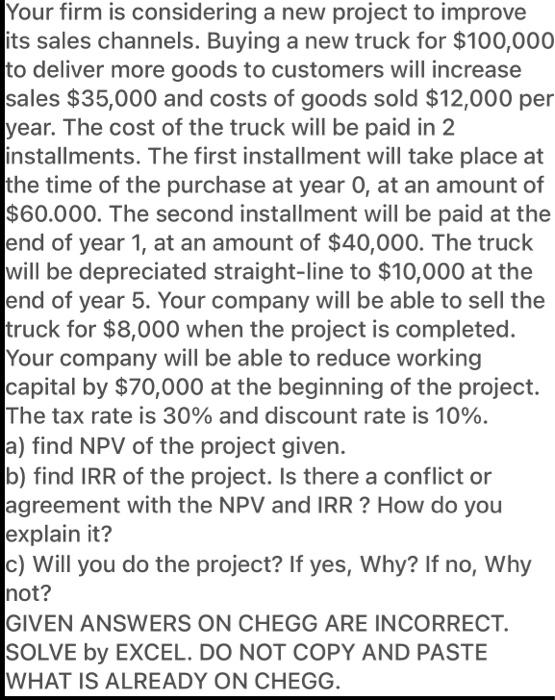

Your firm is considering a new project to improve its sales channels. Buying a new truck for $100,000 to deliver more goods to customers will increase sales $35,000 and costs of goods sold $12,000 per year. The cost of the truck will be paid in 2 installments. The first installment will take place at the time of the purchase at year O, at an amount of $60.000. The second installment will be paid at the end of year 1, at an amount of $40,000. The truck will be depreciated straight-line to $10,000 at the end of year 5. Your company will be able to sell the truck for $8,000 when the project is completed. Your company will be able to reduce working capital by $70,000 at the beginning of the project. The tax rate is 30% and discount rate is 10%. a) find NPV of the project given. b) find IRR of the project. Is there a conflict or agreement with the NPV and IRR ? How do you explain it? c) Will you do the project? If yes, Why? If no, Why not? GIVEN ANSWERS ON CHEGG ARE INCORRECT. SOLVE by EXCEL. DO NOT COPY AND PASTE WHAT IS ALREADY ON CHEGG. Your firm is considering a new project to improve its sales channels. Buying a new truck for $100,000 to deliver more goods to customers will increase sales $35,000 and costs of goods sold $12,000 per year. The cost of the truck will be paid in 2 installments. The first installment will take place at the time of the purchase at year O, at an amount of $60.000. The second installment will be paid at the end of year 1, at an amount of $40,000. The truck will be depreciated straight-line to $10,000 at the end of year 5. Your company will be able to sell the truck for $8,000 when the project is completed. Your company will be able to reduce working capital by $70,000 at the beginning of the project. The tax rate is 30% and discount rate is 10%. a) find NPV of the project given. b) find IRR of the project. Is there a conflict or agreement with the NPV and IRR ? How do you explain it? c) Will you do the project? If yes, Why? If no, Why not? GIVEN ANSWERS ON CHEGG ARE INCORRECT. SOLVE by EXCEL. DO NOT COPY AND PASTE WHAT IS ALREADY ON CHEGG