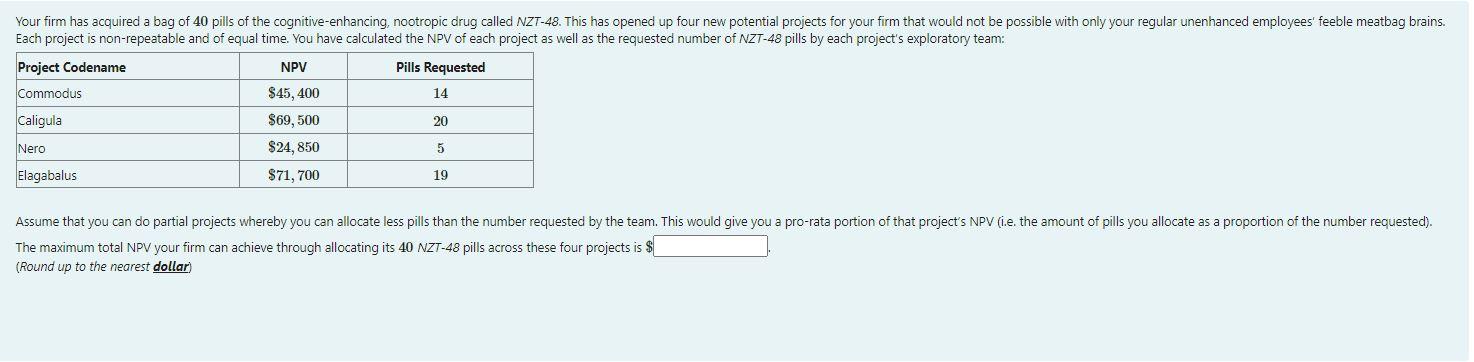

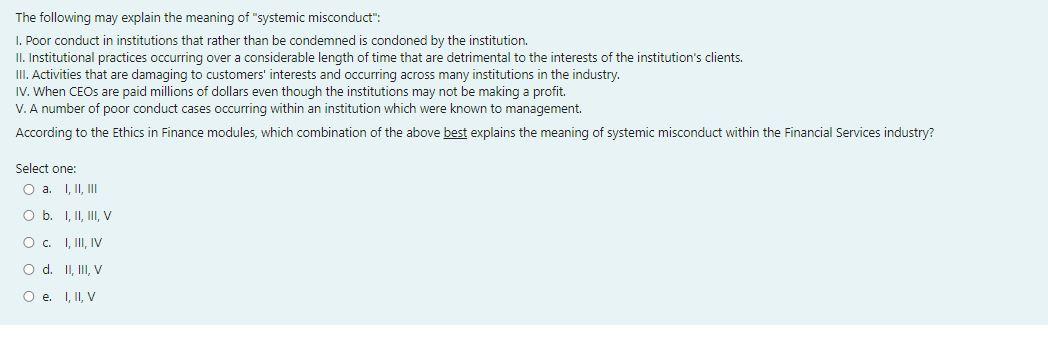

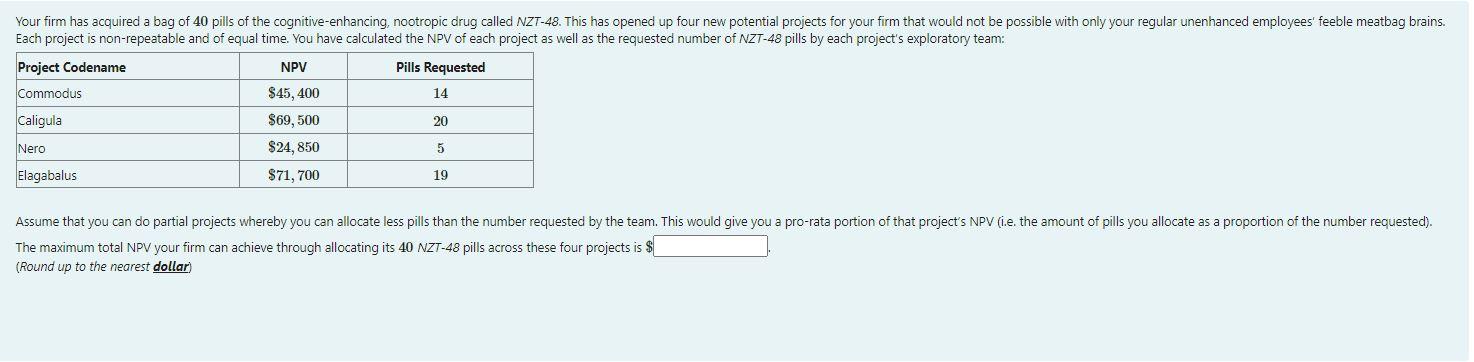

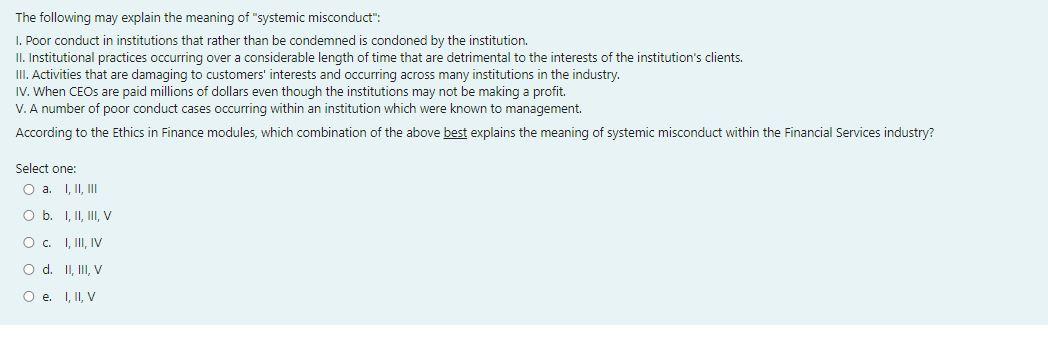

Your firm has acquired a bag of 40 pills of the cognitive-enhancing, nootropic drug called NZT-48. This has opened up four new potential projects for your firm that would not be possible with only your regular unenhanced employees' feeble meatbag brains. Each project is non-repeatable and of equal time. You have calculated the NPV of each project as well as the requested number of NZT-48 pills by each project's exploratory team: Project Codename NPV Pills Requested Commodus $45,400 14 Caligula 20 Nero $69,500 $24, 850 $71,700 5 Elagabalus 19 Assume that you can do partial projects whereby you can allocate less pills than the number requested by the team. This would give you a pro-rata portion of that project's NPV (1.e. the amount of pills you allocate as a proportion of the number requested). The maximum total NPV your firm can achieve through allocating its 40 NZT-48 pills across these four projects is $ (Round up to the nearest dollar) The following may explain the meaning of "systemic misconduct": 1. Poor conduct in institutions that rather than be condemned is condoned by the institution. II. Institutional practices occurring over a considerable length of time that are detrimental to the interests of the institution's clients. III. Activities that are damaging to customers' interests and occurring across many institutions in the industry. IV. When CEOs are paid millions of dollars even though the institutions may not be making a profit. V. A number of poor conduct cases occurring within an institution which were known to management. According to the Ethics in Finance modules, which combination of the above best explains the meaning of systemic misconduct within the Financial Services industry? Select one: O a. I, II, III O b. I, II, III, V O c. I, III, IV O d. II, III, V Oe. I, U, V Your firm has acquired a bag of 40 pills of the cognitive-enhancing, nootropic drug called NZT-48. This has opened up four new potential projects for your firm that would not be possible with only your regular unenhanced employees' feeble meatbag brains. Each project is non-repeatable and of equal time. You have calculated the NPV of each project as well as the requested number of NZT-48 pills by each project's exploratory team: Project Codename NPV Pills Requested Commodus $45,400 14 Caligula 20 Nero $69,500 $24, 850 $71,700 5 Elagabalus 19 Assume that you can do partial projects whereby you can allocate less pills than the number requested by the team. This would give you a pro-rata portion of that project's NPV (1.e. the amount of pills you allocate as a proportion of the number requested). The maximum total NPV your firm can achieve through allocating its 40 NZT-48 pills across these four projects is $ (Round up to the nearest dollar) The following may explain the meaning of "systemic misconduct": 1. Poor conduct in institutions that rather than be condemned is condoned by the institution. II. Institutional practices occurring over a considerable length of time that are detrimental to the interests of the institution's clients. III. Activities that are damaging to customers' interests and occurring across many institutions in the industry. IV. When CEOs are paid millions of dollars even though the institutions may not be making a profit. V. A number of poor conduct cases occurring within an institution which were known to management. According to the Ethics in Finance modules, which combination of the above best explains the meaning of systemic misconduct within the Financial Services industry? Select one: O a. I, II, III O b. I, II, III, V O c. I, III, IV O d. II, III, V Oe. I, U, V