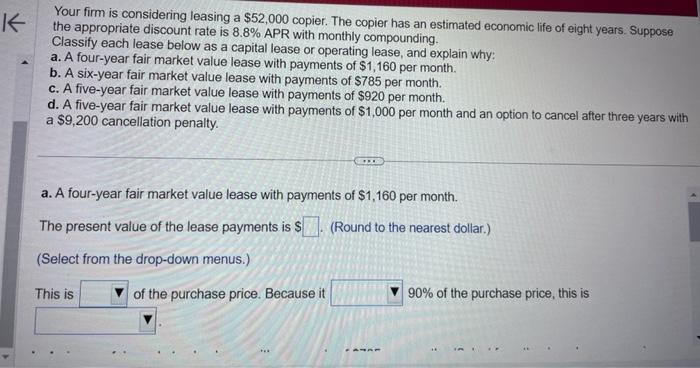

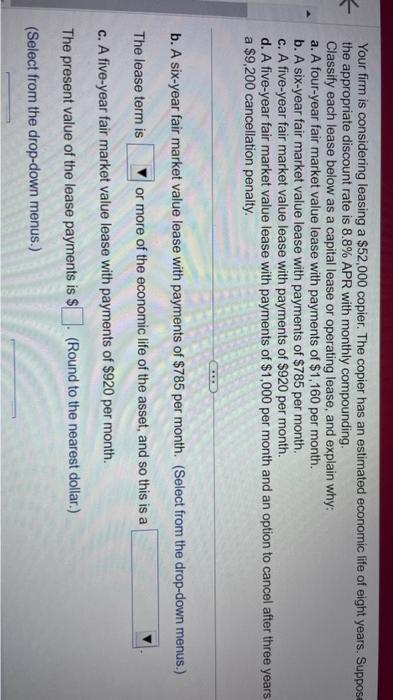

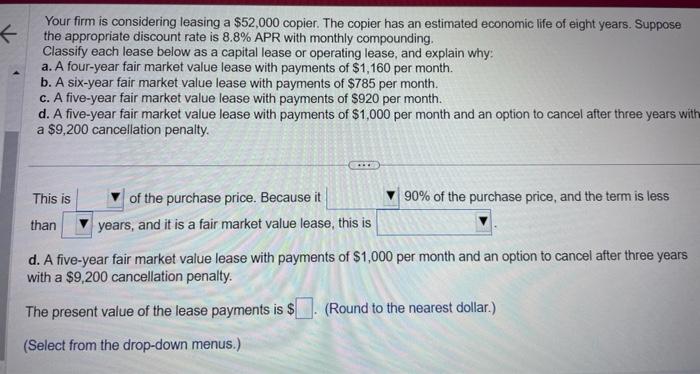

Your firm is considering leasing a $52,000 copier. The copier has an estimated economic life of eight years. Suppose the appropriate discount rate is 8.8% APR with monthly compounding. Classify each lease below as a capital lease or operating lease, and explain why: a. A four-year fair market value lease with payments of $1,160 per month. b. A six-year fair market value lease with payments of $785 per month. c. A five-year fair market value lease with payments of $920 per month. d. A five-year fair market value lease with payments of $1,000 per month and an option to cancel after three years with a $9,200 cancellation penalty. a. A four-year fair market value lease with payments of $1,160 per month. The present value of the lease payments is S (Round to the nearest dollar.) (Select from the drop-down menus.) This is of the purchase price. Because it 90% of the purchase price, this is Your firm is considering leasing a $52,000 copier. The copier has an estimated economic life of eight years. Suppos the appropriate discount rate is 8.8% APR with monthly compounding. Classify each lease below as a capital lease or operating lease, and explain why: a. A four-year fair market value lease with payments of $1,160 per month. b. A six-year fair market value lease with payments of $785 per month. c. A five-year fair market value lease with payments of $920 per month. d. A five-year fair market value lease with payments of $1,000 per month and an option to cancel after three years a $9,200 cancellation penalty. b. A six-year fair market value lease with payments of $785 per month. (Select from the drop-down menus.) The lease term is or more of the economic life of the asset, and so this is a c. A five-year fair market value lease with payments of $920 per month. The present value of the lease payments is $ (Round to the nearest dollar.) (Select from the drop-down menus.) Your firm is considering leasing a $52,000 copier. The copier has an estimated economic life of eight years. Suppose the appropriate discount rate is 8.8% APR with monthly compounding. Classify each lease below as a capital lease or operating lease, and explain why: a. A four-year fair market value lease with payments of $1,160 per month. b. A six-year fair market value lease with payments of $785 per month. c. A five-year fair market value lease with payments of $920 per month. d. A five-year fair market value lease with payments of $1,000 per month and an option to cancel after three years with a $9,200 cancellation penalty. This is of the purchase price. Because it 90% of the purchase price, and the term is less than years, and it is a fair market value lease, this is d. A five-year fair market value lease with payments of $1,000 per month and an option to cancel after three years with a $9,200 cancellation penalty. The present value of the lease payments is $. (Round to the nearest dollar.) (Select from the drop-down menus.)