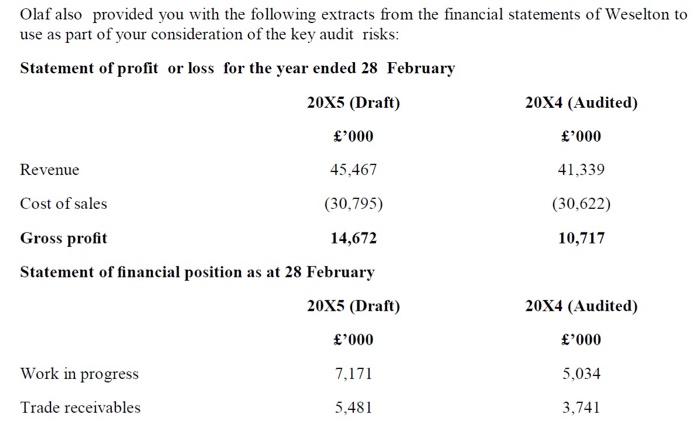

Your firm has recently been appointed as the external auditor of Weselton plc (Weselton) which is your firm's largest and only listed client. You are the senior responsible for planning the external audit for the year ended 28 February 20X5 and the engagement partner has asked you to consider the following key areas of audit risk: (1) Work in progress (2) Trade receivables Weselton provides global relocation services to corporate customers. Services include project management of overseas relocation of offices and employees. For each relocation project, Weselton estimates the cost of supplying services based on customer requirements and the locations in which the services will be supplied. An indicative price is provided to the customer equal to the estimated cost plus a mark-up of 35%. Actual costs incurred often vary from estimated costs due to changes in customer requirements during the relocation project or unforeseen issues resulting in higher than expected costs. On completion of each project, the customer is invoiced, in sterling, for actual costs incurred plus the 35% mark-up. Credit terms are 30 days. Weselton employs a small team of project managers who manage multiple projects. However, the majority of costs billed by Weselton arise from the use of external suppliers and other third parties. Costs include payments to local employment agencies for temporary personnel who pack the items to be relocated, fees for overseas legal and HR advice, local visa and immigration costs, shipping and transport fees and insurance costs. Temporary personnel submit timesheets to local employment agencies which invoice Weselton each month for the total hours worked at rates agreed with Weselton. Invoices may include hours relating to more than one relocation project, Other suppliers invoice Weselton for services at varying points during the relocation and some overseas suppliers invoice in their local currency. All costs incurred, including those of Weselton's own project managers, are recorded in the job costing system against a unique code for each relocation project. Any costs recorded for projects not completed at 28 February are included as work in progress in the year- end financial statements. Weselton's financial controller, Olaf Cyro, has provided you with the following information: In July 20X4, the directors decided that the job costing system was outdated. A replacement system was implemented on 21 January 20X5 and use of the old system ceased immediately. A delay in training employees on the new system resulted in a backlog of costs to be recorded and some customers were invoiced before all the costs relating to their projects were included on the new system. Additional invoices in respect of the omitted costs, plus the 35% mark-up, were sent to customers in February or are due to be sent by 31 March 20X5. Bulda GmbH (Bulda), a customer, is refusing to pay its balance outstanding at 28 February 20x5 due to a disagreement over the amount invoiced in respect of its relocation project. The disagreement has arisen due to a significant variation between the indicative price and the actual amount invoiced. The balance due from Bulda at 28 February 20X5 is 1.8 million. The original indicative price provided was 1.3 million. Olaf believes all of the additional costs arose due to changes in Bulda's requirements during the relocation and that the full amount is recoverable Weselton's previous auditors did not seek reappointment after completing the external audit for the year ended 28 February 20X4. During that audit, reliance was placed on the controls over the job costing system. Olaf requested that your firm also relies on those controls as he believes this will ensure the audit is conducted efficiently. Olaf also provided you with the following extracts from the financial statements of Weselton to use as part of your consideration of the key audit risks: Statement of profit or loss for the year ended 28 February 20X5 (Draft) 20X4 (Audited) '000 '000 Revenue 45,467 41,339 Cost of sales (30,795) (30,622) Gross profit 14,672 10,717 Statement of financial position as at 28 February 20X5 (Draft) 20X4 (Audited) '000 '000 Work in progress 7,171 5,034 Trade receivables 5,481 3,741 Your discussion with Olaf also revealed the following internal control deficiencies: (1) Customers are not required to provide written confirmation of changes to their requirements arising during a relocation project. 5 (2) Project managers do not monitor actual costs incurred to date compared with the estimated cost of each project. Requirements 1. List the matters your firm should have considered and the procedures it should have performed before accepting appointment as external auditor of Weselton. (01 mark) 2. Justify why work in progress and trade receivables have been identified as key areas of audit risk and, for each one, describe the procedures that should be included in the audit plan in order to address those risks. You should present your answer using the following subheadings: (2.5 marks) a) Trade receivables b) Work in progress 3. Explain why reliance on controls over the job costing system, requested by Olaf, is unlikely to be appropriate in respect of the audit for the year ended 28 February 20X5. (0.5 marks) 4. For each internal control deficiency listed as (1) and (2) in the scenario, draft points for inclusion in your firm's report to those charged with governance and management at Weselton. For each deficiency, you should outline the possible consequence(s) of the deficiency and provide recommendations to address it. (01 marks) Your firm has recently been appointed as the external auditor of Weselton plc (Weselton) which is your firm's largest and only listed client. You are the senior responsible for planning the external audit for the year ended 28 February 20X5 and the engagement partner has asked you to consider the following key areas of audit risk: (1) Work in progress (2) Trade receivables Weselton provides global relocation services to corporate customers. Services include project management of overseas relocation of offices and employees. For each relocation project, Weselton estimates the cost of supplying services based on customer requirements and the locations in which the services will be supplied. An indicative price is provided to the customer equal to the estimated cost plus a mark-up of 35%. Actual costs incurred often vary from estimated costs due to changes in customer requirements during the relocation project or unforeseen issues resulting in higher than expected costs. On completion of each project, the customer is invoiced, in sterling, for actual costs incurred plus the 35% mark-up. Credit terms are 30 days. Weselton employs a small team of project managers who manage multiple projects. However, the majority of costs billed by Weselton arise from the use of external suppliers and other third parties. Costs include payments to local employment agencies for temporary personnel who pack the items to be relocated, fees for overseas legal and HR advice, local visa and immigration costs, shipping and transport fees and insurance costs. Temporary personnel submit timesheets to local employment agencies which invoice Weselton each month for the total hours worked at rates agreed with Weselton. Invoices may include hours relating to more than one relocation project, Other suppliers invoice Weselton for services at varying points during the relocation and some overseas suppliers invoice in their local currency. All costs incurred, including those of Weselton's own project managers, are recorded in the job costing system against a unique code for each relocation project. Any costs recorded for projects not completed at 28 February are included as work in progress in the year- end financial statements. Weselton's financial controller, Olaf Cyro, has provided you with the following information: In July 20X4, the directors decided that the job costing system was outdated. A replacement system was implemented on 21 January 20X5 and use of the old system ceased immediately. A delay in training employees on the new system resulted in a backlog of costs to be recorded and some customers were invoiced before all the costs relating to their projects were included on the new system. Additional invoices in respect of the omitted costs, plus the 35% mark-up, were sent to customers in February or are due to be sent by 31 March 20X5. Bulda GmbH (Bulda), a customer, is refusing to pay its balance outstanding at 28 February 20x5 due to a disagreement over the amount invoiced in respect of its relocation project. The disagreement has arisen due to a significant variation between the indicative price and the actual amount invoiced. The balance due from Bulda at 28 February 20X5 is 1.8 million. The original indicative price provided was 1.3 million. Olaf believes all of the additional costs arose due to changes in Bulda's requirements during the relocation and that the full amount is recoverable Weselton's previous auditors did not seek reappointment after completing the external audit for the year ended 28 February 20X4. During that audit, reliance was placed on the controls over the job costing system. Olaf requested that your firm also relies on those controls as he believes this will ensure the audit is conducted efficiently. Olaf also provided you with the following extracts from the financial statements of Weselton to use as part of your consideration of the key audit risks: Statement of profit or loss for the year ended 28 February 20X5 (Draft) 20X4 (Audited) '000 '000 Revenue 45,467 41,339 Cost of sales (30,795) (30,622) Gross profit 14,672 10,717 Statement of financial position as at 28 February 20X5 (Draft) 20X4 (Audited) '000 '000 Work in progress 7,171 5,034 Trade receivables 5,481 3,741 Your discussion with Olaf also revealed the following internal control deficiencies: (1) Customers are not required to provide written confirmation of changes to their requirements arising during a relocation project. 5 (2) Project managers do not monitor actual costs incurred to date compared with the estimated cost of each project. Requirements 1. List the matters your firm should have considered and the procedures it should have performed before accepting appointment as external auditor of Weselton. (01 mark) 2. Justify why work in progress and trade receivables have been identified as key areas of audit risk and, for each one, describe the procedures that should be included in the audit plan in order to address those risks. You should present your answer using the following subheadings: (2.5 marks) a) Trade receivables b) Work in progress 3. Explain why reliance on controls over the job costing system, requested by Olaf, is unlikely to be appropriate in respect of the audit for the year ended 28 February 20X5. (0.5 marks) 4. For each internal control deficiency listed as (1) and (2) in the scenario, draft points for inclusion in your firm's report to those charged with governance and management at Weselton. For each deficiency, you should outline the possible consequence(s) of the deficiency and provide recommendations to address it. (01 marks)