Question: Using the financial statements for Celgene Corporation and Gilead Sciences, Inc., respectively, you will calculate and compare the financial ratios listed further down this document

Using the financial statements for Celgene Corporation and Gilead Sciences, Inc., respectively, you will calculate and compare the financial ratios listed further down this document for the fiscal year ending 2015, and prepare your comments about the two companies’ performances based on your ratio calculations.

Overall Requirements |

Your final Excel workbook submission should contain the following. You cannot use any other software but Excel to complete this project.

A Completed Worksheet Title Page tab, which is really a cover sheet with your name, the course, the date, your instructor’s name, and the title for the project.

A Completed Worksheet Profiles tab which contains a one-paragraph description regarding each company with information about their history, what products they sell, where they are located, and so forth.

All 3 ratios for each company with the supporting calculations and commentary on your Worksheet Ratio tab. Supporting calculations must be shown either as a formula or as text typed into a different cell. The ratios are listed further down this document. Your comments for each ratio should include more than just a definition of the ratio. You should focus on interpreting each ratio number for each company and support your comments with the numbers found in the ratios. You need to specifically state which company performed better for each ratio.

Required Ratios for Final Project Submission:

Rate of Return on Total Assets (ROA)

Dividend Yield [For the purposes of this ratio, use Yahoo Finance to look up current dividend per share and stock price; just note the date that you looked up this information.]

Rate of Return on Common Stockholders’ Equity (ROE)

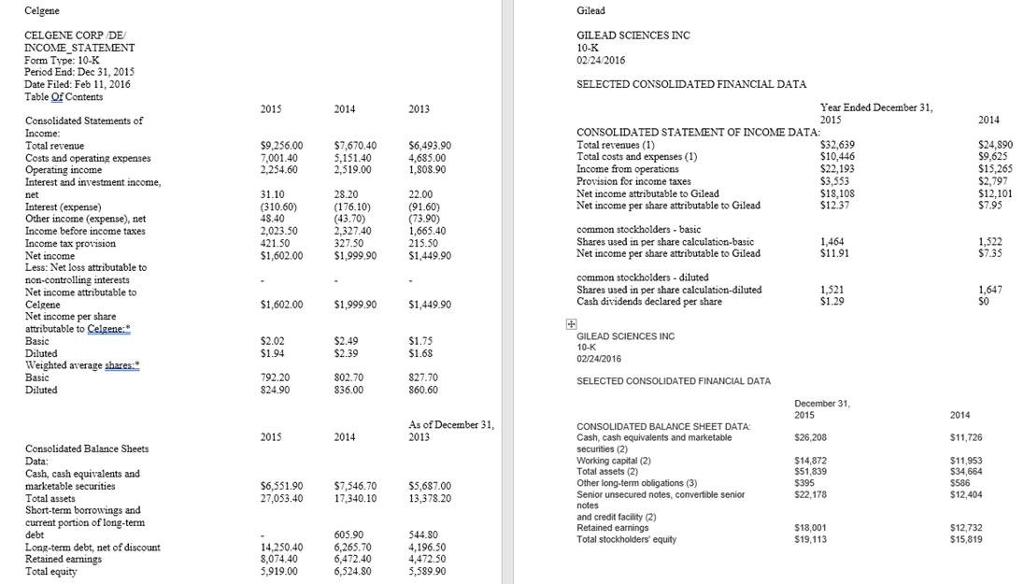

Celgene Gilead CELGENE CORP DE INCOME STATEMENT Form Type: 10-K Period End: Dec 31, 2015 Date Filed: Feb 11, 2016 GILEAD SCIENCES INC 10-K 0224 2016 SELECTED CONSOLIDATED FINANCIAL DATA Table Of Contents Year Ended December 31, 2015 2015 2014 2013 2014 Consolidated Statements of Income: Total revenue $9.256.00 7,001.40 2,254.60 $6,493.90 4,685.00 1,808.90 CONSOLIDATED STATEMENT OF INCOME DATA: Total revenues (1) Total costs and expenses (1) Income from operations $32,639 $10,446 $22,193 $3,553 $18,108 $12.37 $24,890 $9,625 $15,265 $2,797 $12,101 $7.95 Costs and operating expenses Operating income Interest and investment income, $7,670.40 5,151.40 2,319.00 Provision for income taxes Net income attributable to Gilead Net income per share attributable to Gilead 31.10 (310.60) 48.40 2,023.50 421.50 $1,602.00 28.20 22.00 (91.60) (73.90) 1,665.40 net Interest (expense) Other income (expense), net Income before income taxes (176.10) (43.70) Income tax provision Net income Less: Net loss attributable to 2,327.40 327.50 $1,999.90 common stockholders - basic Shares used in per share calculation-basic Net income per share attributable to Gilead 1,464 $11.91 1,522 $7.35 215.50 $1,449.90 non-controlling interests Net income attributable to Celgene Net income per share attributable to Celgene: common stockholders - diluted Shares used in per share calculation-diluted Cash dividends declared per share 1,521 $1.29 1,647 SO $1,602.00 $1,999.90 $1,449.90 GILEAD SCIENCES INC 10-K 02/24/2016 $2.02 $1.94 $2.49 $2.39 $1.75 $1.68 Basic Diluted Weighted average shares. Basic Diluted 827.70 S60.60 792.20 S02.70 SELECTED CONSOLIDATED FINANCIAL DATA 824.90 836.00 December 31, 2015 2014 As of December 31, 2013 CONSOLIDATED BALANCE SHEET DATA 2015 2014 Cash, cash equivalents and marketable $26,208 $11,726 Consolidated Balance Sheets securities (2) Working capital (2) Total assets (2) Other long-term obligations (3) Senior unsecured notes, convertible senior Data: $14,872 $51,839 $395 $22,178 $11,953 $34,664 S586 $12,404 Cash, cash equivalents and marketable securities Total assets Short-term borrwings and current portion of long-term debt Long-term debt, net of discount Retained eamings Total equity $6,551.90 27,053.40 $7.546.70 17,340.10 $5.687.00 13,378.20 notes and credit facility (2) Retained earnings Total stockholders' equity $18,001 $19,113 $12,732 $15,819 14,250.40 8,074.40 5,919.00 605.90 6,265.70 6,472.40 6,524.80 544.80 4,196.50 4,472.50 5,589.90

Step by Step Solution

3.76 Rating (185 Votes )

There are 3 Steps involved in it

Answer Comparison of financial ratios of both the com... View full answer

Get step-by-step solutions from verified subject matter experts