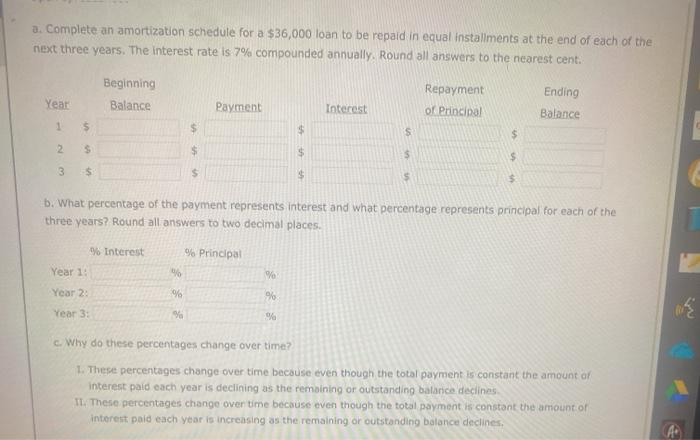

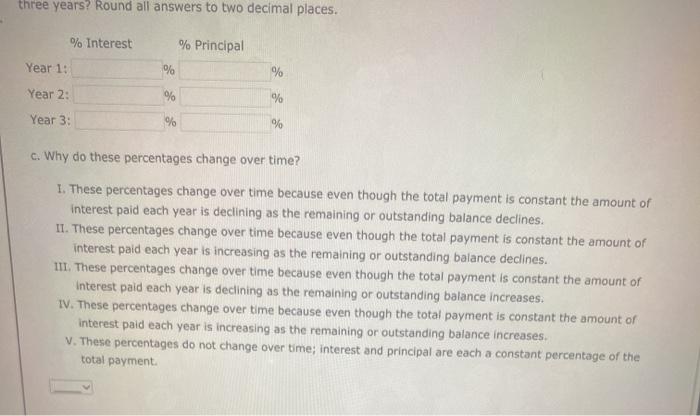

Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $55,000 has today. (The real value of his retirement income will decline annually after he retires. His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 6%. He currently has $205,000 saved, and he expects to earn 8% annually on his savings. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet How much must he save during each of the next 10 years (end-of-year deposits) to meet his retirement goal? Do not round your intermediate calculations. Round your answer to the nearest cent. a. Complete an amortization schedule for a $36,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is 7% compounded annually. Round all answers to the nearest cent. Beginning Balance Year Repayment or Principal Payment Interest Ending Balance 1 5 $ $ S $ 2 $ S $ S $ 3 $ $ $ $ b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places 6 Interest % Principal Year 1: Year 2: % % Year 3: 90 c. Why do these percentages change over time? 1. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance declines II. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance declines, three years? Round all answers to two decimal places. % Interest % Principal % Year 1: % Year 2: % % Year 3: % % c. Why do these percentages change over time? 1. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance declines. II. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance declines. III. These percentages change over time because even though the total payment is constant the amount of Interest paid each year is declining as the remaining or outstanding balance increases. IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance increases. V. These percentages do not change over time; interest and principal are each a constant percentage of the total payment