Answered step by step

Verified Expert Solution

Question

1 Approved Answer

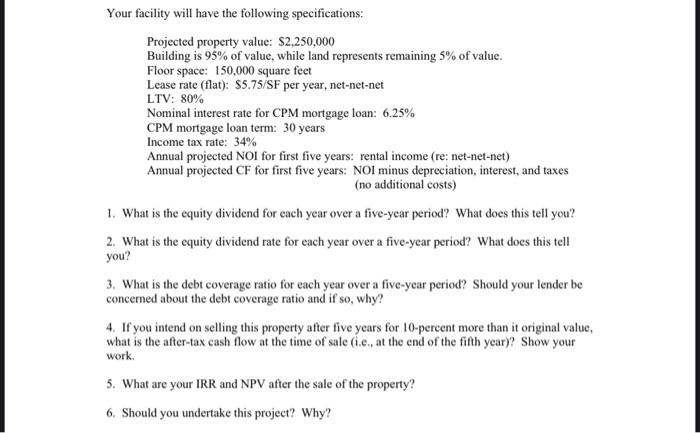

Your facility will have the following specifications: Projected property value: $2,250,000 Building is 95% of value, while land represents remaining 5% of value. Floor space:

Your facility will have the following specifications:

Projected property value: $2,250,000

Building is 95% of value, while land represents remaining 5% of value.

Floor space: 150,000 square feet

Lease rate (flat): $5.75/SF per year, net-net-net

LTV: 80%

Nominal interest rate for CPM mortgage loan: 6.25%

CPM mortgage loan term: 30 years

Income tax rate: 34%

Annual projected NOI for first five years: rental income (re: net-net-net)

Annual projected CF for first five years: NOI minus depreciation, interest, and taxes

(no additional costs)

1. What is the equity dividend for each year over a five-year period? What does this tell you?

2. What is the equity dividend rate for each year over a five-year period? What does this tell you?

3. What is the debt coverage ratio for each year over a five-year period? Should your lender be concerned about the debt coverage ratio and if so, why?

4. If you intend on selling this property after five years for 10-percent more than it original value, what is the after-tax cash flow at the time of sale (i.e., at the end of the fifth year)? Show your work.

5. What are your IRR and NPV after the sale of the property?

6. Should you undertake this project? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started