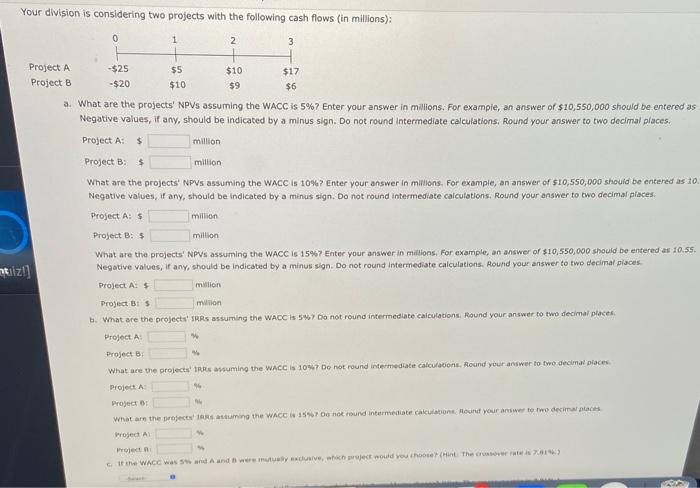

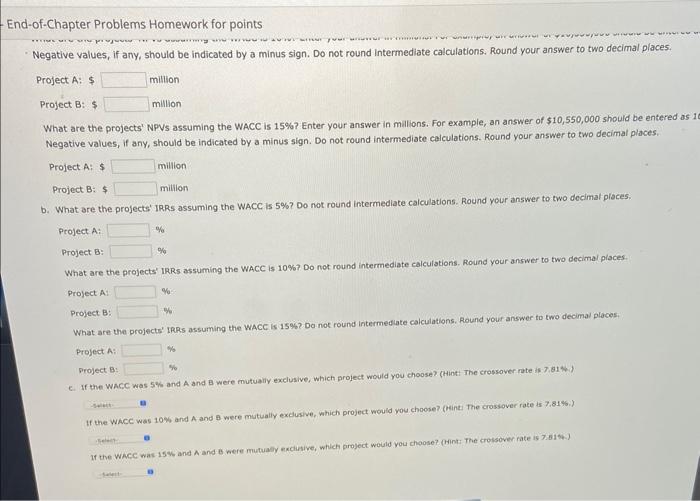

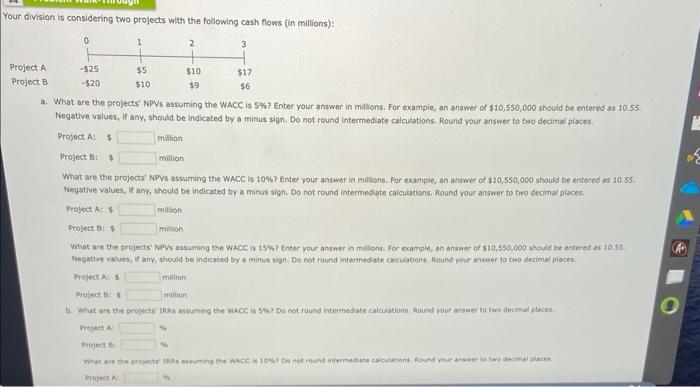

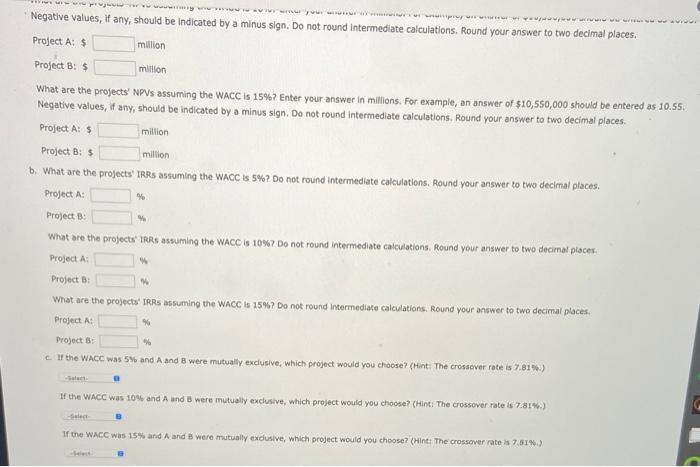

Your division is considering two projects with the following cash flows (in millions): Project A Project B a. What are the projects' NPVs assuming the WACC is 5% ? Enter your answer in millions. For exampie, an answer of $10,550,000 should be entered as Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations, Round your answer to two decimal places. What are the projects' NPVs assuming the WACC is 10\%, Enter your answer in millions, For example, an answer of 510,550,000 shouid be entered as to Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimat places. What are the projects' NPVs assuming the WACC is 15% ? Enter your answer in mallions. For example, an answer of {10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Aound your answer to two decimal places. ProjectA:5ProjectB:3mullionmution 4. What are the projects' sprs assuming the Wacc is 5% to not round intermediate calculotions, Round your answer to two decimal places. Project A: prosect B: Project A: Prosect ber wroject Ai molect 9 : -Chapter Problems Homework for points egative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places. rojectA:$ProjectB:$millionmillion What are the projects' NPVs assuming the WACC is 15% ? Enter your answer in millions. For example, an answer of $10,550,000 should be entered Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places. b. What are the projects' IRRs assuming the WACC is 5% ? Do not round intermediate calculations. Round your answer to two decimal places. ProjectA:ProjectB: What are the projects' IRRs assuming the WACC is 10\%? Do not round intermediate calculations. Round your answer to two decimal places. Project A: Project B: What are the projects' IRRs assuming the WACC is 15\%? Da not round intermediate calculations. Round your answer to two decimal ploces. Project A: Project B: e. If the WaCC was 5% and A and B were mutuanly exclusive, which project would you choose? (Hint The crossover rote is 7.81 * If the WACC was 10% and A and B were mutually exdusive, which project would you choose (Mint the crossover rate is 7.81%, i) Your division is considering two projects with the following cash flows (in millions): Project A Project B a. What are the projects' NPNs assuming the WACC is 5% ? Enter your answer in millons, For example, an answer of $10,550,000 should be entered as 10.55. Negative yalues, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places. Project Ai 5 milion Project B: $ million What are the projects' kipvs assuming the WACC is 10% ?. Enter your answer in milions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, it any, should be indicated by a minus signt. Do not round intermed yte calculations. Round your answer to two decimal placesi: Prajecta: $ mition Project B: 1 malion What arn the projects NPVs assuming the Wacc is 15% ? Enter your answer in melions. For example, an answer of 510,550,000 sheuld be entered as 1055 . Negative values, if any, should be indicated by s minus sign. 00 not round intermediate calculations. Round your answer to two decimal piaces. Hroject a: Project 6 is Project Ail Negative values, if any; should be indicated by a minus sign. Do not round intermediate calculations, Round your answer to two decimal places, ProjectA;$ProjectB:$millionmilion What are the projects' NPVs assuming the WACC is 15% ? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places. b. What are the projects' IRRs assuming the WACC is 5% ? Do not round intermediate calculations, Round your answer to two decimal places. ProjectA:ProjectB: What are the projects' tRRs assuming the WACC is 10%7Do not round intermediate calculations. Round your answer to two decimal placer. Project A: Project B: What are the projects' IRRs assuming the WACC is 15\%? Do not round intermediafe calculations. Round your answer to two decimal places, Project A:- Project B:- c. If the WACC was 5% and A and 8 were mutuall' y exciusive, which project would you choose? (Hint: The crossover rate is 7.81% ) If the WACC was 10% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 7.8 I. We)