Question

Your firm is selling a 3-year old machine that has a 5-year class life. The machine originally cost $580,000 and required an investment in

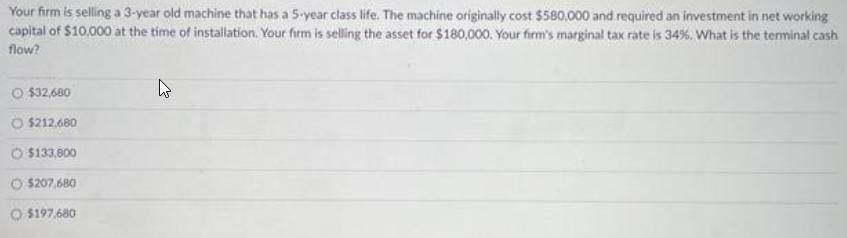

Your firm is selling a 3-year old machine that has a 5-year class life. The machine originally cost $580,000 and required an investment in net working capital of $10,000 at the time of installation. Your firm is selling the asset for $180,000. Your firm's marginal tax rate is 34%. What is the terminal cash flow? O $32,680 $212.680 $133,800 $207,680 O $197.680

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A sale price of asset 180000 Book value of a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of managerial finance

Authors: Lawrence J Gitman, Chad J Zutter

12th edition

9780321524133, 132479540, 321524136, 978-0132479547

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App