Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm's geologists have discovered a small oil field in New York's Westchester County. The field is forecasted to produce a cash flow of c1=$2.2

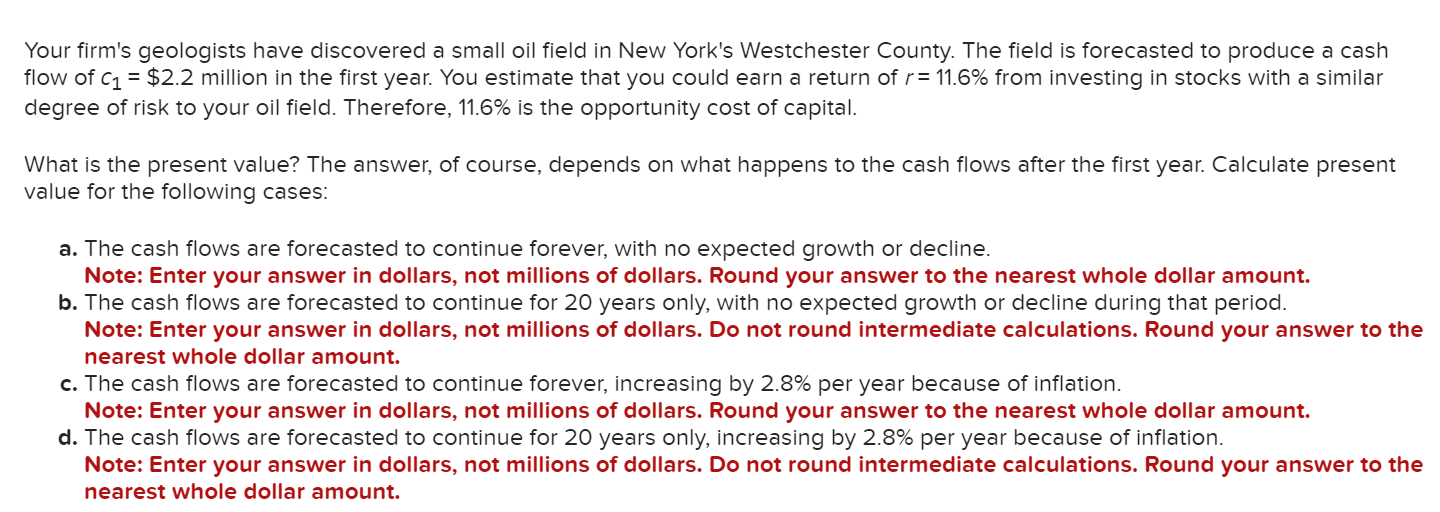

Your firm's geologists have discovered a small oil field in New York's Westchester County. The field is forecasted to produce a cash flow of c1=$2.2 million in the first year. You estimate that you could earn a return of r=11.6% from investing in stocks with a similar degree of risk to your oil field. Therefore, 11.6% is the opportunity cost of capital. What is the present value? The answer, of course, depends on what happens to the cash flows after the first year. Calculate present value for the following cases: a. The cash flows are forecasted to continue forever, with no expected growth or decline. Note: Enter your answer in dollars, not millions of dollars. Round your answer to the nearest whole dollar amount. b. The cash flows are forecasted to continue for 20 years only, with no expected growth or decline during that period. Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. c. The cash flows are forecasted to continue forever, increasing by 2.8% per year because of inflation. Note: Enter your answer in dollars, not millions of dollars. Round your answer to the nearest whole dollar amount. d. The cash flows are forecasted to continue for 20 years only, increasing by 2.8% per year because of inflation. Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. Your firm's geologists have discovered a small oil field in New York's Westchester County. The field is forecasted to produce a cash flow of c1=$2.2 million in the first year. You estimate that you could earn a return of r=11.6% from investing in stocks with a similar degree of risk to your oil field. Therefore, 11.6% is the opportunity cost of capital. What is the present value? The answer, of course, depends on what happens to the cash flows after the first year. Calculate present value for the following cases: a. The cash flows are forecasted to continue forever, with no expected growth or decline. Note: Enter your answer in dollars, not millions of dollars. Round your answer to the nearest whole dollar amount. b. The cash flows are forecasted to continue for 20 years only, with no expected growth or decline during that period. Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. c. The cash flows are forecasted to continue forever, increasing by 2.8% per year because of inflation. Note: Enter your answer in dollars, not millions of dollars. Round your answer to the nearest whole dollar amount. d. The cash flows are forecasted to continue for 20 years only, increasing by 2.8% per year because of inflation. Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount

Your firm's geologists have discovered a small oil field in New York's Westchester County. The field is forecasted to produce a cash flow of c1=$2.2 million in the first year. You estimate that you could earn a return of r=11.6% from investing in stocks with a similar degree of risk to your oil field. Therefore, 11.6% is the opportunity cost of capital. What is the present value? The answer, of course, depends on what happens to the cash flows after the first year. Calculate present value for the following cases: a. The cash flows are forecasted to continue forever, with no expected growth or decline. Note: Enter your answer in dollars, not millions of dollars. Round your answer to the nearest whole dollar amount. b. The cash flows are forecasted to continue for 20 years only, with no expected growth or decline during that period. Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. c. The cash flows are forecasted to continue forever, increasing by 2.8% per year because of inflation. Note: Enter your answer in dollars, not millions of dollars. Round your answer to the nearest whole dollar amount. d. The cash flows are forecasted to continue for 20 years only, increasing by 2.8% per year because of inflation. Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. Your firm's geologists have discovered a small oil field in New York's Westchester County. The field is forecasted to produce a cash flow of c1=$2.2 million in the first year. You estimate that you could earn a return of r=11.6% from investing in stocks with a similar degree of risk to your oil field. Therefore, 11.6% is the opportunity cost of capital. What is the present value? The answer, of course, depends on what happens to the cash flows after the first year. Calculate present value for the following cases: a. The cash flows are forecasted to continue forever, with no expected growth or decline. Note: Enter your answer in dollars, not millions of dollars. Round your answer to the nearest whole dollar amount. b. The cash flows are forecasted to continue for 20 years only, with no expected growth or decline during that period. Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. c. The cash flows are forecasted to continue forever, increasing by 2.8% per year because of inflation. Note: Enter your answer in dollars, not millions of dollars. Round your answer to the nearest whole dollar amount. d. The cash flows are forecasted to continue for 20 years only, increasing by 2.8% per year because of inflation. Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started