Answered step by step

Verified Expert Solution

Question

1 Approved Answer

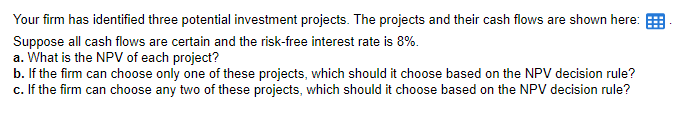

Your firm has identified three potential investment projects. The projects and their cash flows are shown here: 1 . Suppose all cash flows are certain

Your firm has identified three potential investment projects. The projects and their cash flows are shown here:

Suppose all cash flows are certain and the riskfree interest rate is

a

b

c

a What is the NPV of each project?

b If the firm can choose only one of these projects, which should it choose based on the NPV decision rule?

c If the firm can choose any two of these projects, which should it choose based on the NPV decision rule?

You have been offered a unique investment opportunity. If you invest $ today, you will receive $ year

from now, $ years from now, and $ years from now.

a What is the NPV of the investment opportunity if the interest rate is per year? Should you take

the opportunity?

b What is the NPV of the investment opportunity if the interest rate is per year? Should you take the opportunity?

You are head of the Schwartz Family Endowment for the Arts. You have decided to fund an arts school in the San

Francisco Bay area in perpetuity. Every years, you will give the school $ The first payment will occur

years from today. If the interest rate is per year, what is the present value of your gift?

The year interest rate is

Round to three decimal places.

Suppose you invest $ today and receive $ in years.

a What is the internal rate of return IRR of this opportunity?

b Suppose another investment opportunity also requires $ upfront, but pays an equal amount at the end of

each year for the next years. If this investment has the same IRR as the first one, what is the amount you will

receive each year?

a What is the internal rate of return IRR of this opportunity?

The IRR of this opportunity is

Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started