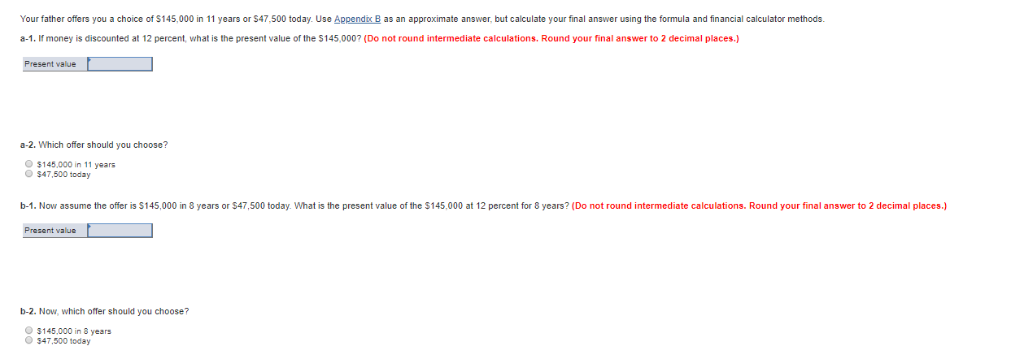

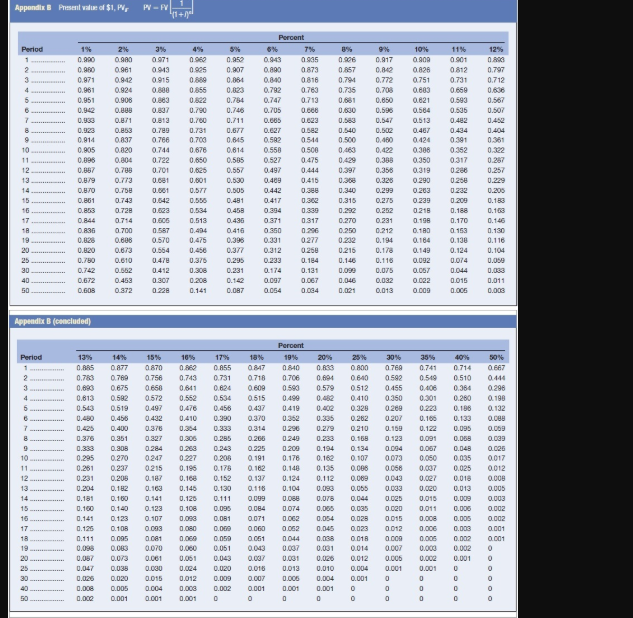

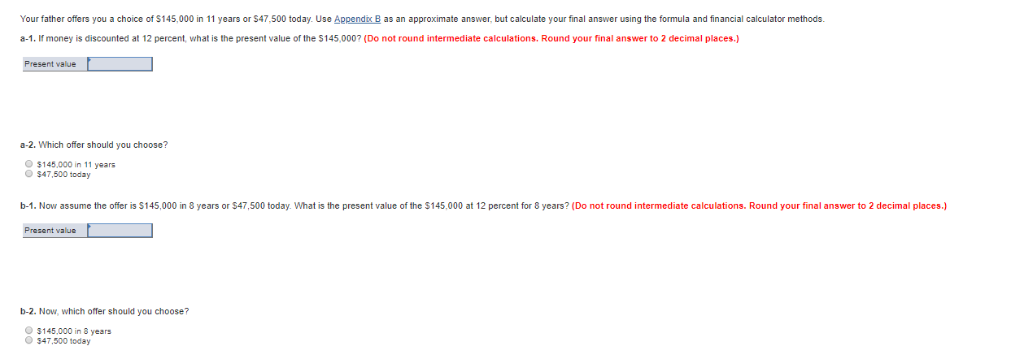

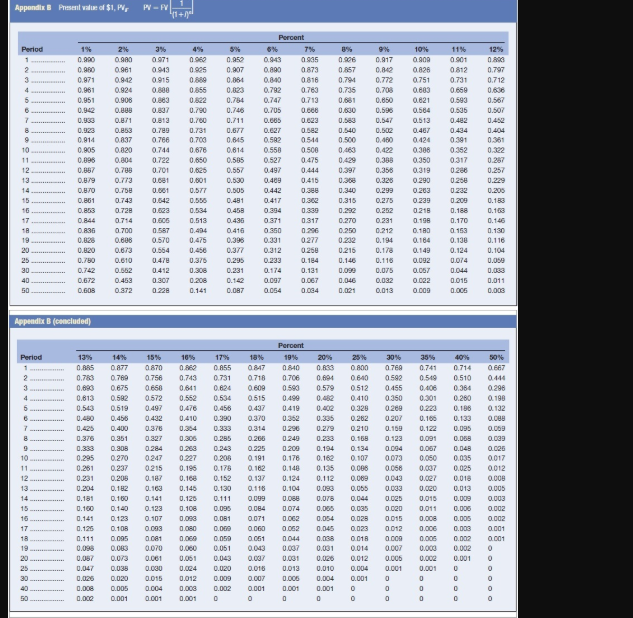

Your father offers you a choice of $145,000 in 11 years or $47,500 today. Use Appendix B as an approximate answer, but calculate your final answer using the formula and financial calculator methods. 8-1 lf money is discounted at 12 percent what i$ the present value of the $145 0007 (Do not round intermediate calculations. Round your final answer to 2 decimal places .) Present value a-2. Which offer should you choose? $145.000 in 11 year $47,500 today b-1. Now assume the offer is S145,000 in 8 years or $47,500 today. What is the present value of the $145,000 at 12 percent for 8 years? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value b-2. Now, which offer should you choose? 3145.000 in 8 years 347.500 today Appondix Present value of $1, P PY-F 11% 12% 0857 0.735 0.630 0.960 0943 0915 088 0.6 0800 0856 0823 0.826 0.797 0712 0.840 0.792 0747 0705 0.924 0763 0.708 0.803 0 0. 0.951 0.942 0.888 0.883 022 0.784 0.746 0766 0.805 020 0744 0.804 0.700 0.676 0.850 0544 0 0500 0.550 0,422 0.388 0.306 0350 0352 0 475 130.89 0730.08 0.00.530 409 0415 038 032 020 268 0.229 14.- 0B70 Q7ba 0.001 0.577 0.505 0442 0.3ee u.340 0299 0.263 0.232 0.205 0.318 0275 239 0.338 0.232 17.8440714 0.513 0.436 0.494 0416 0350 0.130 0.828 0.60 0.820 063 0564 570 0475 0277 0232 0.194 0.130 0.456 0377 0312 0.09 0.067 0.046 0.075 0.307 0.208 0.608 372 0228 0.141 0.087 0.064 0.034 .021 0.013 000 0.006 0.003 , 6 15% 16% 17% 18% 19% 25% 30% 35% 50% n.RR5 0877 0870 0862 0.855 847 0840 0.R33 0800 7EA 0.741 0.714 0667 20.783 .7 0756 0.743 0731 0718 706 0604 640 0592 0.549 0510 044 0.63 0675 650 0641 0624 0609 0593 0.579 0512 455 406 0.364 0296 0.813 0582 0572 0.552 .534 0515 049 0 0410 350 0.301 0.260 0190 0.543 0.519 0497 0476 .456 0437 0419 0.402 0328 0269 0.220 0.198 132 0.480 0.450432 0410 0.390 030 0352 0.335 0.262 20 0.10.133 0.088 0.376 0.351 027 0.306 0.285 0.206 0249 0.233 0.168 0123 0.09 0.D58 0.039 0.333 0.308 0284 0263 0.243 0225 0200 0.194 0134 0004 0.07 0.048 0026 0.295 0270 247 0227 0.208 0191 0.178 0.162 0107 073 .050 0.035 0017 0.237 0215 0.196 0.176 0162 0.148 0.135 0098 0056 0,037 0.025 0012 20.231 0.20 0.168 .152 013 0.14 0.112 0089 043 0027 0.0 0008 140.181 0.100 4 .120 0111 0099 .088 0.08 0.044 0025 0.01 .009 .003 10.141 0123 0.107 0.083 0.081 0071 .062 0.04 0.028 0.015 0.008 .005 .002 170.126 0.108 0.093 0.080 0.009 0.060 0062 .045 0.023 0012 0.006 0.003 0.001 0.096 0.083 0070 0.000 0.051 0043 0.007 0.031 0014 0.007 0000 0.002 .057 0.073 0.061 .001 0.043 0.037 0.031 0.026 0.012 0.005 0.00Q 0.001 0 250.047 0.038 000 0.24 0.020 0018 0013 0.010 0.004 o001 0.001 0 300.026 0.020 0015 0.012 0.009 0.007 006 0.004 0.001 0 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0 0.002 0.001 0.00 0.0010