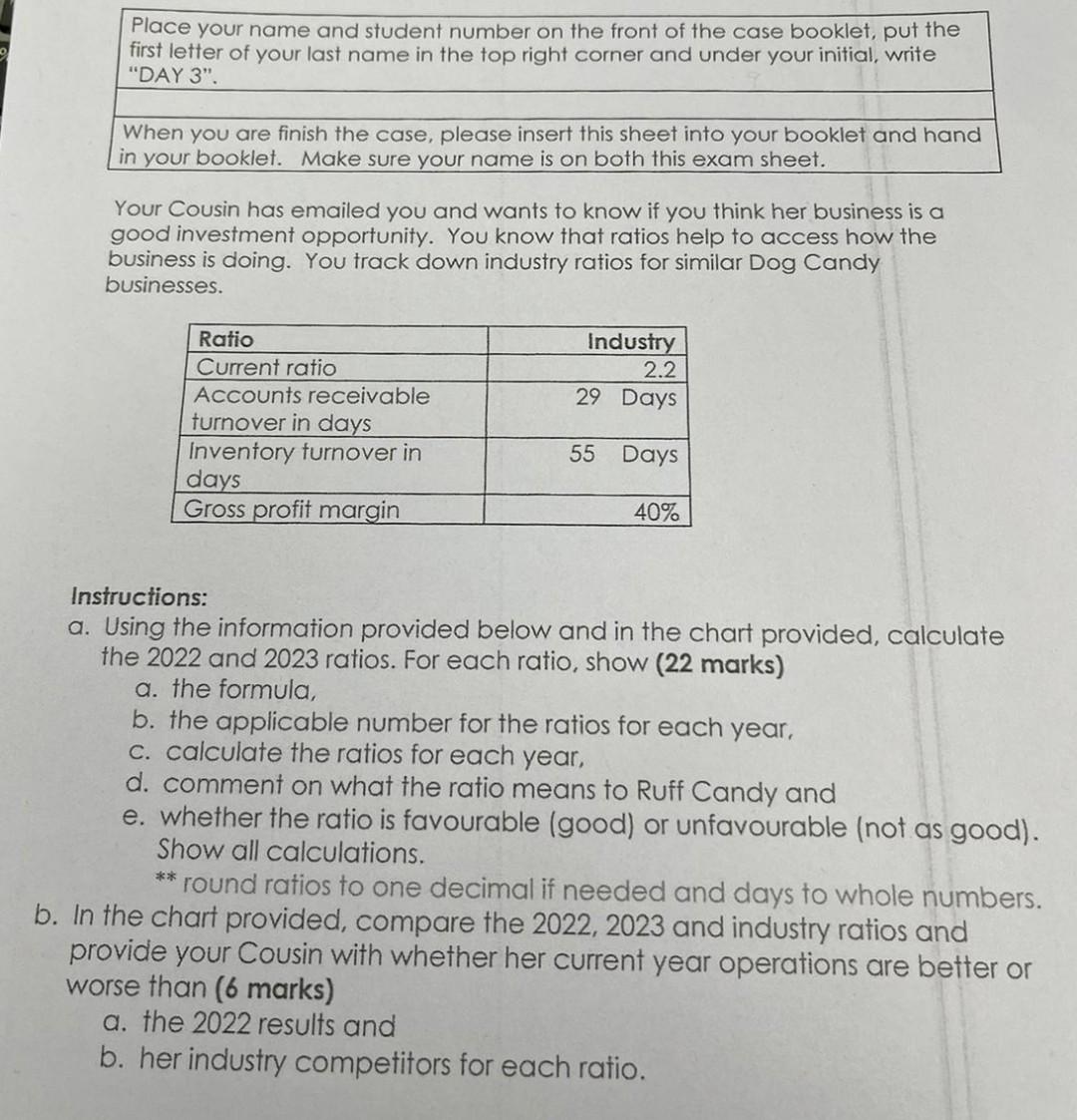

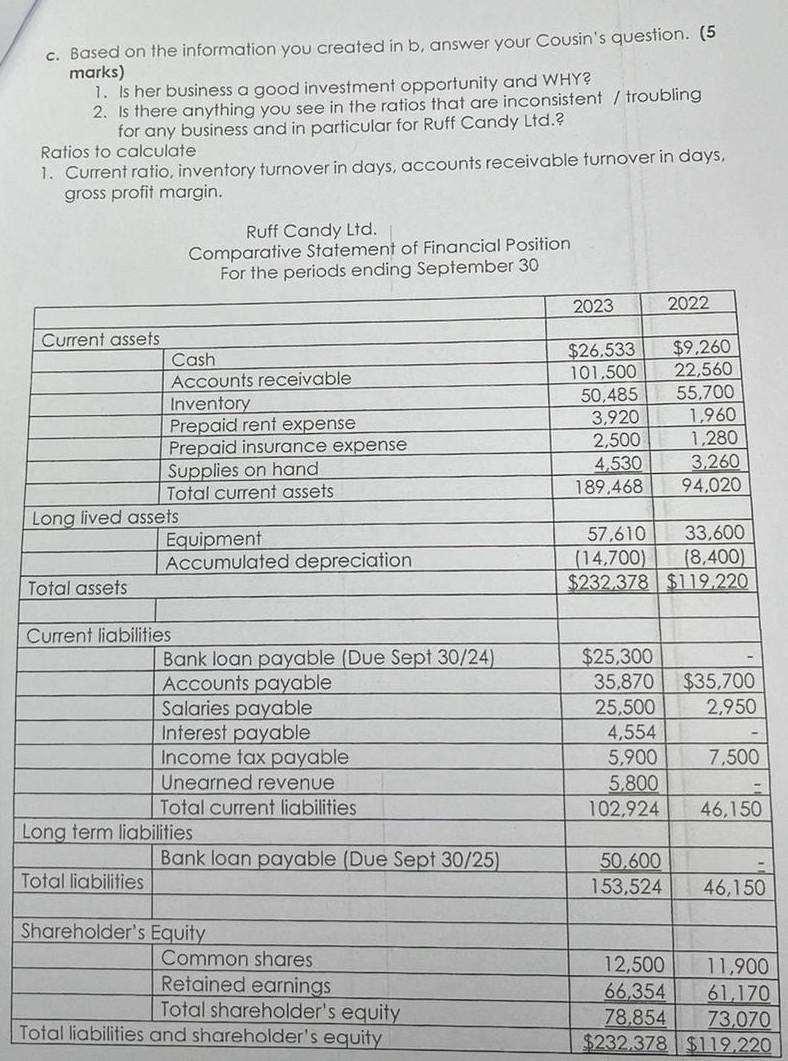

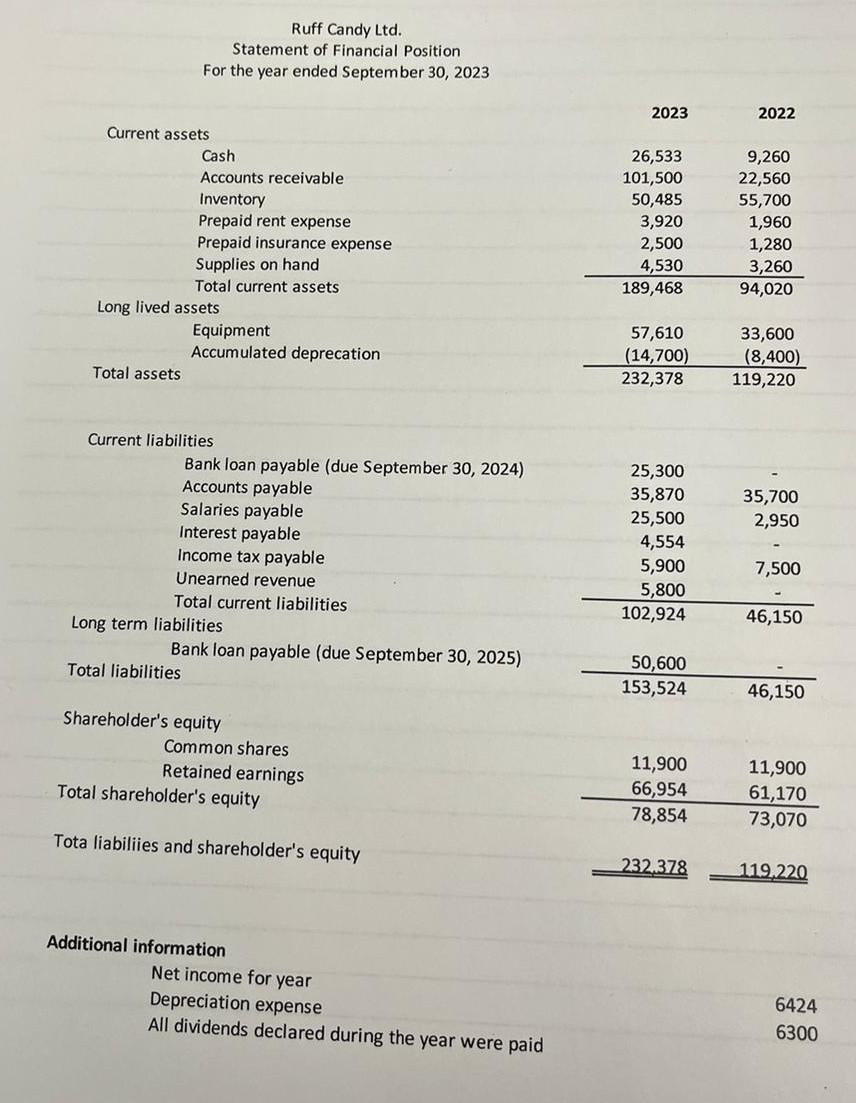

Your Cousin has emailed you and wants to know if you think her business is a good investment opportunity. You know that ratios help to access how the business is doing. You track down industry ratios for similar Dog Candy businesses. Instructions: a. Using the information provided below and in the chart provided, calculate the 2022 and 2023 ratios. For each ratio, show (22 marks) a. the formula, b. the applicable number for the ratios for each year, c. calculate the ratios for each year, d. comment on what the ratio means to Ruff Candy and e. whether the ratio is favourable (good) or unfavourable (not as good). Show all calculations. ** round ratios to one decimal if needed and days to whole numbers. b. In the chart provided, compare the 2022, 2023 and industry ratios and provide your Cousin with whether her current year operations are better or worse than ( 6 marks) a. the 2022 results and b. her industry competitors for each ratio. c. Based on the information you created in b, answer your Cousin's question. (5 marks) 1. Is her business a good investment opportunity and WHY? 2. Is there anything you see in the ratios that are inconsistent / troubling for any business and in particular for Ruff Candy Ltd.? Ratios to calculate 1. Current ratio, inventory turnover in days, accounts receivable turnover in days, gross profit margin. Ruff Candy Ltd. Comparative Statement of Financial Position For the periods ending September 30 Ruff Candy Ltd. Statement of Financial Position For the year ended September 30, 2023 \begin{tabular}{crr} Current assets & 2023 & 2022 \\ Cash & & \\ Accounts receivable & 26,533 & 9,260 \\ Inventory & 101,500 & 22,560 \\ Prepaid rent expense & 50,485 & 55,700 \\ Prepaid insurance expense & 3,920 & 1,960 \\ Supplies on hand & 2,500 & 1,280 \\ Total current assets & 4,530 & 3,260 \\ \cline { 2 - 4 } Long lived assets & 189,468 & 94,020 \\ Equipment & & \\ Accumulated deprecation & 57,610 & 33,600 \\ Total assets & (14,700) & (8,400) \\ \cline { 3 - 4 } & 232,378 & 119,220 \end{tabular} Current liabilities Bankloanpayable(dueSeptember30,2024)AccountspayableSalariespayableInterestpayableIncometaxpayableUnearnedrevenueTotalcurrentliabilities25,30035,87025,5004,5545,9005,800102,92435,7002,9507,50046,150 Long term liabilities \begin{tabular}{rc} 50,600 & \\ \hline 153,524 & 46,150 \end{tabular} Total liabilities Shareholder's equity Common shares Retained earnings Total shareholder's equity Tota liabiliies and shareholder's equity 232,378119,220 Additional information Net income for year Depreciation expense All dividends declared during the year were paid 6424 6300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started