Question

Your firm is interested in selling a new tablet computer. The machinery used to make these tabletscosts $350,000 (at year 0) and will be used

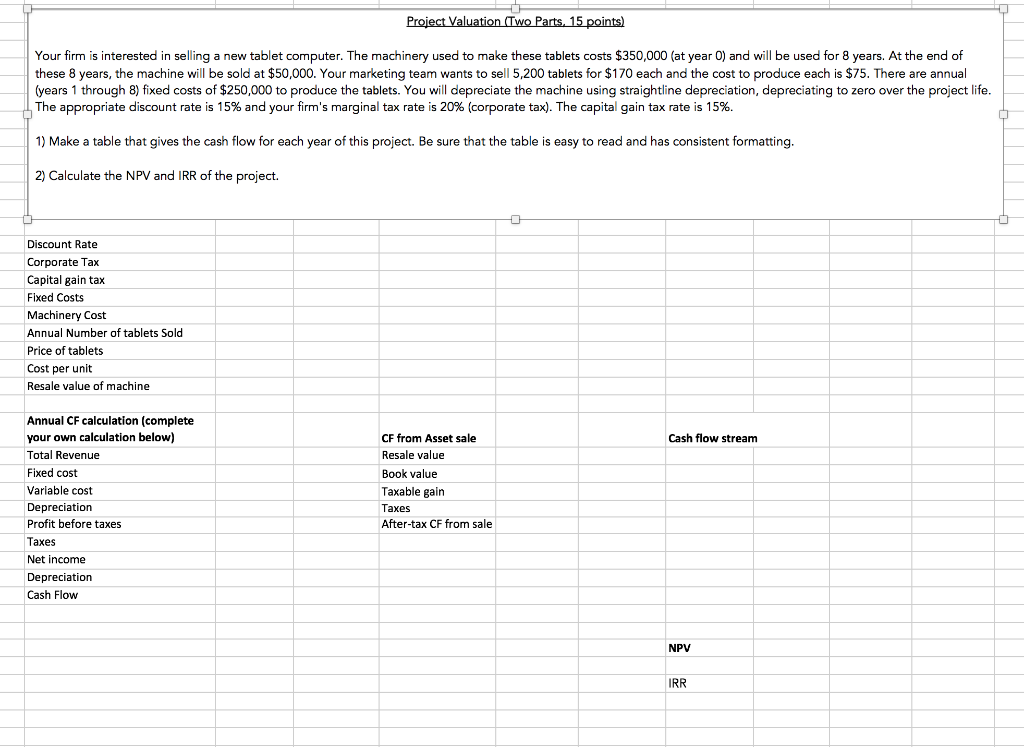

Your firm is interested in selling a new tablet computer. The machinery used to make these tabletscosts $350,000 (at year 0) and will be used for 8 years. At the end of these 8 years, the machine will be sold at $50,000. Your marketing team wants to sell 5,200 tabletsfor $170 each and the cost to produce each is $75. There are annual (years 1 through 8) fixed costs of $250,000 to produce the tablets. You will depreciate the machine using straightline depreciation, depreciating to zero over the project life. The appropriate discount rate is 15% and your firm's marginal tax rate is 20% (corporate tax). The capital gain tax rate is 15%.

1) Make a table that gives the cash flow for each year of this project. Be sure that the table is easy to read and has consistent formatting.

2) Calculate the NPV and IRR of the project.

Project Valuation (Two Parts, 15 points) Your firm is interested in selling a new tablet computer. The machinery used to make these tablets costs $350,000 (at year O) and will be used for 8 years. At the end of these 8 years, the machine will be sold at $50,000. Your marketing team wants to sell 5,200 tablets for $170 each and the cost to produce each is $75. There are annual (years 1 through 8) fixed costs of $250,000 to produce the tablets. You will depreciate the machine using straightline depreciation, depreciating to zero over the project life. The appropriate discount rate is 15% and your firm's marginal tax rate is 20% (corporate tax). The capital gain tax rate is 15%. 1) Make a table that gives the cash flow for each year of this project. Be sure that the table is easy to read and has consistent formatting. 2) Calculate the NPV and IRR of the project. Discount Rate Corporate Tax Capital gain tax Fixed Costs Machinery Cost Annual Number of tablets Sold Price of tablets Cost per unit Resale value of machine Cash flow stream Annual CF calculation (complete your own calculation below) Total Revenue Fixed cost Variable cost Depreciation Profit before taxes Taxes Net income Depreciation Cash Flow CF from Asset sale Resale value Book value Taxable gain Taxes After-tax CF from sale NPV IRRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started