Question

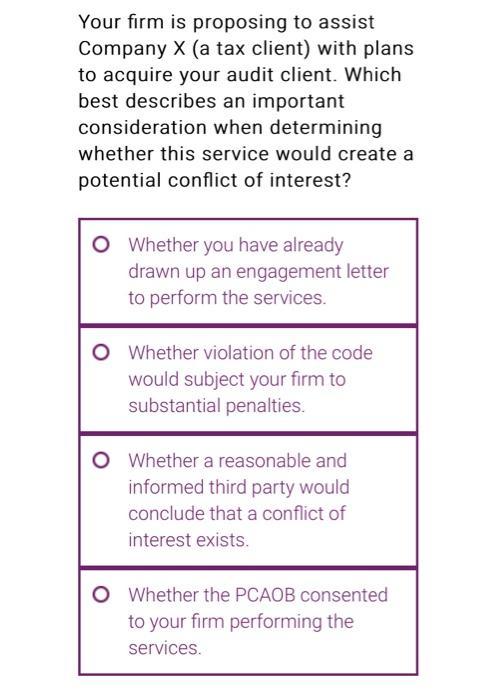

Your firm is proposing to assist Company X (a tax client) with plans to acquire your audit client. Which best describes an important consideration

Your firm is proposing to assist Company X (a tax client) with plans to acquire your audit client. Which best describes an important consideration when determining whether this service would create a potential conflict of interest? O Whether you have already drawn up an engagement letter to perform the services. O Whether violation of the code would subject your firm to substantial penalties. O Whether a reasonable and informed third party would conclude that a conflict of interest exists. O Whether the PCAOB consented to your firm performing the services.

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answer I The correct option ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing Cases An Interactive Learning Approach

Authors: Mark S Beasley, Frank A. Buckless, Steven M. Glover, Douglas F Prawitt

7th Edition

0134421825, 9780134421827

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App