Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm: The Boeing Company In your previous discussion forum, we calculated the WACC, using Kd , Ks , % of utilization, and taxes. As

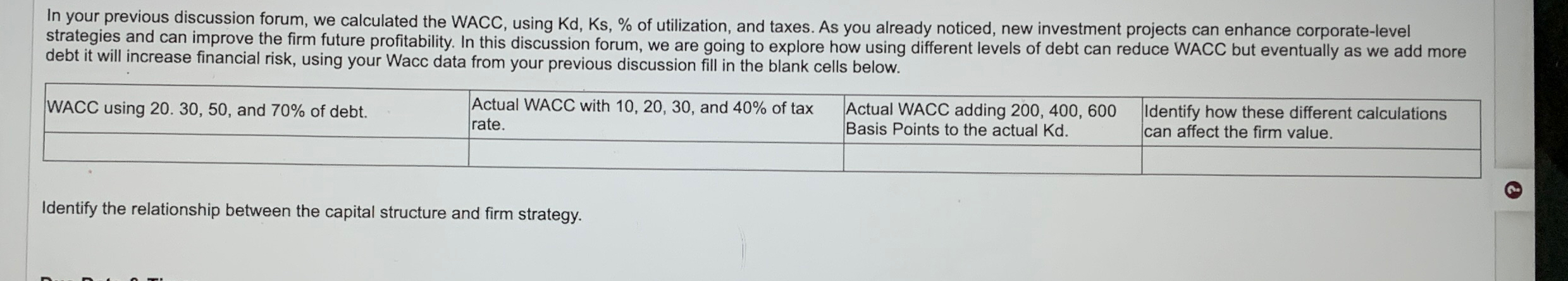

Your firm: The Boeing Company In your previous discussion forum, we calculated the WACC, using Kd Ks of utilization, and taxes. As you already noticed, new investment projects can enhance corporatelevel strategies and can improve the firm future profitability. In this discussion forum, we are going to explore how using different levels of debt can reduce WACC but eventually as we add more debt it will increase financial risk, using your Wacc data from your previous discussion fill in the blank cells below.

tableWACC using and of debt.,tableActual WACC with and of taxratetableActual WACC adding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started