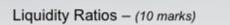

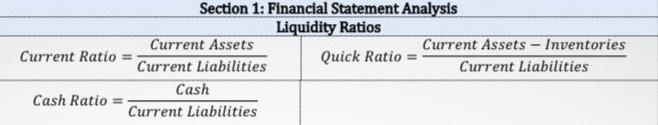

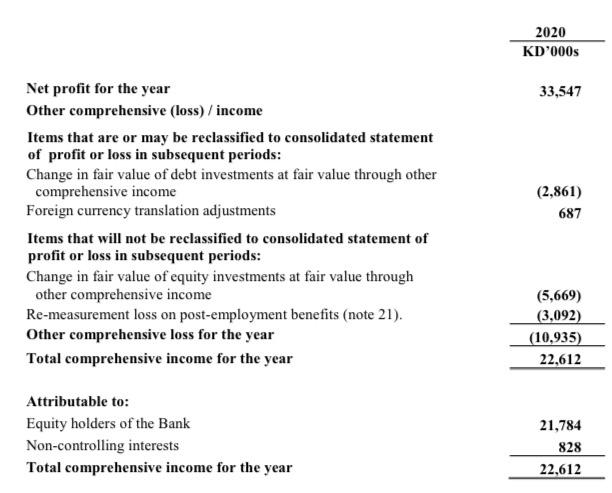

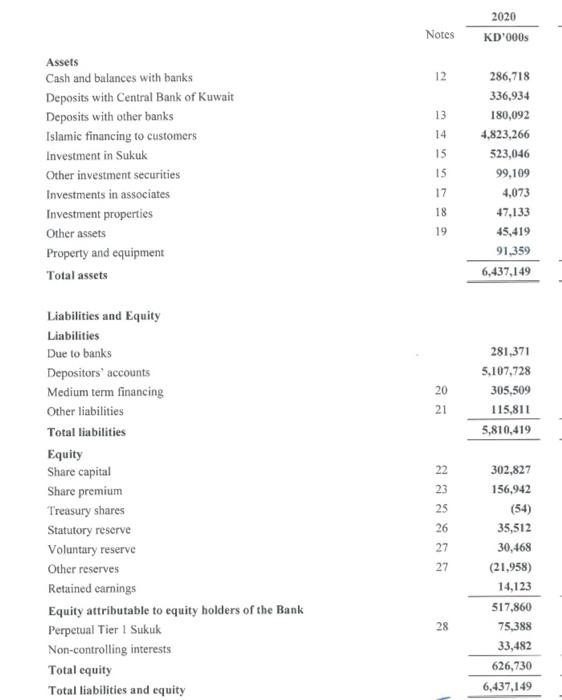

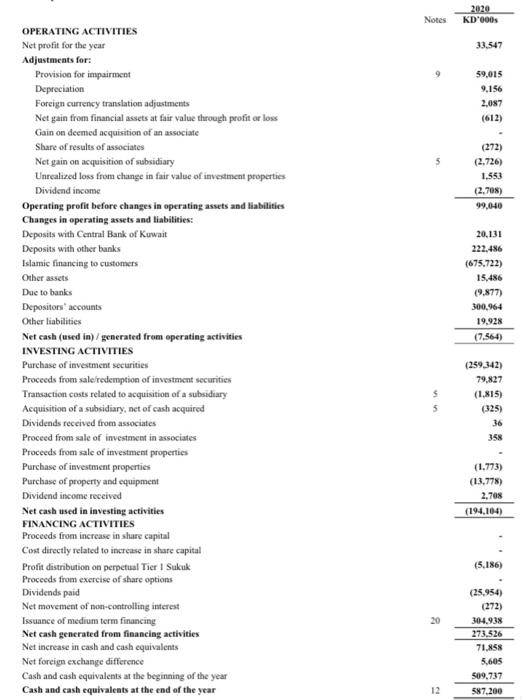

Your financial statement analysis must include the calculation and interpretation of the following ratios for the assigned company Liquidity Ratios - (10 marks) Section 1: Financial Statement Analysis Liquidity Ratios \begin{tabular}{c|c} Current Ratio =CurrentLiabilitiesCurrentAssets & Quick Ratio =CurrentLiabilitiesCurrentAssetsInventories \\ Cash Ratio =CurrentLiabilitiesCash & \end{tabular} Notes K000s2020 Income Murabaha and other Islamic financing income Net investment income Net fees and commission income Net foreign exchange gain Other income Net operating income Staff costs (45,230) General and administrative expenses (20,011) Depreciation Operating expenses (9,156)(74,397) Operating profit before provision for impairment Provision for impairment Operating profit before taxation and board of directors' remuneration Taxation Board of directors' remuneration Net profit for the year Attributable to: Equity holders of the Bank Non-controlling interests Net profit for the year Basic and diluted earnings per share attributable to the equity holders of the Bank (fils) 11 10 (73) (73)33,547 Net profit for the year Other comprehensive (loss) / income Items that are or may be reclassified to consolidated statement of profit or loss in subsequent periods: Change in fair value of debt investments at fair value through other comprehensive income Foreign currency translation adjustments Items that will not be reclassified to consolidated statement of profit or loss in subsequent periods: Change in fair value of equity investments at fair value through other comprehensive income Re-measurement loss on post-employment benefits (note 21). Other comprehensive loss for the year Total comprehensive income for the year Attributable to: Equity holders of the Bank Non-controlling interests Total comprehensive income for the year Notes KD000s2020 Assets Cash and balances with banks \begin{tabular}{rr} 12 & 286,718 \\ & 336,934 \\ 13 & 180,092 \\ 14 & 4,823,266 \\ 15 & 523,046 \\ 15 & 99,109 \\ 17 & 4,073 \\ 18 & 47,133 \\ 19 & 45,419 \\ & 91,359 \\ \hline & 6,437,149 \\ \hline \end{tabular} Deposits with Central Bank of Kuwait Deposits with other banks Islamic financing to customers Investment in Sukuk Other investment securities Investments in associates Investment properties Other assets Property and equipment Total assets Liabilities and Equity Liabilities Due to banks Depositors' accounts Medium term financing Other liabilities Total liabilities Equity Share capital Share premium Treasury shares Statutory reserve Voluntary reserve Other reserves Retained carnings Equity attributable to equity holders of the Bank Perpetual Tier I Sukuk 281,3715,107,728305,509115,8115,810,419 Non-controlling interests Total equity Total liabilities and equity \begin{tabular}{rr} 22 & 302,827 \\ 23 & 156,942 \\ 25 & (54) \\ 26 & 35,512 \\ 27 & 30,468 \\ 27 & (21,958) \\ & 14,123 \\ \cline { 2 - 2 } & 517,860 \\ 28 & 75,388 \\ & 33,482 \\ \hline & 626,730 \\ \hline & 6,437,149 \\ \hline \end{tabular} OPERATING ACTIVITIES Notes KD000s2020 Net profit for the year Adjustments for: Provision for impairment Depreciation Foreign currency translation adjustments 33,547 Net gain from financial assets at fair value through profit or loss Gain on deemed acquisition of an associate Share of results of associates Net gain on acquisition of subsidiary Unrealized loss from change in fair value of investment propertics Dividend income Operating profit before changes in operating assets and liabilities Changes in operatiag assets and liabilities: Deposits with Central Bank of Kuwait Deposits with other banks Islamic financing to customers Ouhcr assets Dae to banks Depositors" accocints Orher liabilities Net cash (used in)/generated frum operating activities INVESTING ACTIVTIIES Purchase of investment securities Proceeds from sale/redemption of investment securitien Transaction costs related to acquisition of a subsidiary Acquisition of a subsidiary, net of cash acquared Dividends received from associates Proceed from sale of investment in associates Proceeds from sale of investment properties Purchase of investment properties Purchase of property and equipment Dividend income received Net cash used in investing activities FINANCING ACTIVITIES Proceeds from increase in share capital Cost directly related to increase in share capital Profit distribution on perpetual Tier 1 Sukuk Proceeds from exercise of share options Dividends paid Net movement of non-coatrolling interest Lssuance of medium term financing Net cash generated from financing activities Net increase in cash and cash equivalents Net foreign exchange difference Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the cad of the yrar 99,040(2,798) 20,131222,486(675,722)15,486(9,877)300,96419,928(7,564) (259,342) 79,827 (1,815) (325) 36 358