Question

Your Firm, Crapshooter Construction (CC) is constructing a Brunton snowboard factory outside of Park City, Utah and the contract stipulates that CC provides the equipment

Your Firm, Crapshooter Construction (CC) is constructing a Brunton snowboard factory outside of Park City, Utah and the contract stipulates that CC provides the equipment to fabricate the boards. You have been asked by Brunton executives to analyze three alternative pieces of equipment, and help select the best alternative from a cost perspective.

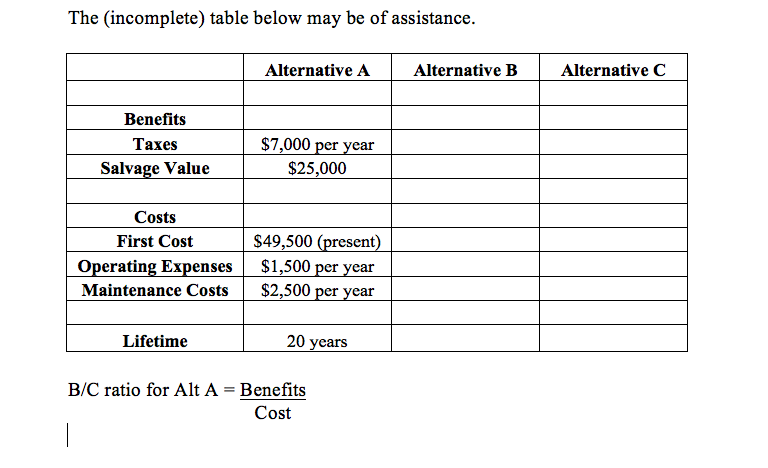

Alternative A has a first cost of $49,500 and would provide tax benefits of $7,000 per year and a salvage value of $25,000. Operating costs for alternative A will be $1,500 per year and maintenance costs will be $2,500 per year.

Alternative B has a first cost of $38,000 and would provide tax benefits of $3,000 per year and a salvage value of $15,000. Operating costs for alternative B will be $3,000 per year and maintenance costs will be $2,500 per year.

Alternative C has a first cost of $52,500 and would provide tax benefits of $7,500 per year and a salvage value of $25,000. Operating costs for alternative C will be $1000 per year and maintenance costs will be $1500 per year.

The lifetime of all the machines is 25 years. Assuming a 6.50% interest rate, which machine should you select? Show your work for each alternative.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started