Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm is contemplating the purchase of a new $500,000 computer-based order entry system. The system will be depreciated using the MACRS 5-year depreciation

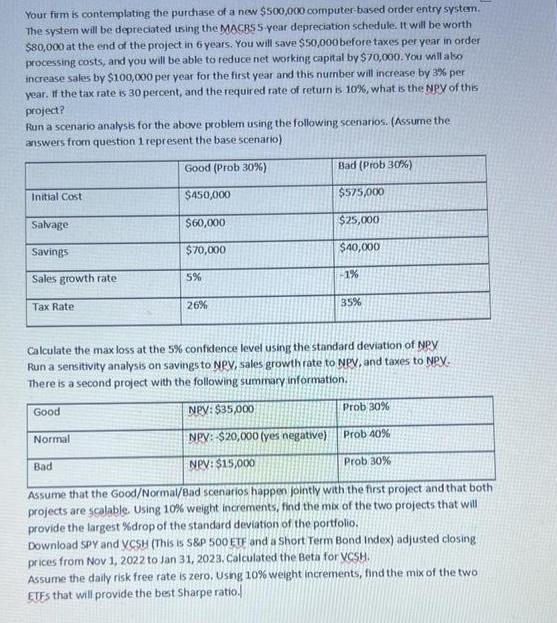

Your firm is contemplating the purchase of a new $500,000 computer-based order entry system. The system will be depreciated using the MACRS 5-year depreciation schedule. It will be worth $80,000 at the end of the project in 6 years. You will save $50,000 before taxes per year in order processing costs, and you will be able to reduce net working capital by $70,000. You will also increase sales by $100,000 per year for the first year and this number will increase by 3% per year. If the tax rate is 30 percent, and the required rate of return is 10%, what is the NPV of this project? Run a scenario analysis for the above problem using the following scenarios. (Assume the answers from question 1 represent the base scenario) Good (Prob 30%) Initial Cost Salvage Savings Sales growth rate Tax Rate $450,000 Normal $60,000 $70,000 Bad 5% 26% Bad (Prob 30%) $575,000 $25,000 $40,000 Calculate the max loss at the 5% confidence level using the standard deviation of NPY Run a sensitivity analysis on savings to NPV, sales growth rate to NPV, and taxes to NPY. There is a second project with the following summary information. Good NPV: $35,000 NPV: $20,000 (yes negative) NPV: $15,000 -1% 35% Prob 30% Prob 40% Prob 30% Assume that the Good/Normal/Bad scenarios happen jointly with the first project and that both projects are scalable. Using 10% weight increments, find the mix of the two projects that will provide the largest % drop of the standard deviation of the portfolio. Download SPY and VCSH (This is S&P 500 ETF and a Short Term Bond Index) adjusted closing prices from Nov 1, 2022 to Jan 31, 2023. Calculated the Beta for VCSH. Assume the daily risk free rate is zero. Using 10% weight increments, find the mix of the two ETFS that will provide the best Sharpe ratio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of the project we need to calculate the present value of cash flows and compare it to the initial cost Lets calculate the NPV for the base scenario first Given I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started