Question

Your employer has asked you to examine the interest-rate risk of your bank relative to your direct competition. Management is concerned that interest rates will

Your employer has asked you to examine the interest-rate risk of your bank relative to your direct competition. Management is concerned that interest rates will fall by the end of the year and wants to see what would happen to the relative profitability of the firm if the decline actually occurs.

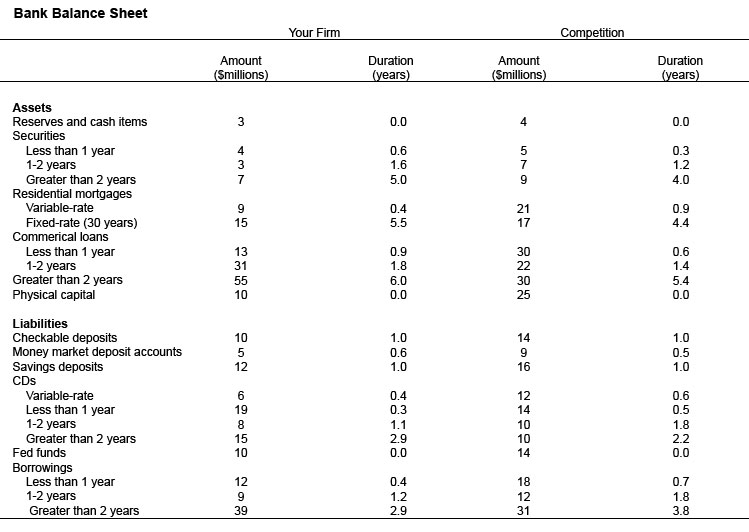

Interest-rate risk depends on each bank's relative position of interest-sensitive assets and liabilities. You begin the analysis by collecting the information and estimates.

Question: What would your firm need to do(please provide reasoning/calc as necessary):

A.) To eliminate the income gap using adjustments to rate-sensitive assets?

B.)To immunize the market value of net worth from interest-rate risk using duration?

Bank Balance Sheet Competition Your Firm Amount Smillions Duration ears Amount Smillions Duration ears 4 0.0 0.0 Reserves and cash items Securities 0.6 1.6 5.0 0.3 1.2 4.0 4 Less than 1 year 1-2 years Greater than 2 years 0.9 4.4 Residential mortgages Variable-rate Fixed-rate (30 years) 0.4 5.5 17 30 30 0.6 1.4 5.4 0.0 Commerical loans 0.9 1.8 6.0 0.0 Less than 1 year 1-2 years 13 31 Greater than 2 years Physical capital 25 10 Liabilities Checkable deposits Money market deposit accounts Savings deposits CDs 1.0 0.5 1.0 14 10 12 6 1.0 0.6 1.0 16 0.4 0.3 1.1 2.9 0.0 12 14 10 10 14 0.6 0.5 1.8 2.2 0.0 Variable-rate Less than 1 year 19 1-2 years Greater than 2 years 15 10 12 39 Fed funds Less than 1 year 1-2 years Greater than 2 years 0.4 1.2 2.9 18 12 31 0.7 1.8 3.8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started