Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your friend brings you the following business proposal to be partners in a fast-food joint he wants to open. He says that the shop

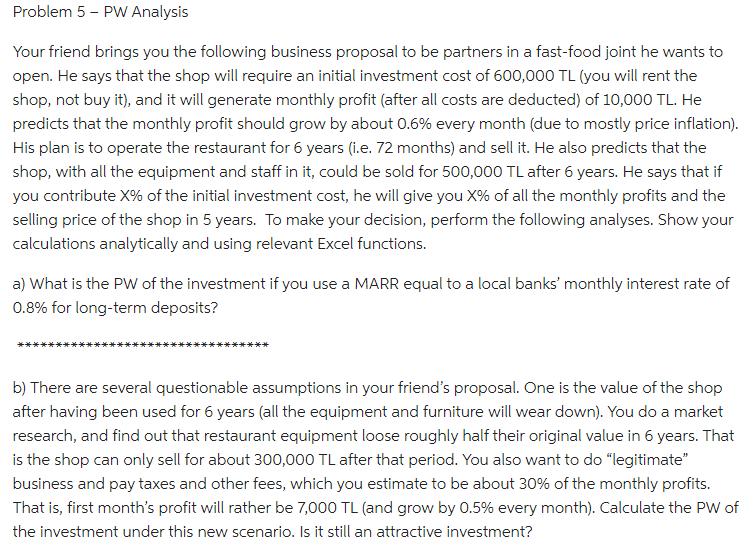

Your friend brings you the following business proposal to be partners in a fast-food joint he wants to open. He says that the shop will require an initial investment cost of 600,000 TL (you will rent the shop, not buy it), and it will generate monthly profit (after all costs are deducted) of 10,000 TL. He predicts that the monthly profit should grow by about 0.6% every month (due to mostly price inflation). His plan is to operate the restaurant for 6 years (i.e. 72 months) and sell it. He also predicts that the shop, with all the equipment and staff in it, could be sold for 500,000 TL after 6 years. He says that if you contribute X% of the initial investment cost, he will give you X% of all the monthly profits and the selling price of the shop in 5 years. To make your decision, perform the following analyses. Show your calculations analytically and using relevant Excel functions. a) What is the PW of the investment if you use a MARR equal to a local banks' monthly interest rate of 0.8% for long-term deposits? b) There are several questionable assumptions in your friend's proposal. One is the value of the shop after having been used for 6 years (all the equipment and furniture will wear down). You do a market research, and find out that restaurant equipment loose roughly half their original value in 6 years. That is the shop can only sell for about 300,000 TL after that period. You also want to do "legitimate" business and pay taxes and other fees, which you estimate to be about 30% of the monthly profits. That is, first month's profit will rather be 7,000 TL (and grow by 0.5% every month). Calculate the PW of the investment under this new scenario. Is it still an attractive investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started