Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm specializes in the acquisition of office and industrial properties throughout the southeast and has recently identified an investment opportunity in the Concord

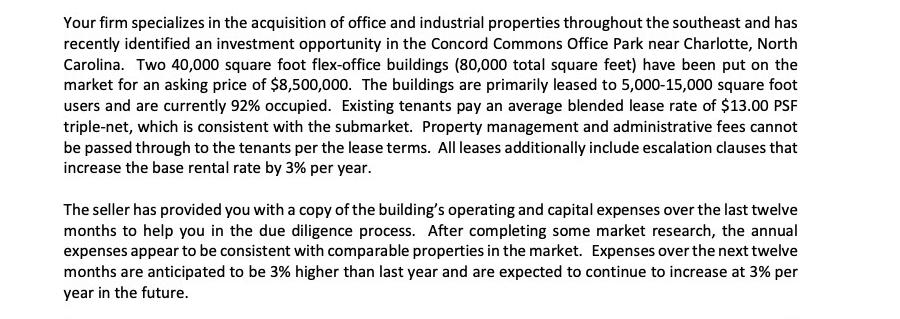

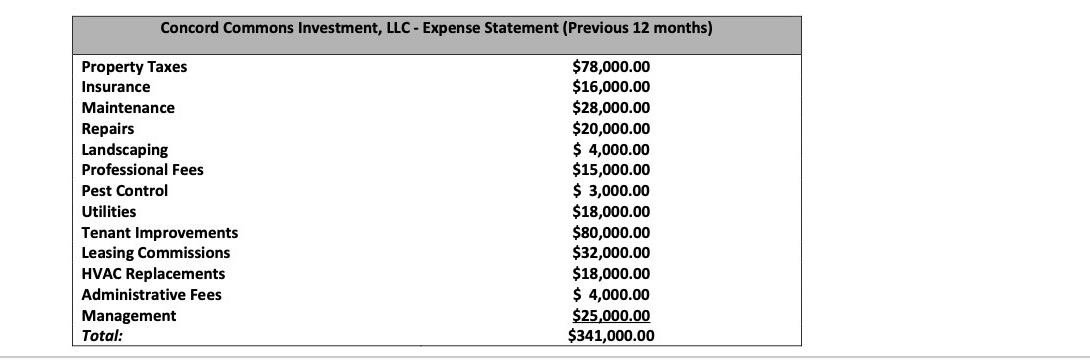

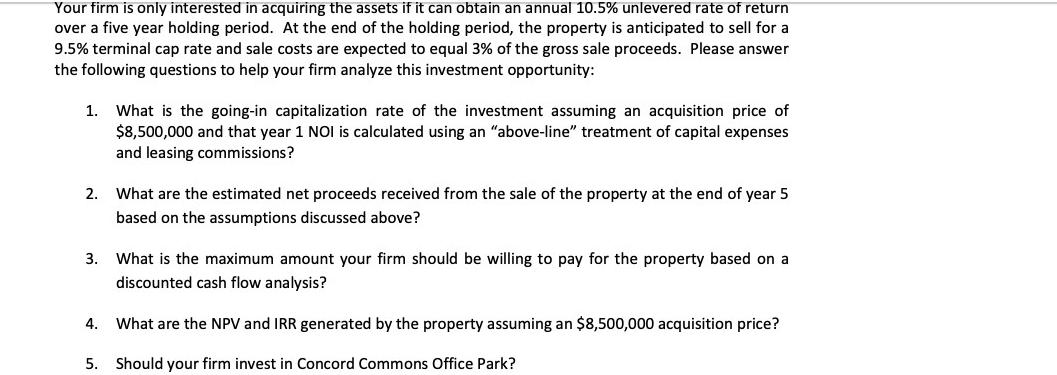

Your firm specializes in the acquisition of office and industrial properties throughout the southeast and has recently identified an investment opportunity in the Concord Commons Office Park near Charlotte, North Carolina. Two 40,000 square foot flex-office buildings (80,000 total square feet) have been put on the market for an asking price of $8,500,000. The buildings are primarily leased to 5,000-15,000 square foot users and are currently 92% occupied. Existing tenants pay an average blended lease rate of $13.00 PSF triple-net, which is consistent with the submarket. Property management and administrative fees cannot be passed through to the tenants per the lease terms. All leases additionally include escalation clauses that increase the base rental rate by 3% per year. The seller has provided you with a copy of the building's operating and capital expenses over the last twelve months to help you in the due diligence process. After completing some market research, the annual expenses appear to be consistent with comparable properties in the market. Expenses over the next twelve months are anticipated to be 3% higher than last year and are expected to continue to increase at 3% per year in the future. Concord Commons Investment, LLC - Expense Statement (Previous 12 months) $78,000.00 $16,000.00 $28,000.00 $20,000.00 $ 4,000.00 $15,000.00 $ 3,000.00 $18,000.00 $80,000.00 $32,000.00 $18,000.00 $ 4,000.00 $25,000.00 $341,000.00 Property Taxes Insurance Maintenance Repairs Landscaping Professional Fees Pest Control Utilities Tenant Improvements Leasing Commissions HVAC Replacements Administrative Fees Management Total: Your firm is only interested in acquiring the assets if it can obtain an annual 10.5% unlevered rate of return over a five year holding period. At the end of the holding period, the property is anticipated to sell for a 9.5% terminal cap rate and sale costs are expected to equal 3% of the gross sale proceeds. Please answer the following questions to help your firm analyze this investment opportunity: 1. 2. What is the going-in capitalization rate of the investment assuming an acquisition price of $8,500,000 and that year 1 NOI is calculated using an "above-line" treatment of capital expenses and leasing commissions? What are the estimated net proceeds received from the sale of the property at the end of year 5 based on the assumptions discussed above? 3. What is the maximum amount your firm should be willing to pay for the property based on a discounted cash flow analysis? 4. What are the NPV and IRR generated by the property assuming an $8,500,000 acquisition price? 5. Should your firm invest in Concord Commons Office Park?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the investment opportunity in Concord Commons Office Park lets calculate the relevant financial metrics based on the given information 1 Go...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started