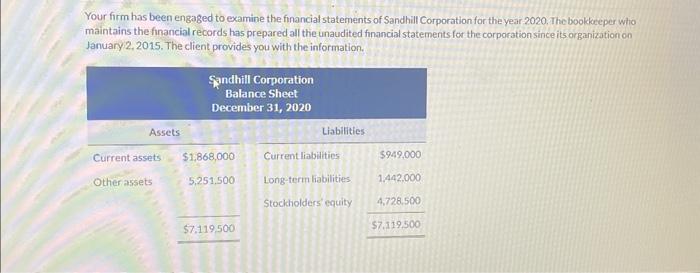

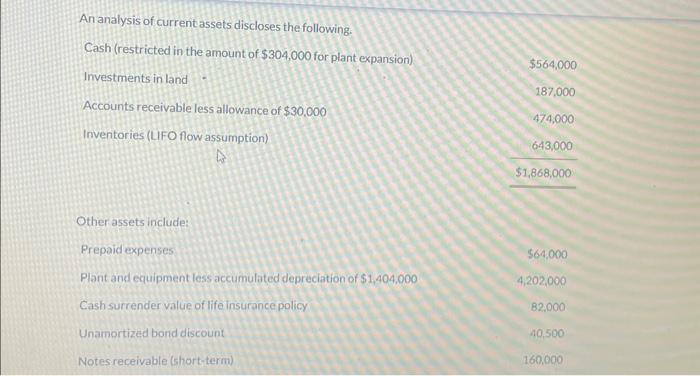

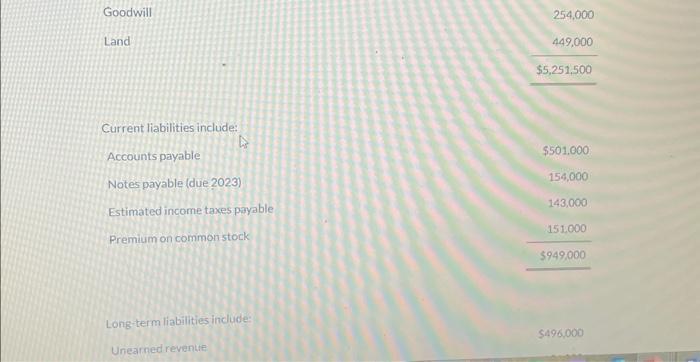

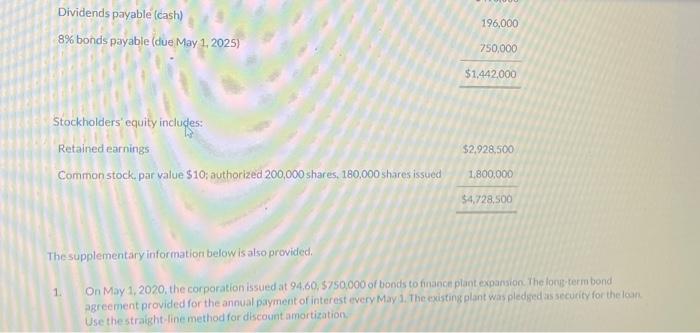

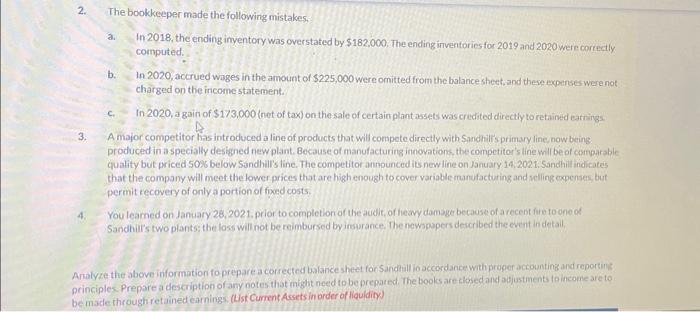

Your firm has been engaged to examine the financial statements of Sandhill Corporation for the year 2020, The bookkeeper whio maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2015. The client provides you with the intormation. An analysis of current assets discloses the following. Cash (restricted in the amount of $304,000 for plant expansion) Investments in land $564,000 Accounts receivable less allowance of $30.000 187,000 Inventories (LIFO flow assumption) 474,000 643,000 $1,868,000 Other assets include: Prepaid expenses Plant and equipment less accumulated depreciation of $1,404,000 564,000 Cash surrender value of life insurance policy 4,202,000 Unamortized bond discount 82,000 Notesreceivable (short-term) 40,500 160,000 Goodwill Land 254,000 449,000 Current liabilities include: Accounts payable Notes payable (due 2023) Estimated income taxes payable Premium on common stock Long-term liabilities incude: Unearned reventue Thesupplementary information below is also provided. 1. On May 1,2020, the corporation issued at 94,60,5750,000 of bonds to finance plant expansion The forst term bond agreement provided for the annual payment of interest every May 1. The exigtingplant was pledged as securify for the laan Use the straight-line method for discount amortization. 2. The bookkeeper made the following mistakes. a. In 2018, the ending inyentory was overstated by $182,000. The ending inventories for 2019 and 2020 were correctly computed. b. In 2020, accrued wages in the amount of $225,000 were omitted from the balance sheet, and these expenses were not charged on the income statement. c. In 2020, a gain of $173,000 (net of tax) on the sale of certain plant assets was credited directly to retained earnings 3. A major competitor has introduced a line of products that will compete directly with Sandhill'sprimary line, now being: produced in a specially designed new plant. Because of manufacturing innovations, the competitor's line will be of comparable quality but priced S096 below Sandhills line. The competitor autpunced is new line on January 14, 2021. Sandhill indicates that the company will meet the lower prices that are high enough to cover variable manufacturing and relling expenses, but permit recovery of only a portion of fixed costs. 4. You leamed on January 28,2021. prior to complethon of the audit, of heayy damoge because of a recent fire to one of Sandhill's two plants; the loss will not be reimbursed by ingurance. The nowepapers described the event in detall. Analyze the above information fo prepare a corrected balance sheet for Sandill io accordance with praper accounting and reporting principles. Prepare a description of any notes that inight need to be prepared. The books are dlosec and agjustments to income are to be made throughretained earnings. (List Current Assets in order of liquidity)