Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The spot price of crude oil is $60 per barrel and the cost of storing a barrel of crude oil for one year is

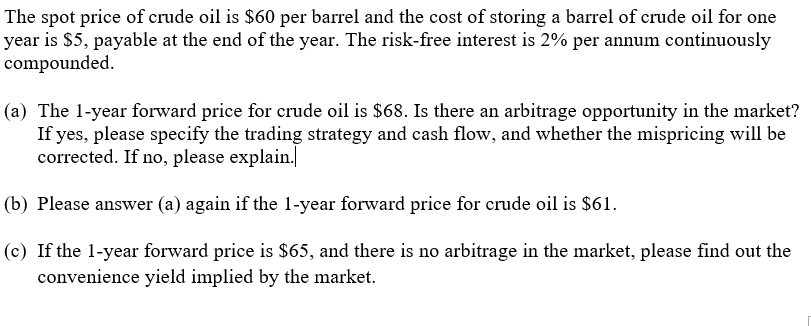

The spot price of crude oil is $60 per barrel and the cost of storing a barrel of crude oil for one year is $5, payable at the end of the year. The risk-free interest is 2% per annum continuously compounded. (a) The 1-year forward price for crude oil is $68. Is there an arbitrage opportunity in the market? If yes, please specify the trading strategy and cash flow, and whether the mispricing will be corrected. If no, please explain. (b) Please answer (a) again if the 1-year forward price for crude oil is $61. (c) If the 1-year forward price is $65, and there is no arbitrage in the market, please find out the convenience yield implied by the market.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The 1year forward price for crude oil is 68 Is there an arbitrage opportunity in the market To determine if there is an arbitrage opportunity we compare the cost of storing crude oil for one year to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started