Question

Your credit card has a balance of $4900 and an annual interest rate of 18%. You decide to pay off the balance over three years.

Your credit card has a balance of $4900 and an annual interest rate of 18%. You decide to pay off the balance over three years. If there are no further purchases charged to the card, you must pay $177.15 each month, and you will pay a total interest of $1477.40. Assume you decide to pay off the balance over one year rather than three. How much more must you pay each month and how much less will you pay in total interest?

a.) You will pay $__ more each month. (Round to the nearest cent as needed.)

b.) You will pay $__ less in total interest. (Round to the nearest cent as needed.)

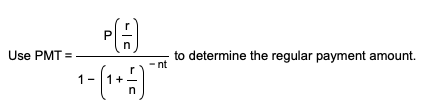

Use PMT= P(H) 1- ( + 7) n to determine the regular payment amount. ntStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started